NOTES TO THE FINANCIAL STATEMENTS

For The Financial Period From 1 January 2014 To 31 March 2015 (Cont’d)

86

Annual Report 2015

9.

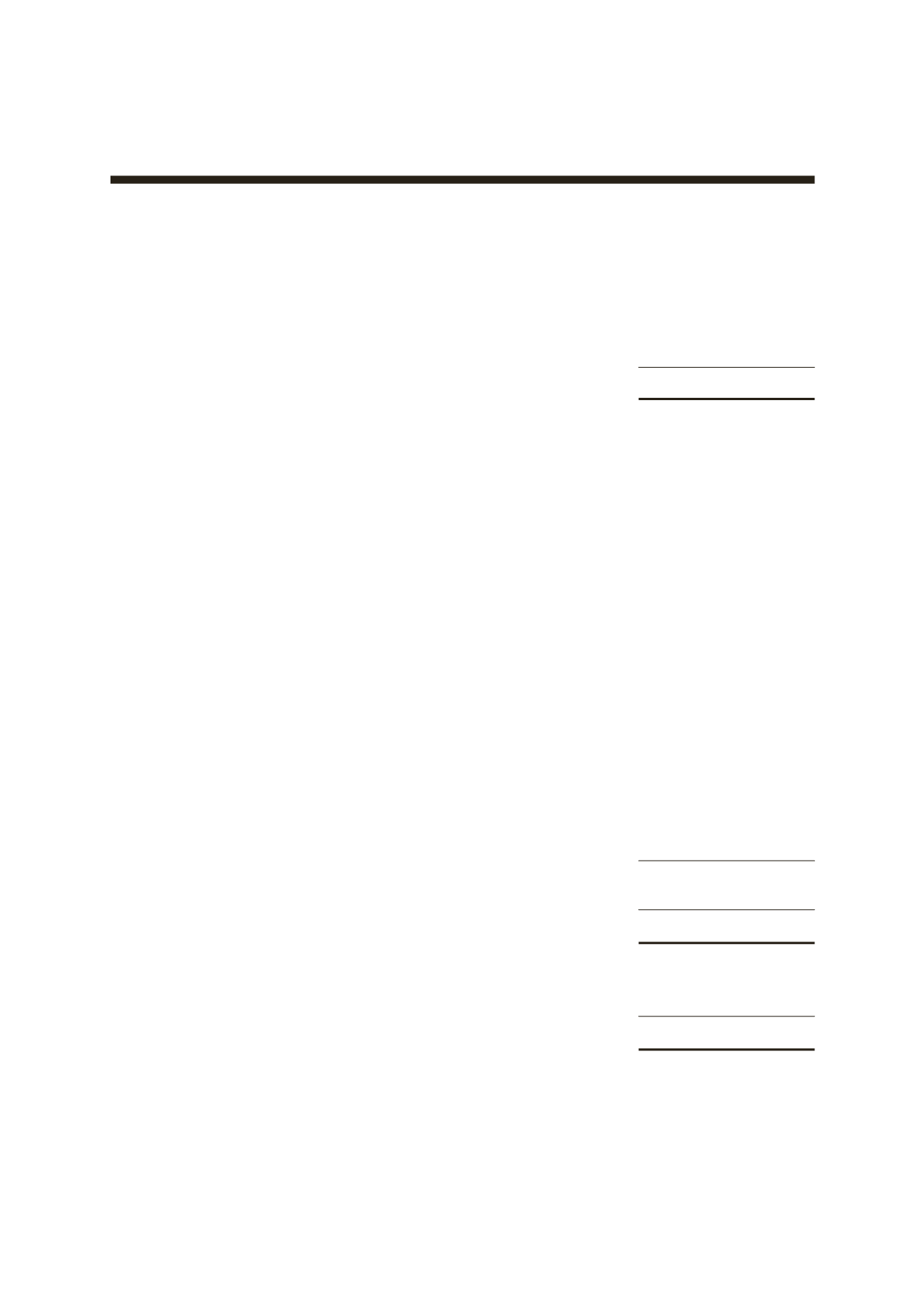

GOODWILL

Group

31.3.2015

31.12.2013

RM’000

RM’000

At 1.1.2014/2013

–

–

Acquisition of new subsidiaries

4,153

–

At 31.3.2015/31.12.2013

4,153

–

The amount of goodwill relates to the manufacturing of cards cash-generating unit. The goodwill

arose from the investment in subsidiaries and is reviewed for impairment annually.

The Group has assessed the recoverable amount of goodwill, and determined that no impairment is

required. The recoverable amount of the manufacturing of cards cash-generating unit is computed

using the value-in-use approach, and this is derived from the present value of the future cash flows from

the generating segment based on the projections of financial budgets approved by management

covering a period of 3 years. The key assumptions used in the determination of the recoverable

amount are as follows:-

(i)

Budgeted profit margin Average profit margin achieved in the 3 years immediately

before the budgeted period increased for expected efficiency

improvements and cost saving measures.

