Annual report 2014

143

NOTES TO THE FINANCIAL STATEMENTS

31 December 2014 (continued)

35. FINANCIAL INSTRUMENTS (continued)

(a) Capital management

(continued)

Total capital managed at Group level, which comprises shareholders’ funds, cash and cash equivalents

and bank borrowings.

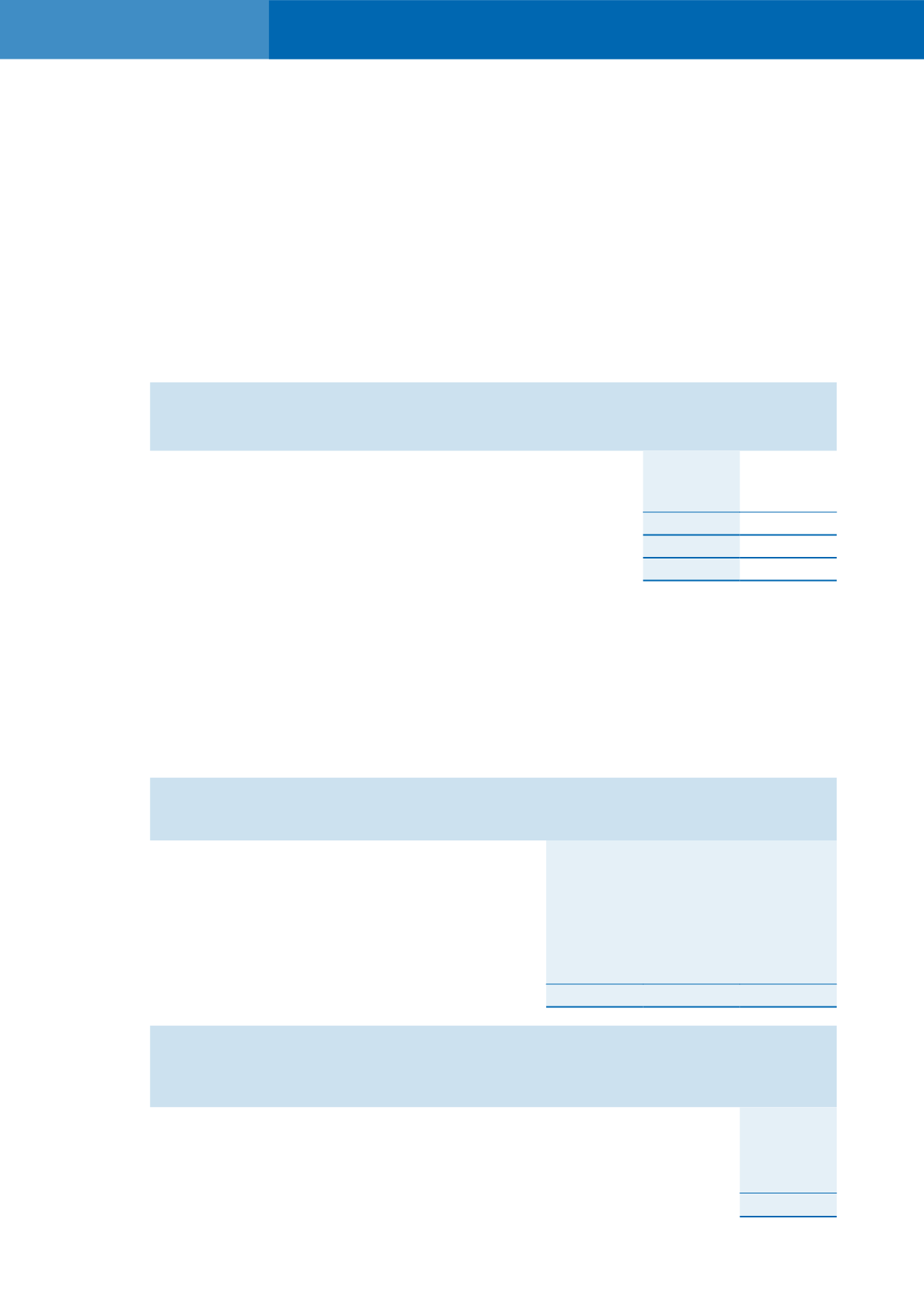

The gearing ratios are as follows:

Group

2014

2013

RM

RM

Total borrowings

40,465,796

974,224

Less: Cash and cash equivalents

(39,441,558) (13,997,422)

Net debt

1,024,238 (13,023,198)

Total equity

222,658,360 56,228,344

Gearing ratio

>0.01

N/A

Pursuant to the requirements of Practice Note No. 17/2005 of the Bursa Malaysia Securities, the Group

is required to maintain a consolidated shareholders’ equity equal to or not less than the twenty-five

percent (25%) of the issued and paid-up capital (excluding treasury shares) and such shareholders’

equity is not less than RM40 million. The Company has complied with this requirement for the financial

year ended 31 December 2014.

