NOTES TO THE FINANCIAL STATEMENTS

For The Financial Period From 1 January 2014 To 31 March 2015 (Cont’d)

99

Datasonic Group Berhad

(Company No. 809759-X)

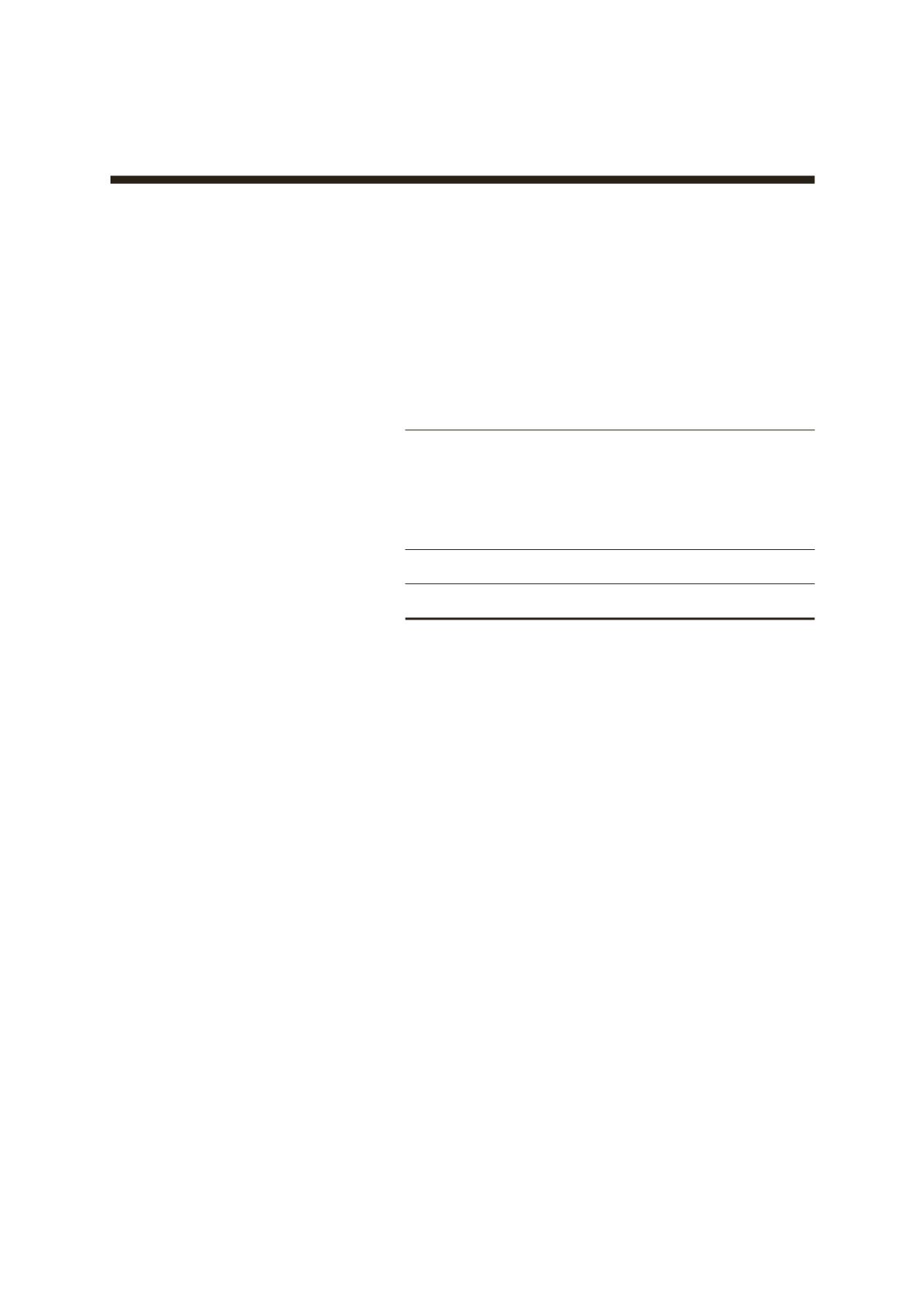

36.

INCOME TAX EXPENSE

Group

Company

1.1.2014

1.1.2013

1.1.2014

1.1.2013

to

to

to

to

31.3.2015

31.12.2013

31.3.2015

31.12.2013

RM’000

RM’000

RM’000

RM’000

Current tax expense:

- for the financial period/year

3,400

12,229

550

387

- under/(over)provision in the

previous financial year

322

(126)

115

13

3,722

12,103

665

400

Deferred tax liabilities (Note 25):

- for the financial period/year

3

(195)

5

14

- (over)/underprovision in the

previous financial year

(10)

(63)

6

(15)

(7)

(258)

11

(1)

3,715

11,845

676

399

During the financial period, the statutory tax rate remained at 25% (31.2.2013 - 25%).

On 6 November 2013, a wholly-owned subsidiary, DSSSB was granted the Multimedia Super Corridor

status which qualifies for Pioneer Status incentive under the Promotion of Investments Act, 1986 for

the period from 18 May 2012 to 17 May 2017 whereby the statutory income from approved activities

is exempted from tax.