15

GHL Systems Berhad

(293040-D)

Annual report 2015

ceo

Report

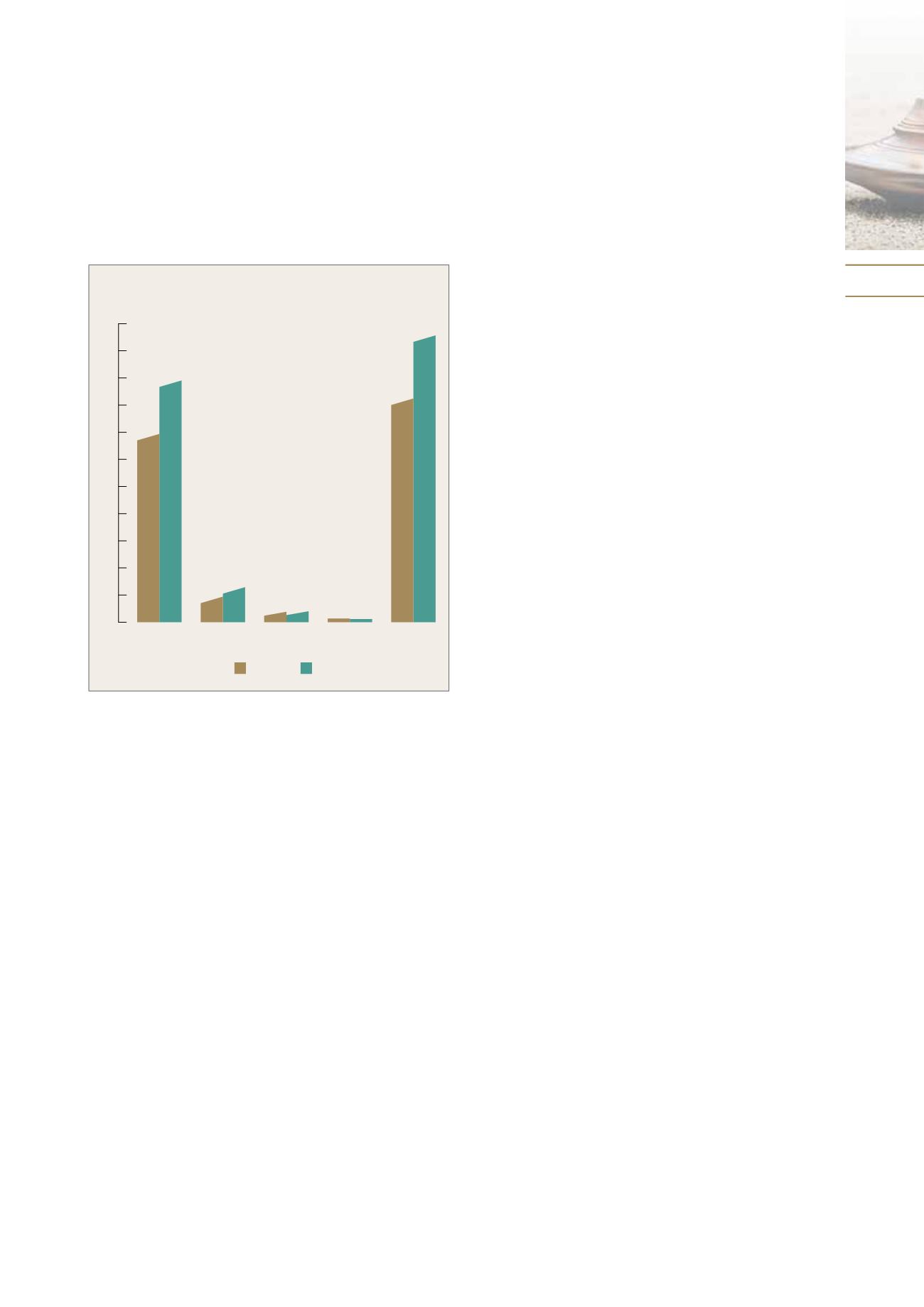

Figure 3 - Revenue by Country 2015 (RM’m)

Malaysia Philippines

Thailand

Australia

Total

2014

2015

0

20

40

60

80

100

120

140

160

180

200

220

138.8

178.2

164.9

211.4

18.9

25.9

5.8

6.2

1.4

1.1

2015 vs 2014 Revenue by Country (RMMillion)

2015 Group turnover grew +28% yoy to RM211.38

million (2014 – RM164.93 million). Pre-tax profits grew

+45% to RM16.12 million compared to RM11.12 million

a year ago with pre-tax margins better at 7.6%

compared to 2014’s pre-tax margins of 6.7%.

Malaysian operations contributed 84% of Group

turnover (2014 – 84%) and revenue grew 28% yoy

mainly due to higher EDC sales and rental revenues

and, growth of TPA transaction fee income and

volumes. EBIT margins were 9.4% for 2015, an

improvement from 7.8% in 2014.

Philippines turnover grew 37% yoy to RM25.92 million

(2014 - RM18.89 million) but EBIT margins were lower at

12.3% in 2015 vs 16.9% in 2014 due to lower hardware

sales (which had higher margins) as compared to the

annuity based rental, which continued to outperform.

Both Shared Services and TPA registered growth of

+24% and +32% respectively with Solutions Services

showing the highest growth at 6% but off a much

lower base in 2014. Philippines contributed 12.3% to

Group revenue in 2015.

Thailand recorded a small growth of 7% in revenue

due to an improvement in TPA revenues in 2015. This

was, tempered by a reduction in Shared Services and

Solutionsservicesrevenueof-6%and-39%respectively.

The business climate remains challenging in Thailand

due to the lacklustre economy and competitive

pressures from some of the Thai commercial banks.

The Group continues to be cautious in its investment

pending an improvement in the macro environment.

EBIT remained in negative territory with losses before

interest of RM2.18 million as compared to RM1.84

million losses in 2014. The loss increased slightly due to

the effect of weaker Ringgit when consolidating Thai

Bhat losses.

Australia remains the smallest contributor to Group

operations at RM1.05 million or 1% of group turnover

compared to 2014 turnover of RM1.39 million. This

led to a small EBIT contribution of RM0.21 million as

compared to the loss of RM0.11 million in the same

period for the previous year.

TRANSACTION PAYMENT ACQUISITION (“TPA”)

TPA revenue overall grew +32% in 2015 to RM157.25

million (2014 – RM119.64 million) driven primarily by

higher volume sales and terminal population growth.

The Bank TPA segment is relatively new and only

started growing in 3Q15 and 4Q15 after GHL signed

a TPA agreement with a major Malaysian banking

group in 2Q2015.

e-pay (Reload and Collection Services)

The e-pay, reload and bill collections business

constitutes the largest component within the TPA

segment (86% of 2015 TPA segment revenue). While

the reload and bill collections business constitutes

the most mature component within the overall TPA

segment, its gross revenue continues to grow strongly

- 20% to RM134.50 million in 2015 (2014 – RM118.30

million). To enable easier comparison, the values

shown in the 2014 column in Figure 4 are for the full

year rather than just the post-acquisition period of 10

months.