The Group is not subject to any other externally imposed capital requirements.

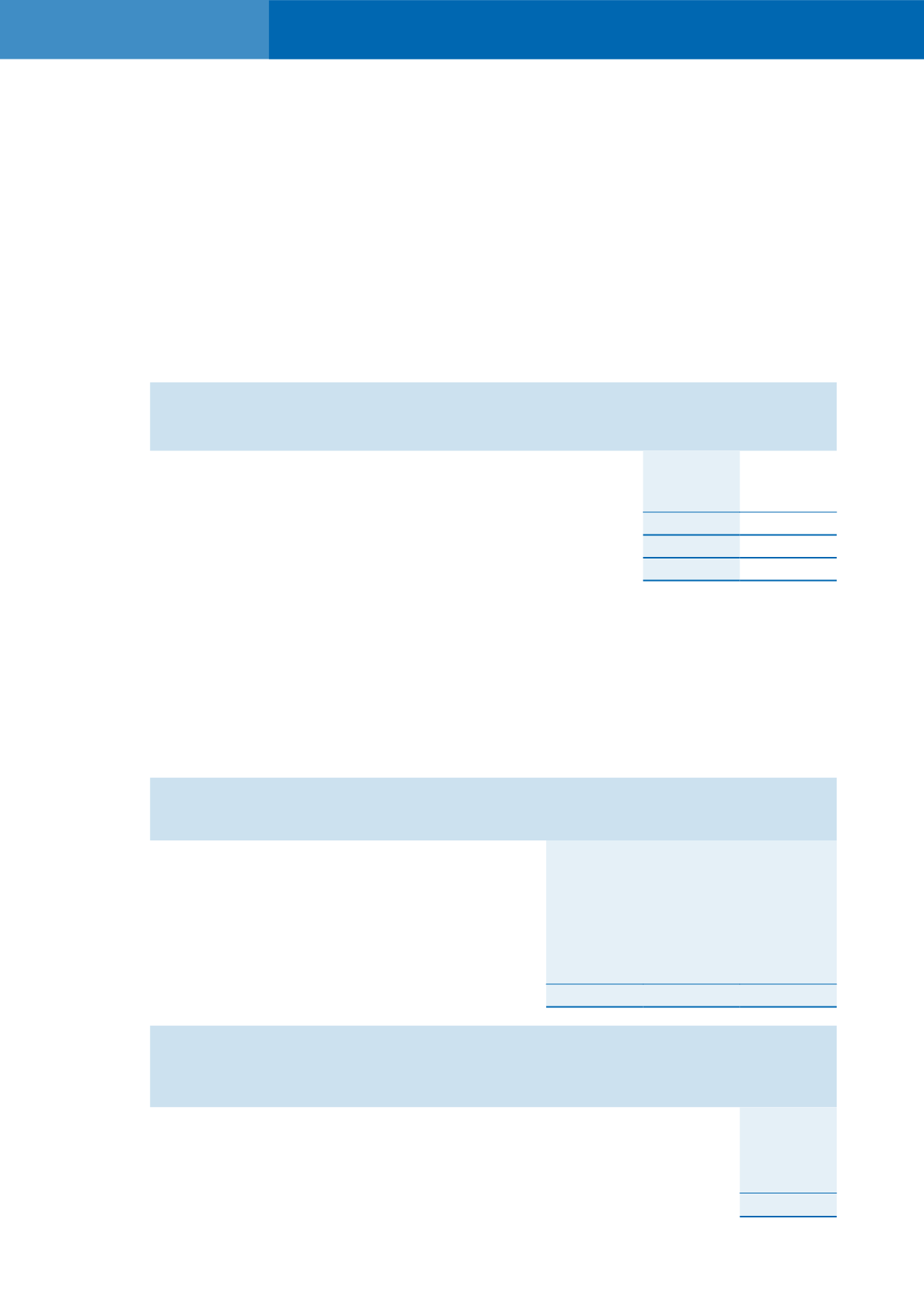

(b) Financial instruments

Loans and

receivables

Available-

for-sale

Total

Group

RM

RM

RM

31 December 2014

Financial assets

Available-for-sale investments

-

8,000,000 8,000,000

Trade and other receivables

38,932,707

-

38,932,707

Cash and bank balances

45,327,322

-

45,327,322

84,260,029 8,000,000 92,260,029

Other

financial

liabilities

RM

Financial liabilities

Borrowings

40,465,796

Trade and other payables

53,604,876

94,070,672