170

GHL Systems Berhad

(293040-D)

Annual report 2015

6. Potential Advantages and Disadvantages of the Proposed Renewal

The potential advantages of the Proposed Shares Buy-Back are as follows:

(i)

the Proposed Share Buy-Back is expected to stabilise the supply and demand as well as the prices of

the GHL Shares traded on Bursa Securities and thereby support its fundamental value and to maintain

investors’ confidence in GHL;

(ii)

if the Shares are bought back as treasury shares, it will provide the Directors of GHL an option to sell the

purchased GHL Shares at a higher price and generate capital gain for the Company.

(iii)

the purchased GHL Shares can be distributed as share dividends to reward its shareholders.

The potential disadvantages of the Proposed Shares Buy-Back are as follows;

(i)

The Proposed Renewal can only be made out of retained profits and/or share premium account of

the Company resulting in a reduction of the amount available for distribution as dividends and bonus

issues to shareholders;

(ii)

The Proposed Renewal will reduce the financial resources of the Company which may result in the

Company foregoing better investment opportunities that may emerge in the future;

(iii)

The cashflow of the Company may be affected if the Company decides to utilise bank borrowings to

finance a Share Buy-Back.

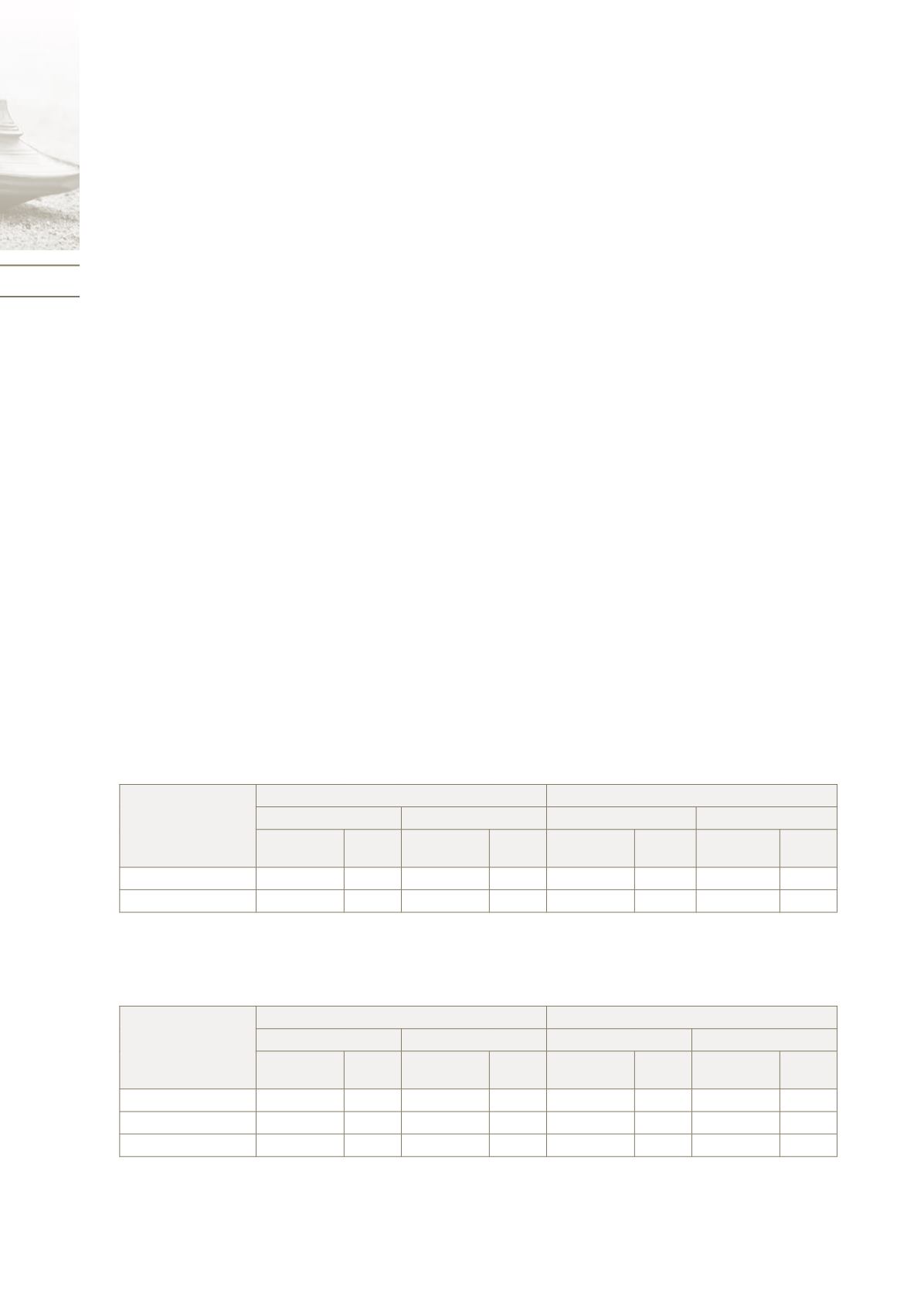

7. Direct and Indirect Interests of the Directors and Substantial Shareholders

The effects of the Proposed Shares Buy-Back on the Substantial shareholders’ and Directors’ shareholdings

based on the Register of Substantial Shareholders and the Register of Directors’ Shareholdings respectively

as at 31 March 2016 are as follow:

Substantial

Shareholders

Before the Proposed Shares Buy-Back *(a)

After the Proposed Shares Buy-Back *(b)

Direct

Indirect

Direct

Indirect

No of

shares

%

No of

shares

%

No of

shares

%

No of

shares

%

Loh Wee Hian

229,137,425 35.30 6,110,250 0.94 229,137,425 39.22 6,110,250 1.05

Cycas

185,239,518 28.54

-

- 185,239,518 31.71

-

-

Notes:

*(a) Adjusted for the number of treasury shares held as at 31 March 2016

*(b) Assuming that 10% of the issued and paid up capital is purchased and retained as treasury shares.

Directors

Before the Proposed Shares Buy-Back *(a)

After the Proposed Shares Buy-Back *(b)

Direct

Indirect

Direct

Indirect

No of

shares

%

No of

shares

%

No of

shares

%

No of

shares

%

Loh Wee Hian

229,137,425 35.30 6,110,250 0.94 229,137,425 39.22 6,110,250 1.05

Kanagaraj Lorenz

5,295,900 0.82

-

-

5,295,900 0.75

-

-

Fong Seow Kee

1,861,950 0.29

635,175 0.10 1,861,950 0.32

635,175 0.11

Notes:

*(a) Adjusted for the number of treasury shares held as at 31 March 2016

*(b) Assuming that 10% of the issued and paid up capital is purchased and retained as treasury shares.

Statement of Shareholders

in relation to the Proposed Renewal of Authority for the Company to

Purchase its own Ordinary Shares (continued)