152

GHL Systems Berhad

(293040-D)

NOTES TO THE FINANCIAL STATEMENTS

31 December 2014 (continued)

36. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)

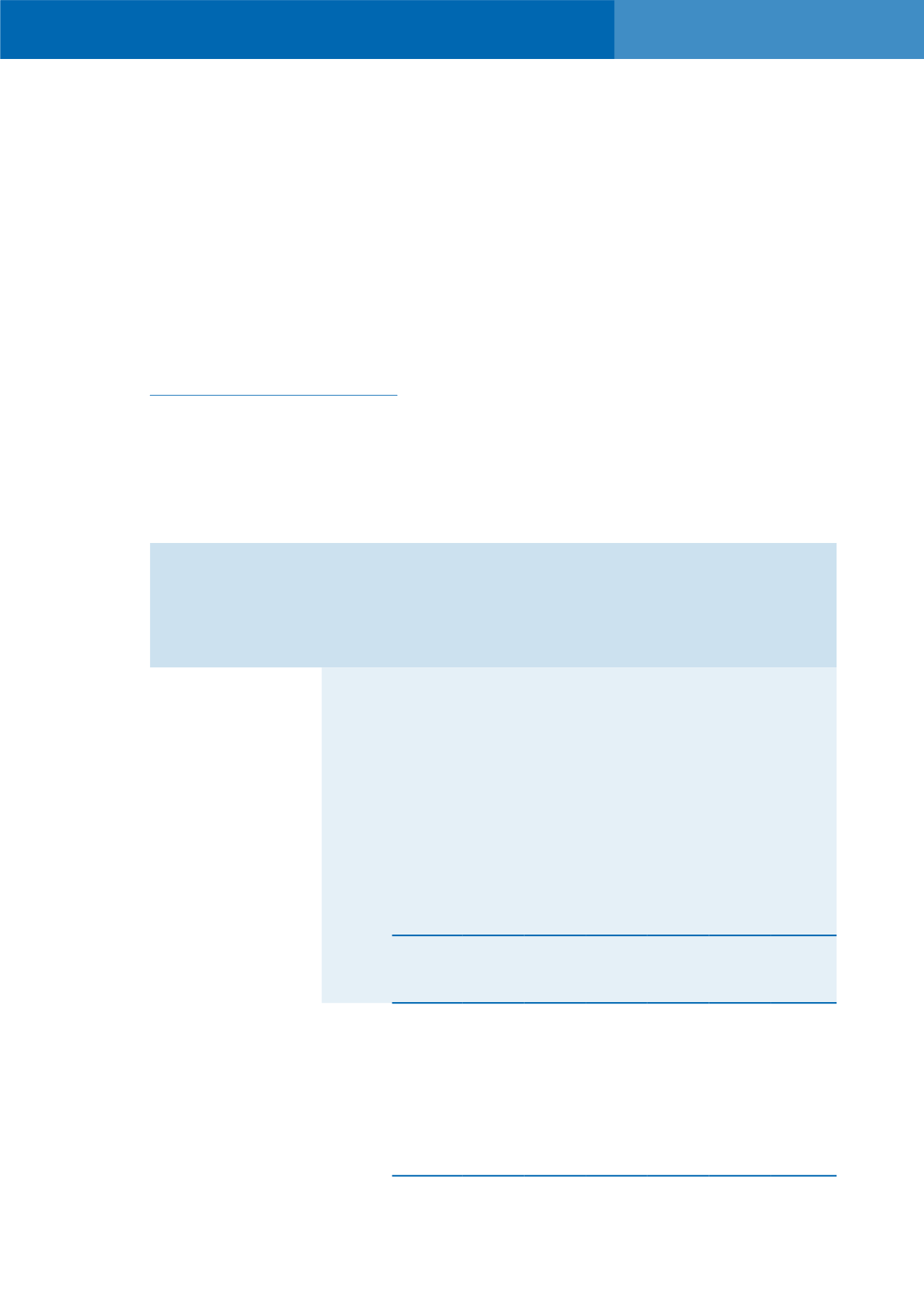

(c) Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of the financial instruments of the Group

and of the Company would fluctuate because of changes in market interest rates.

The exposure of the Group and of the Company to interest rate risk arises primarily from their borrowings.

Sensitivity analysis for interest rate risk

The exposure to interest rate risk of the Group and of the Company is not significant and therefore,

sensitivity analysis is not presented.

The following tables set out the carrying amounts, the weighted average effective interest rates as at

the end of each reporting period and the remaining maturities of the financial instruments of Group

and of the Company that are exposed to interest rate risk:

Weighted

average

effective Within

1 - 2

2 - 3

3 - 4

4 - 5 More than

interest rate 1 year

years

years

years

years

5 years

Total

Note per annum RM RM RM RM RM RM RM

%

Group

At 31 December 2014

Fixed rates

Deposits with licensed

banks

16

2.95 7,102,550

-

-

-

-

- 7,102,550

Hire purchase creditors

- RM

- PHP

21

21

4.45

6.45

218,213

1,533,465

228,134

1,754,033

201,582

2,393,835

53,006

-

-

-

-

-

700,935

5,681,333

Bankers’ acceptance 22

3.99 15,000,000

-

-

-

-

- 15,000,000

Islamic facility

22

5.08 6,000,000

-

-

-

-

- 6,000,000

Term loans

20

3.29 5,878,123 3,813,615 341,226 350,866 1,139,458

- 11,523,288

Floating rates

Term loans

20

5.00 520,080 520,080 520,080

-

-

- 1,560,240

At 31 December 2013

Fixed rates

Deposits with licensed

banks

16

2.95 117,310

-

-

-

-

-

117,310

Hire purchase creditors

- RM

- PHP

21

21

4.52

10.37

167,391

440,783

147,757

-

115,925

-

98,651

-

3,717

-

-

-

533,441

440,783