14

GHL Systems Berhad

(293040-D)

Annual report 2015

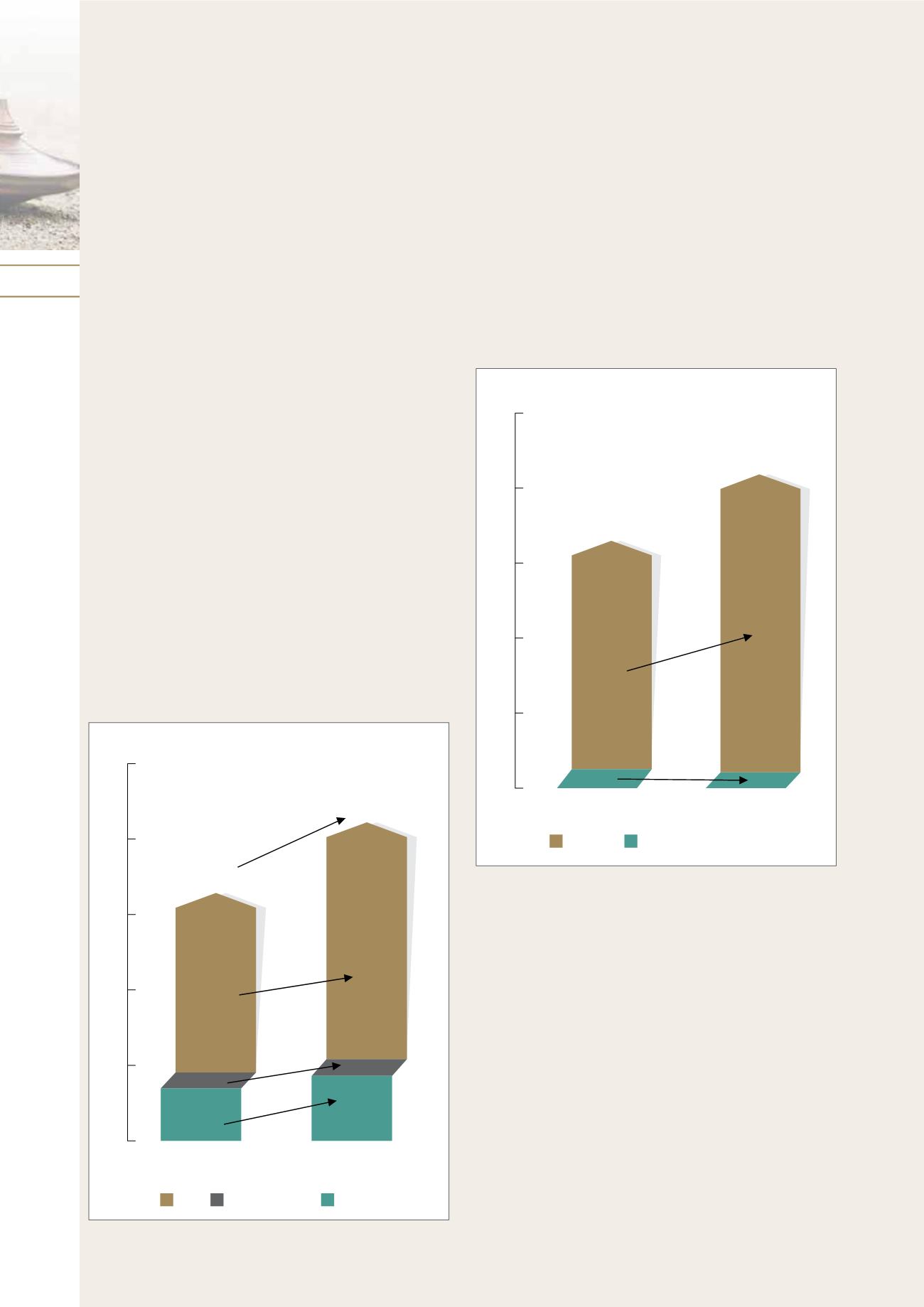

Group turnover for the 12 months in 2015 grew +28%

yoy to RM211.38 million (2014 – RM164.93 million)

driven by growth in all three segments; Shared Services

(+24% yoy), Solutions Services (+6% yoy) and TPA (32%

yoy). Pre-tax profits grew 45% to RM16.12 million as

compared to RM11.12 million a year ago and pre-tax

margins improved to 7.6% over 2014’s pre-tax margins

of 6.7%.

Net profit after tax grew by +61% yoy to RM10.24

million (2014 – RM6.37 million). Net profits grew at a

higher rate than pre-tax profits due to lower taxation

charges in 2015. The effective taxation charge in 2015

was 35% as compared to 43% in 2014 resulting from

deferred tax provisions in that financial year. Also, the

full year’s net profit result for 2015 would have been

much improved had the Group not incurred a charge

of RM1.21 million for unrealised forex losses arising from

an unexpected ringgit devaluation in 3Q2015. The

small US$ loan that caused this loss will be fully repaid

by the first half of 2016.

The chart in Figure 1 illustrates the significant changes

in business composition that occurred between 2014

and 2015.

Shared Services and TPA recorded strong growth

whereas Solutions Services revenue grew more

modestly due to fewer non-annuity software and

hardware sales in 2015 as compared to the same

period last financial year.

ceo

Report

Figure 1 - Revenue By Business Segment

0

50

100

150

200

250

28%

Total: RM211.4M

Total: RM164.9M

32%

6%

24%

YTD 2014 (RM’mil)

YTD 2015 (RM’mil)

RM119.6m

RM157.3m

RM11.1m

RM43.0m

RM10.5m

RM34.8m

TPA Solution Services

Shared Services

The annuity based component of the Group’s total

revenue grew from 92% of total revenue in 2014 to

94% of total revenue in 2015. The Group has now

clearly weaned itself of its previous dependency on

non-annuity based revenue streams. The non-annuity

component of the Group’s revenue has now shrunk

to 6% reflecting lower hardware and software sales

principally from Philippines operations in 2015. While

theGroup’s strategy remains focussedonaccelerating

the annuity based TPA businesses across the region,

the Group will continue to opportunistically contract

non-annuity based deals particularly if these support

the needs of our acquirers and our larger merchants.

On balance, it is likely that the mix between annuity

and non-annuity revenue will stabilise at these levels

in the near future.

Figure 2 - Annuity vs Non-Annuity Revenue

YTD 2014 (RM’mil)

YTD 2015 (RM’mil)

0

50

100

150

200

250

-21%

6%

8%

+1.7%

94%

92%

Total: RM211.4M

Total: RM164.9M

Annuity

Non-annuity

(Note: The 2014 TPA Revenue component only includes 10

months of e-pay’s post acquisition revenue)

(Note: The 2014 Annuity Revenue component only includes

10 months of e-pay’s post acquisition revenue)