Annual report 2014

153

NOTES TO THE FINANCIAL STATEMENTS

31 December 2014 (continued)

36. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)

(c) Interest rate risk (continued)

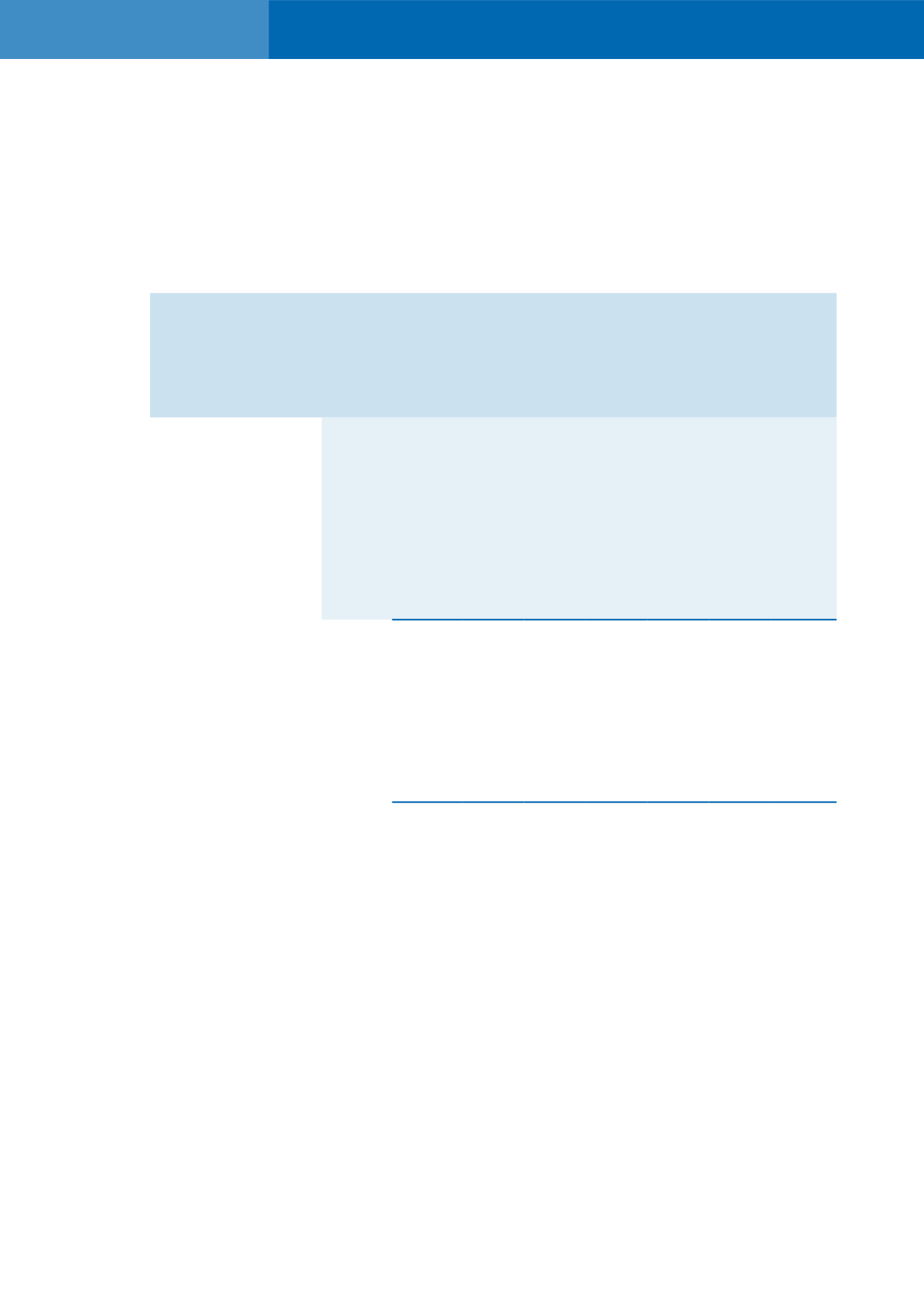

Weighted

average

effective Within

1 - 2

2 - 3

3 - 4

4 - 5 More than

interest rate 1 year

years

years

years

years

5 years

Total

Note per annum RM RM RM RM RM RM RM

%

Company

At 31 December 2014

Fixed rates

Amounts owing by

subsidiaries

13

4.70 14,999,187 3,215,493 1,665,048 611,267 322,037

- 20,813,032

Deposits with licensed

banks

16

2.95

721,705

-

-

-

-

-

721,705

Hire purchase creditors 21

4.63

107,614 112,533 98,651

3,717

-

-

322,515

At 31 December 2013

Fixed rates

Amounts owing by

subsidiaries

13

