168

GHL Systems Berhad

(293040-D)

6. Potential Advantages and Disadvantages of the Proposed Renewal (Cont’d)

The potential disadvantages of the Proposed Shares Buy-Back are as follows;

(i) The Proposed Renewal can only be made out of retained profits and/or share premium account of

the Company resulting in a reduction of the amount available for distribution as dividends and bonus

issues to shareholders;

(ii) The Proposed Renewal will reduce the financial resources of the Company which may result in the

Company foregoing better investment opportunities that may emerge in the future;

(iii) The cashflow of the Company may be affected if the Company decides to utilise bank borrowings to

finance a Share Buy-Back.

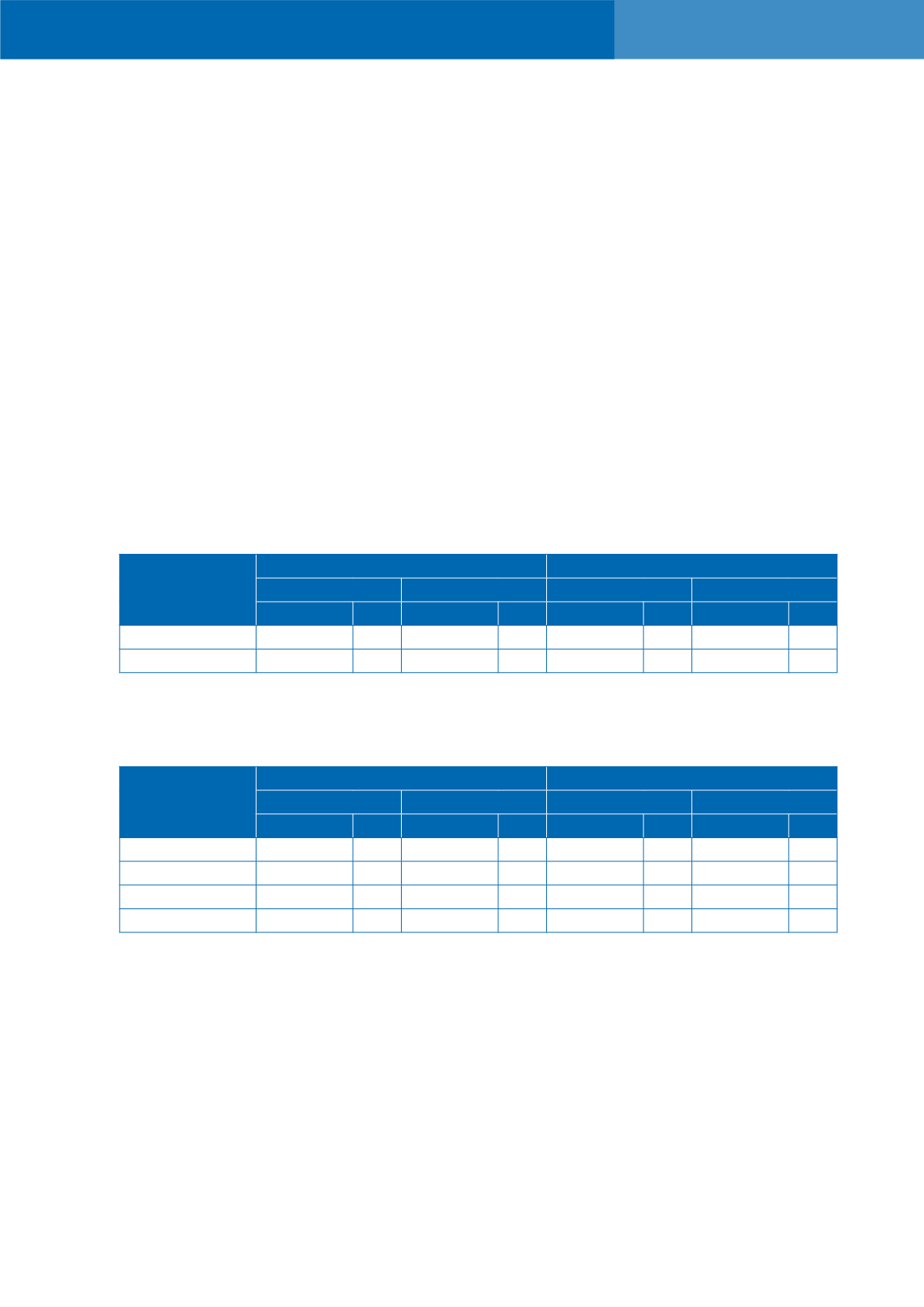

7. Direct and Indirect Interests of the Directors and Substantial Shareholders

The effects of the Proposed Shares Buy-Back on the Substantial shareholders’ and Directors’ shareholdings

based on the Register of Substantial Shareholders and the Register of Directors’ Shareholdings respectively

as at 15 April 2015 are as follow:

Substantial

Shareholders

Before the Proposed Shares Buy-Back *(a) After the Proposed Shares Buy-Back *(b)

Direct

Indirect

Direct

Indirect

No. of shares % No of shares % No. of shares % No. of shares %

Loh Wee Hian

229,137,425 35.65 6,110,250 0.95 229,137,425 39.62 6,110,250 1.06

Cycas

185,239,518 28.82

-

-

185,239,518 32.03

-

-

Notes:

*(a) Adjusted for the number of treasury shares held as at 15 April 2015

*(b) Assuming that 10% of the issued and paid up capital is purchased and retained as treasury shares.

