171

GHL Systems Berhad

(293040-D)

Annual report 2015

8. Effects of Proposed Shares Buy-Back

Assuming that the Company buys back up to 64,909,129 GHL Shares representing 10% of its issued and paid-

up share capital as at 31 March 2016 and such shares purchased are cancelled or alternatively be retained

as treasury shares or both, the financial effects of the Proposed Share Buy-Back on the share capital of the

Company, Net Assets, working capital, earnings and dividends of GHL are as follows:

8.1 Share Capital

In the event that all GHL shares purchased are cancelled, the Proposed Share Buy-Back will result in

the issued and paid up share capital of GHL as at 31 March 2016 to be reduced from RM129,818,258

comprising 649,091,291 GHL Shares to RM116,836,432 comprising 584,182,162 GHL Shares. It is not

expected to have any effect on the issued and paid up capital if all GHL Shares purchased are to be

retained as treasury shares.

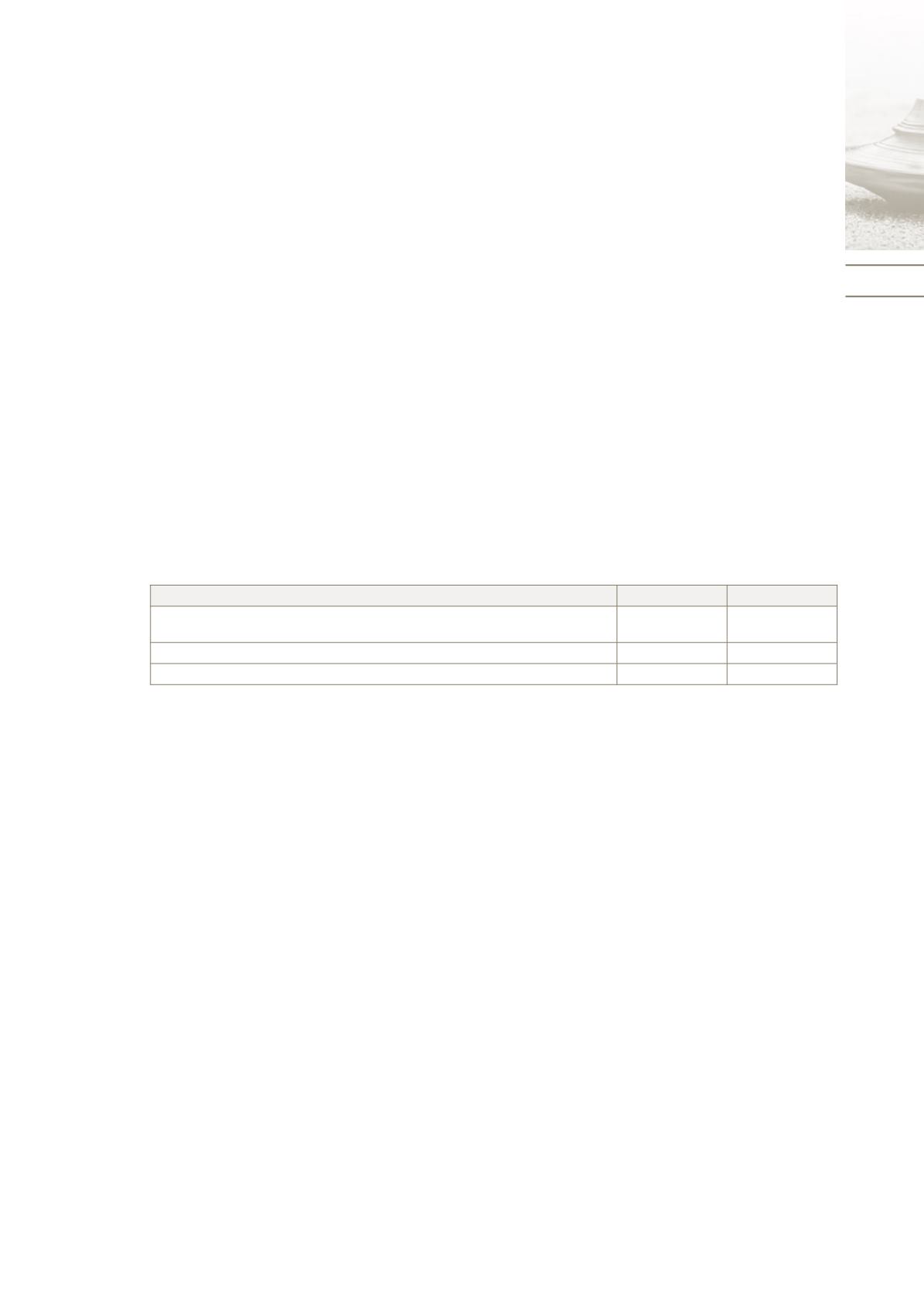

The effect of the Proposed Shares Buy-Back on the issued and paid up share capital of GHL are

illustrated below:

No of Shares

RM

Issued and paid up share capital as per audited account as at

31 December 2015

649,847,192 129,969,438

Issued and paid up share capital as at 31 March 2016

649,091,291 129,818,258

After share purchase and cancellation

584,182,162 # 116,836,432

Notes:

# Assuming up to 10% of the issued and paid up capital of GHL or 64,909,129 GHL Shares are

purchased and cancelled.

8.2 Net Assets

The Proposed Share Buy-Back, if implemented may increase or decrease the net assets and net assets

per Share depending on the purchase prices of GHL Shares pursuant to the Proposed Share Buy-

Back. The consolidated net assets per Share will increase if the purchase price is less than the audited

consolidated net assets per Share and conversely, the consolidated net assets per share will decrease

if the purchase price exceeds the consolidated net assets per Share at the time when the GHL Shares

are purchased.

In theevent thepurchasedGHL Shares which are retainedas treasury shares are resold, theconsolidated

Net Assets per Share of GHL will increase or decrease depending on whether a gain or a loss is realised

upon the resale. The quantum of the increase or decrease in net assets will depend on the actual

selling price and the number of the treasury shares resold to the market.

8.3 Working Capital

The Proposed Share Buy-Back, as and when implemented, will reduce the working capital of the GHL

Group, the quantum of which will depend on the actual purchase price and number of purchased

GHL Shares as well as any associated costs incurred in relation to the share buy-back pursuant to

the Proposed Share Buy-Back. However, it is not expected to have a material adverse effect on the

working capital of the Company.

The working capital and the cash flow of the Company will also increase accordingly when the

Proposed Share Buy-Back which are retained as treasury shares are resold. The quantum of the increase

in working capital and cash flow will depend on the actual selling price and the number of the treasury

shares resold to the market.

Statement of Shareholders

in relation to the Proposed Renewal of Authority for the Company to

Purchase its own Ordinary Shares (continued)