4.70 2,855,417 2,309,500 671,341

-

-

- 5,836,258

Deposits with licensed

banks

16

2.95

100,000

-

-

-

-

-

100,000

Hire purchase creditors 21

4.63

129,107 107,615 112,532 98,651

3,717

-

451,622

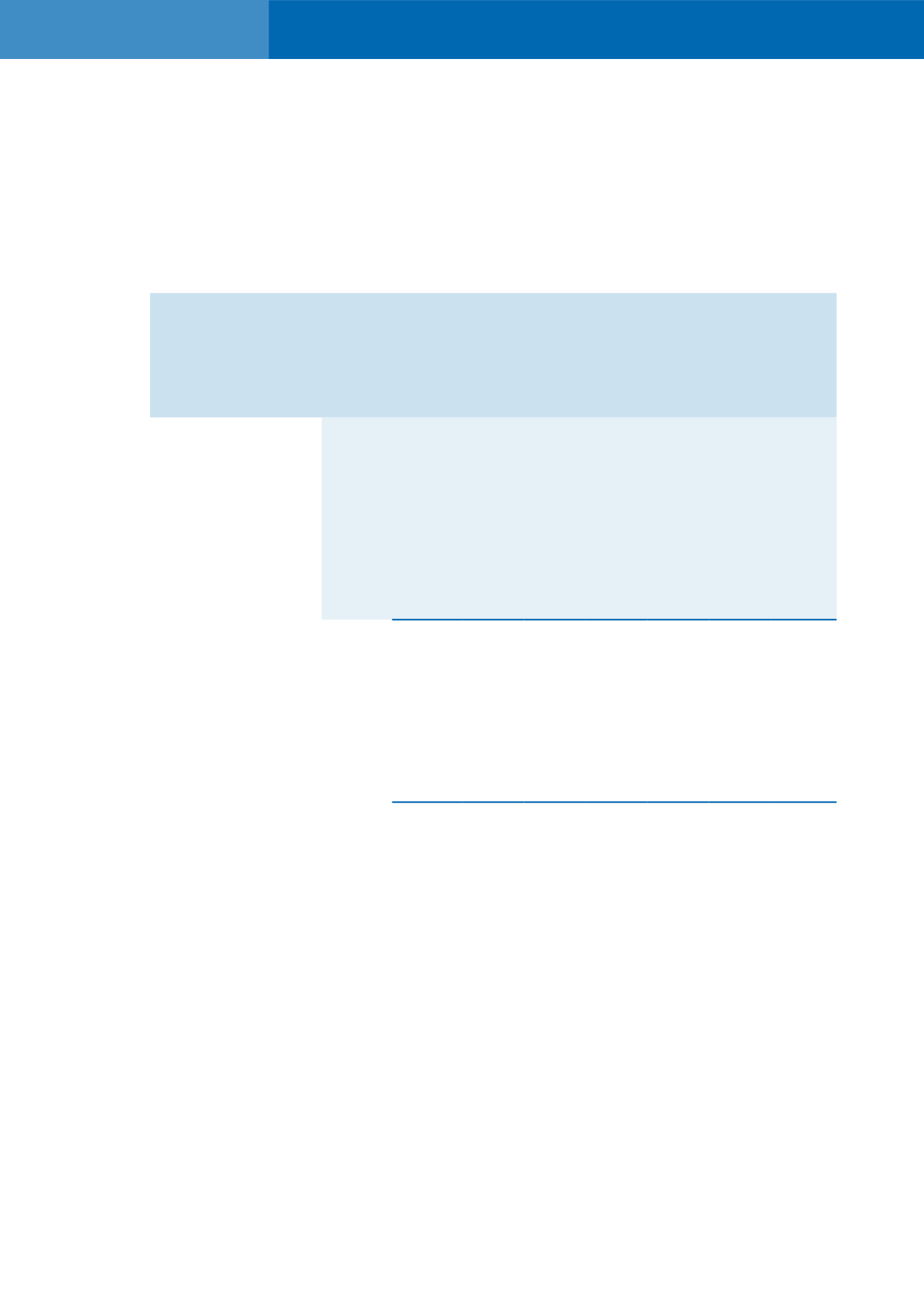

(d) Foreign currency risk

Foreign currency risk is the risk that the fair value or future cash flows of a financial instrument would

fluctuate because of changes in foreign exchange rates.

Subsidiaries operating in Australia, Philippines and Thailand have assets and liabilities together with

expected cash flows from anticipated transactions denominated in foreign currencies that give rise to

foreign exchange exposures.

The Group also hold cash and cash equivalents denominated in foreign currencies for working capital

purposes.