NOTES TO THE FINANCIAL STATEMENTS

For The Financial Period From 1 January 2014 To 31 March 2015 (Cont’d)

94

Annual Report 2015

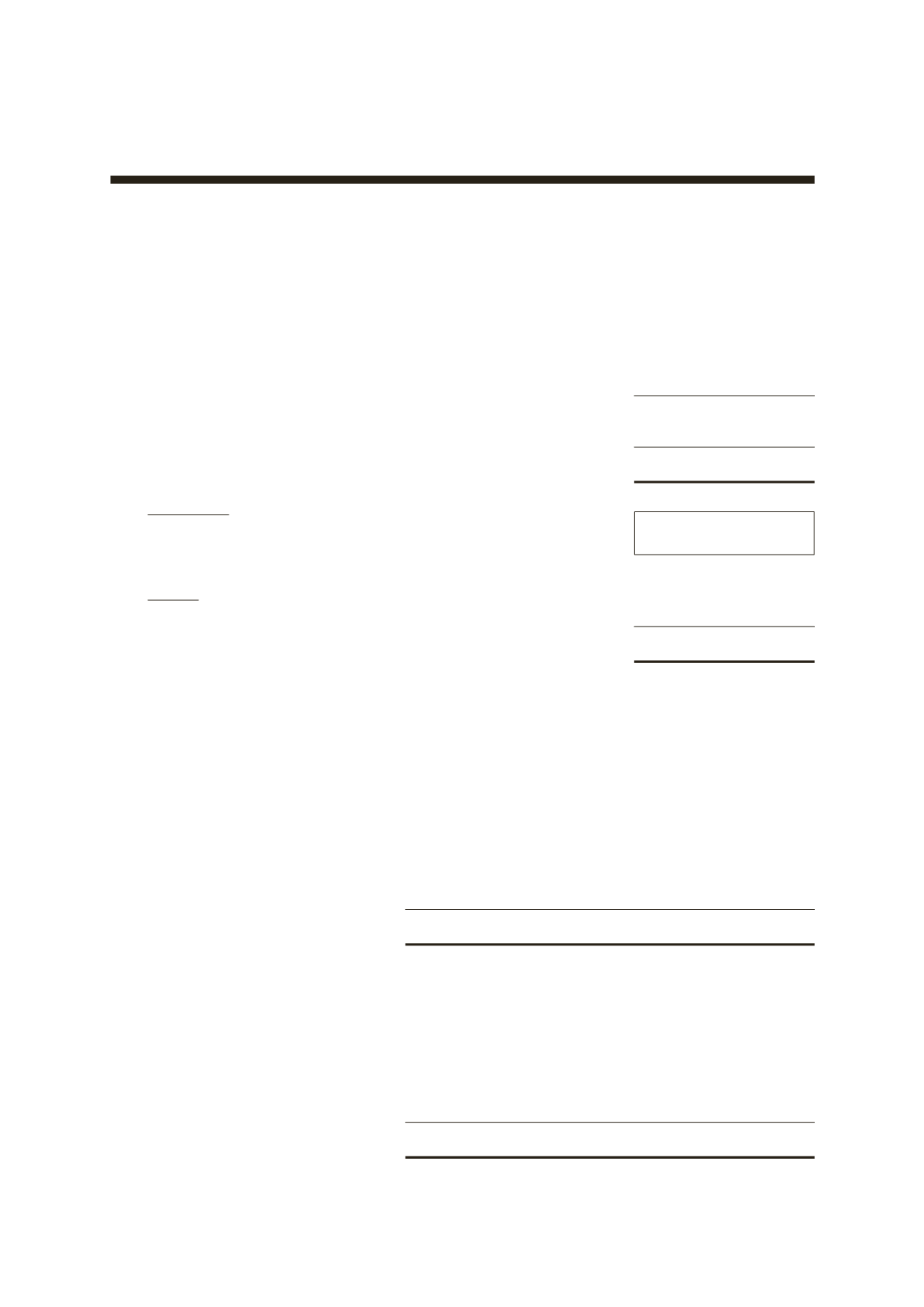

24. HIRE PURCHASE PAYABLE

Group/Company

31.3.2015

31.12.2013

RM’000

RM’000

Minimum hire purchase payments:

- not later than one year

23

23

- later than one year and not later than five years

94

94

- later than five years

4

33

121

150

Less: Future finance charges

(13)

(20)

Present value of hire purchase payable

108

130

Non-current (Note 21):

- later than one year and not later than five years

85

80

- later than five years

4

32

89

112

Current (Note 28):

- not later than one year

19

18

108

130

The hire purchase payable bore an effective interest rate of 4.53% (31.12.2013 - 4.53%) per annum

at the end of the financial period/year.