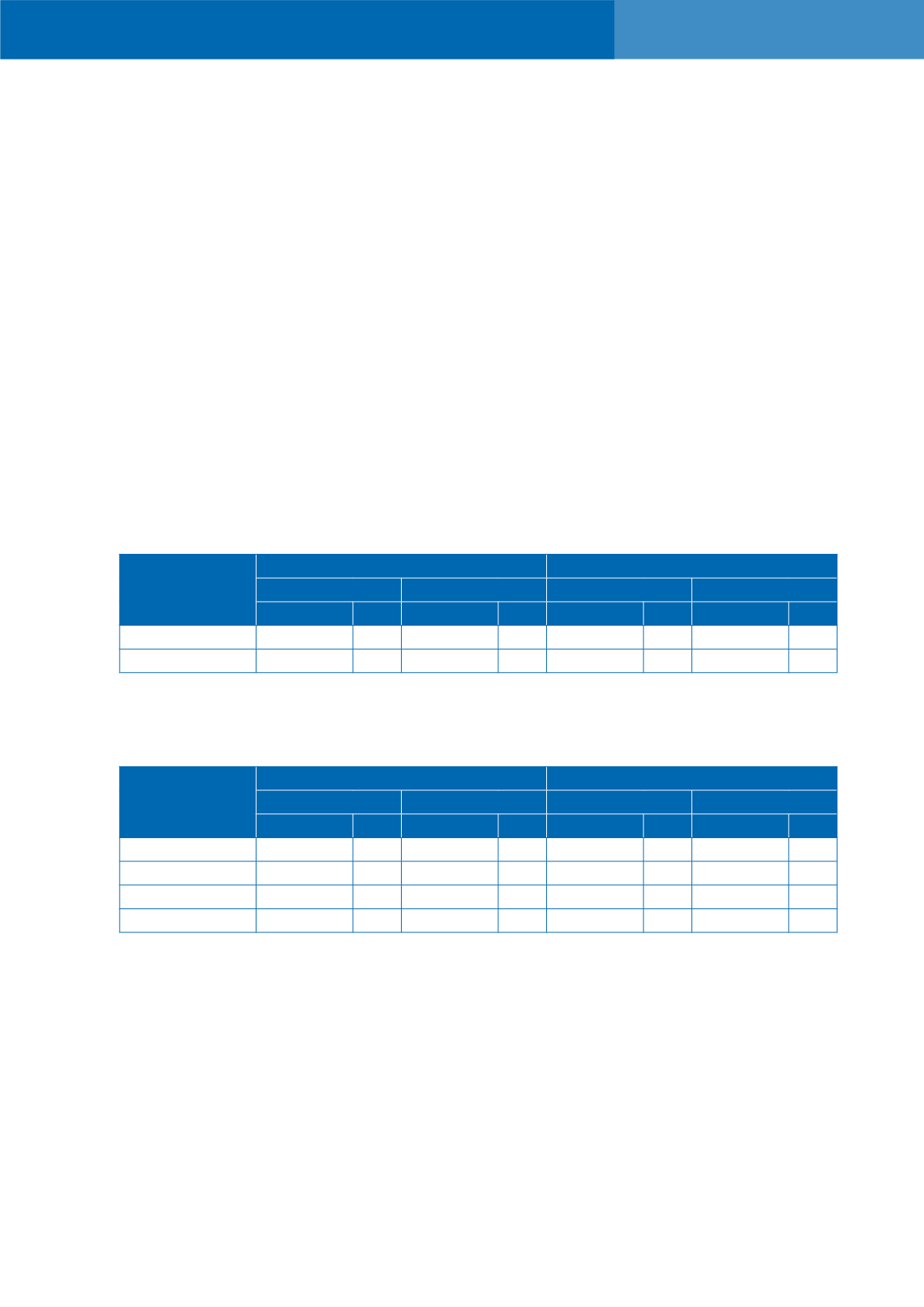

Directors

Before the Proposed Shares Buy-Back *(a) After the Proposed Shares Buy-Back *(b)

Direct

Indirect

Direct

Indirect

No of shares % No of shares % No of shares % No of shares %

Loh Wee Hian

229,137,425 35.65 6,110,250 0.95 229,137,425 39.62 6,110,250 1.06

Kanagaraj Lorenz

4,395,900 0.68

-

-

4,395,900 0.76

-

-

Ng King Kau

1,800,000 0.28

-

-

1,800,000 0.31

-

-

Fong Seow Kee 1,861,950 0.29 635,175 0.10 1,861,950 0.32 635,175 0.11

Notes:

*(a) Adjusted for the number of treasury shares held as at 15 April 2015

*(b) Assuming that 10% of the issued and paid up capital is purchased and retained as treasury shares.

8. Effects of Proposed Shares Buy-Back

Assuming that the Company buys back up to 64,417,029 GHL Shares representing 10% of its issued and paid-

up share capital as at 15 April 2015 and such shares purchased are cancelled or alternatively be retained

as treasury shares or both, the financial effects of the Proposed Share Buy-Back on the share capital of the

Company, Net Assets, working capital, earnings and dividends of GHL are as follows:

STATEMENT TO SHAREHOLDERS

in relation to the Proposed Renewal of Authority for the Company to Purchase its

own Ordinary Shares