Annual report 2014

147

NOTES TO THE FINANCIAL STATEMENTS

31 December 2014 (continued)

35. FINANCIAL INSTRUMENTS (continued)

(d) Fair value hierarchy (continued)

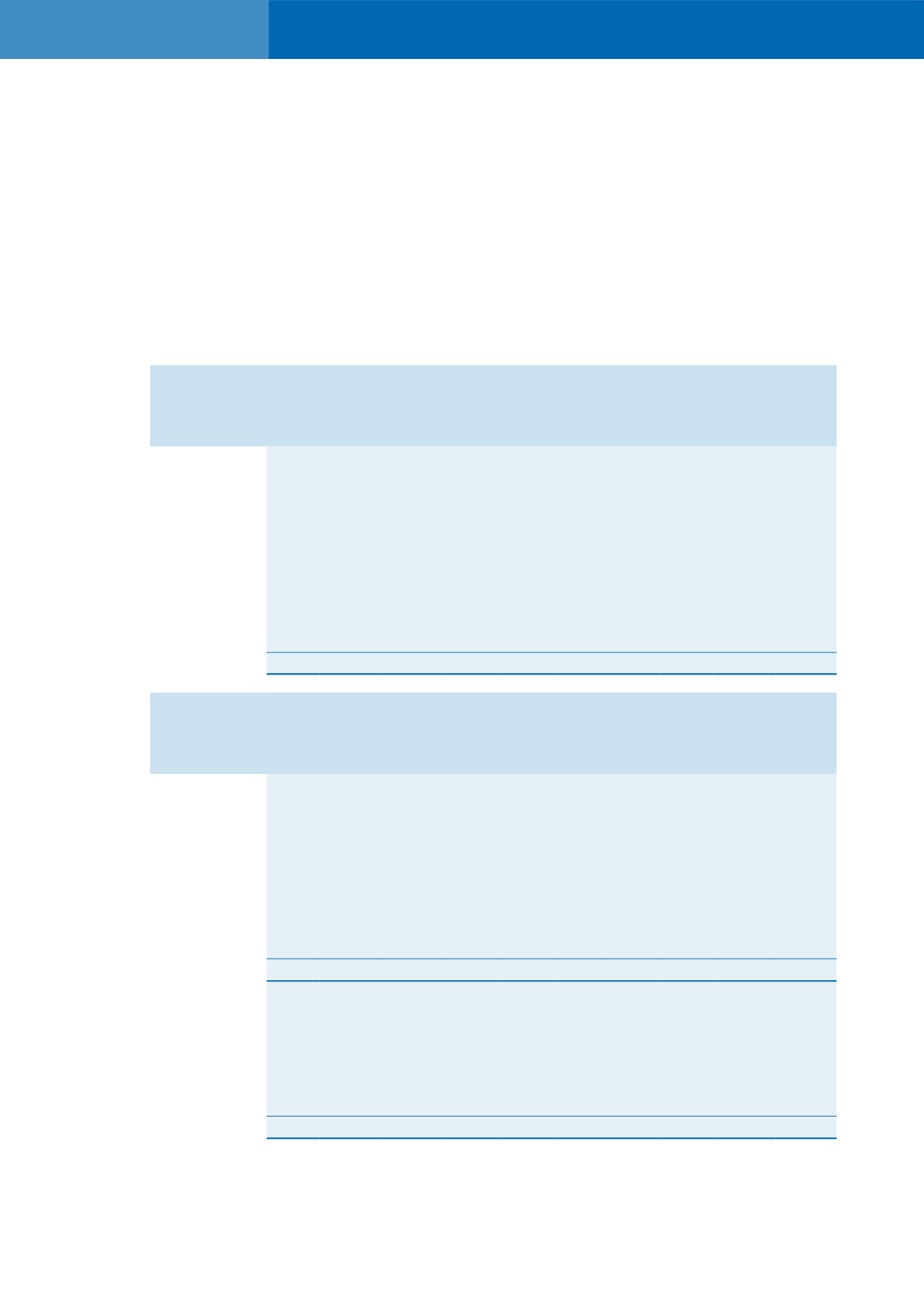

The following tables set out the financial instruments carried at fair value and those not carried at fair

value for which fair value is disclosed, together with their fair values and carrying amounts shown in the

statements of financial position (continued).