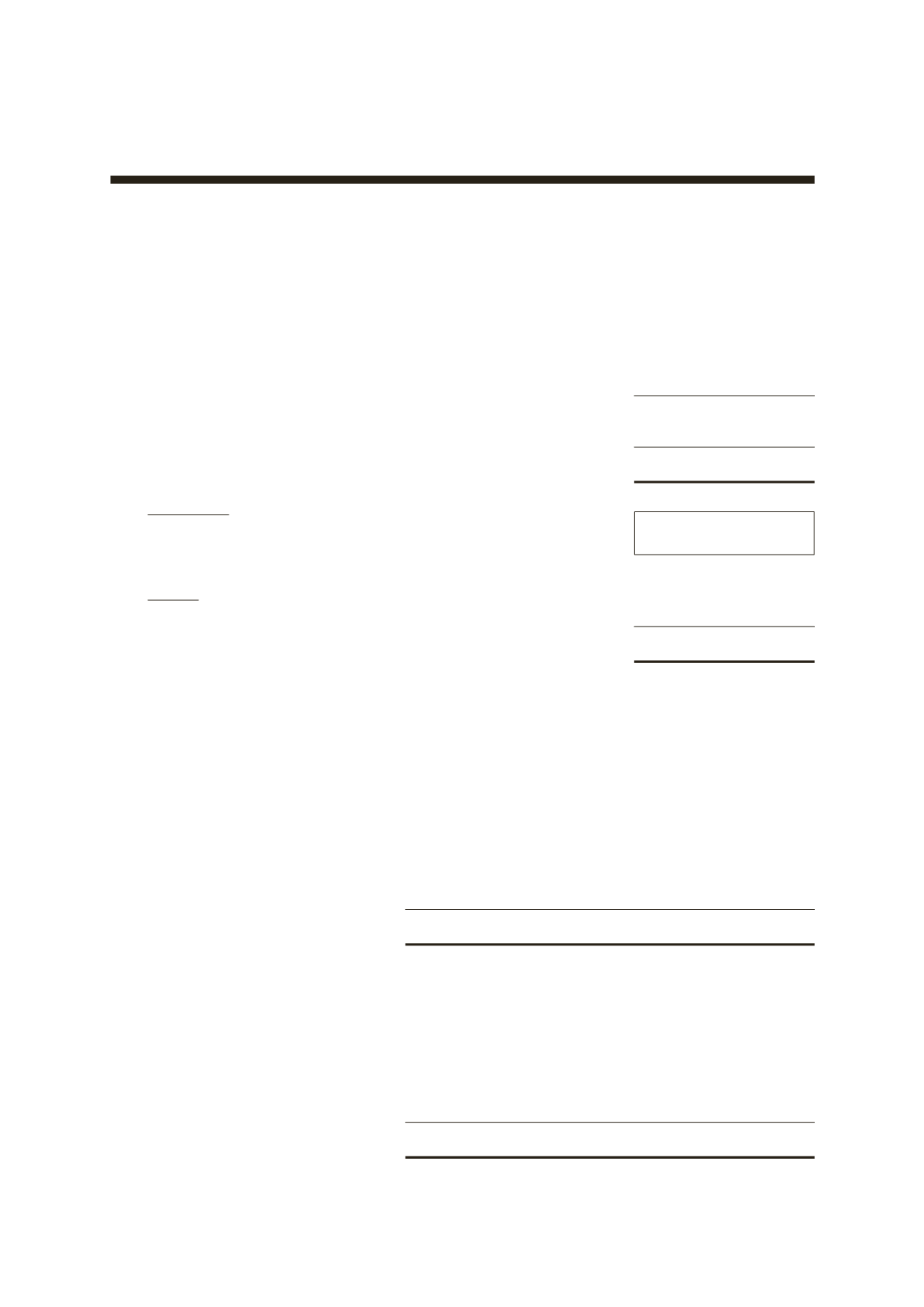

25. DEFERRED TAX LIABILITIES

Group

Company

31.3.2015

31.12.2013

31.3.2015

31.12.2013

RM’000

RM’000

RM’000

RM’000

At 1.1.2014/2013

71

329

24

25

Recognised in profit or

loss (Note 36)

(7)

(258)

11

(1)

At 31.3.2015/31.12.2013

64

71

35

24

The deferred tax liabilities consist of the tax effects of temporary differences arising from the following

items:-

Group

Company

31.3.2015

31.12.2013

31.3.2015

31.12.2013

RM’000

RM’000

RM’000

RM’000

Accelerated capital allowances

64

911

35

24

Other temporary differences

–

(840)

–

–

64

71

35

24