Fair values of financial instruments

carried at fair value

Fair values of financial instruments

not carried at fair value

Total

Carrying

Level 1 Level 2 Level 3

Total

Level 1 Level 2 Level 3 Total

fair value amount

RM RM RM RM RM RM RM RM RM RM

Financial liabilities

Other financial

liabilities

- Term loans

- 13,083,528

- 13,083,528

-

-

-

- 13,083,528 13,083,528

- Hire purchase

creditors

- 6,409,085

- 6,409,085

-

-

-

- 6,409,085 6,382,268

- Bankers’

acceptance

- 15,000,000

- 15,000,000

-

-

-

- 15,000,000 15,000,000

- Islamic facility

- 6,000,000

- 6,000,000

-

-

-

- 6,000,000 6,000,000

- 40,492,613

- 40,492,613

-

-

-

- 40,492,613 40,465,796

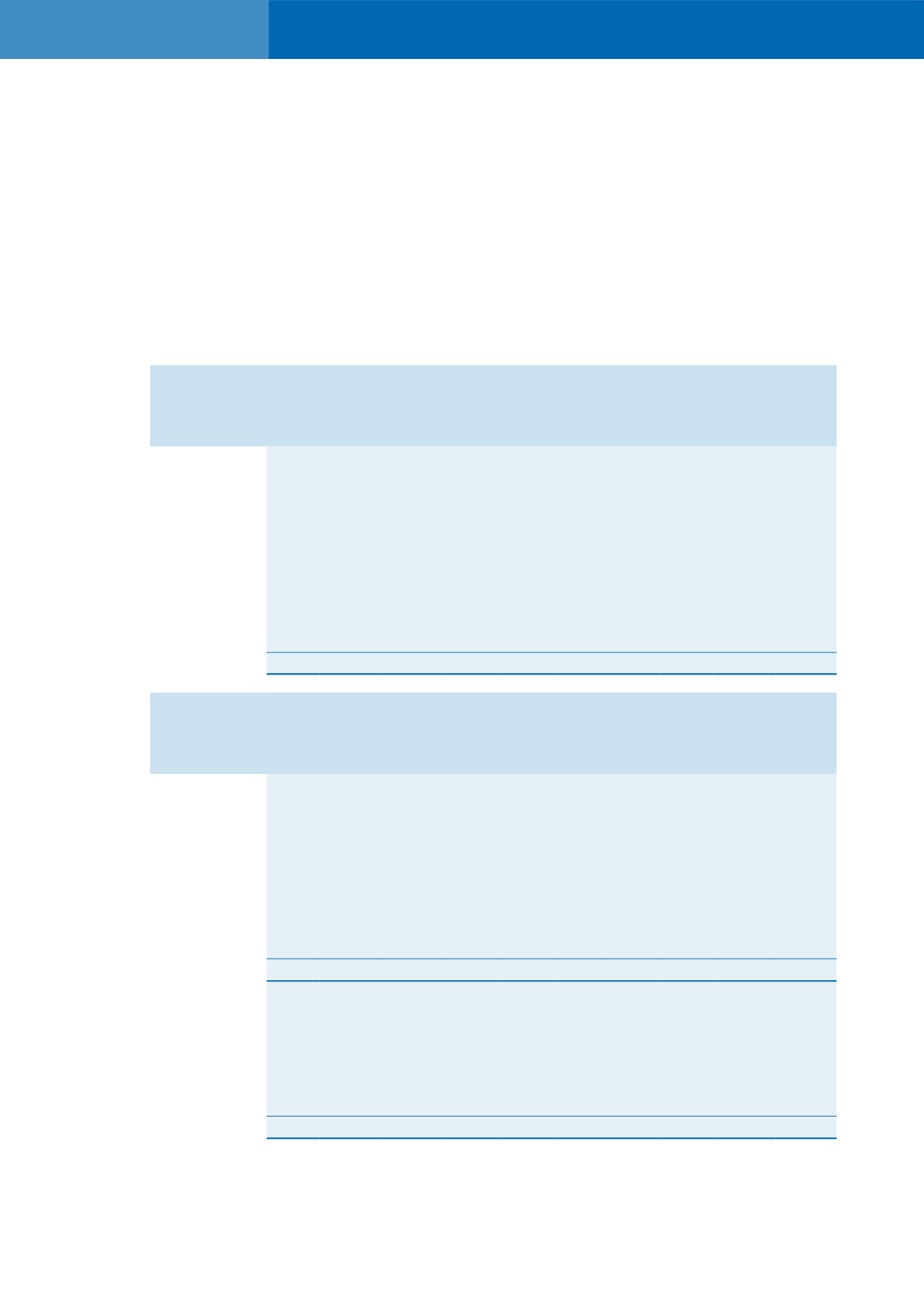

Fair values of financial instruments

carried at fair value

Fair values of financial instruments

not carried at fair value

Total

Carrying

Level 1 Level 2 Level 3

Total

Level 1 Level 2 Level 3 Total

fair value amount

RM RM RM RM RM RM RM RM RM RM

2014

Company

Financial assets

Loans and

receivables

- Amounts owing by

subsidiaries

-

- 5,813,845 5,813,845

-

-

-

- 5,813,845 5,813,845

-

- 5,813,845 5,813,845

-

-

-

- 5,813,845 5,813,845

Financial liabilities

Other financial

liabilities

- Hire purchase

creditors

-

319,001

-

319,001

-

-

-

-

319,001 322,515

-

319,001

-

319,001

-

-

-

-

319,001 322,515