(ii) Growth rate

Based on the expected projection of the smart card business.

(iii) Discount rate (pre-tax)

Reflects specific risks relating to the relevant operating segments.

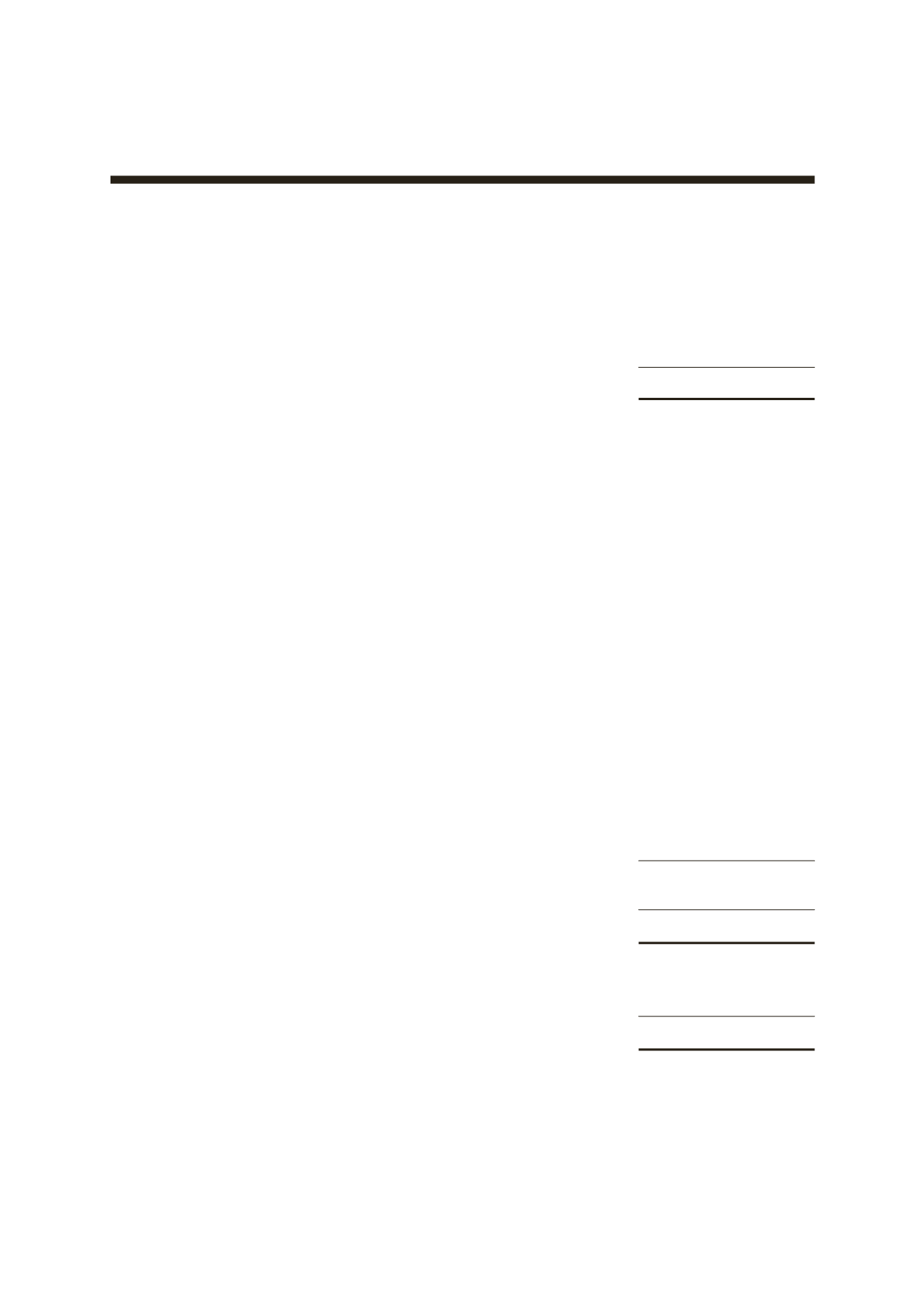

10. DEVELOPMENT EXPENDITURES

Group

31.3.2015

31.12.2013

RM’000

RM’000

At cost:-

At 1.1.2014/2013

3,519

3,668

Additions

9,639

912

Cost of sales

(811)

(1,061)

At 31.3.2015/31.12.2013

12,347

3,519

Allowance for impairment losses

(1,222)

(1,222)

11,125

2,297

Allowance for impairment losses:-

At 1.1.2014/2013

(1,222)

–

Addition

–

(1,222)

At 31.3.2015/31.12.2013

(1,222)

(1,222)

The development expenditures consist of direct and related costs for overhead and software solutions

incurred in the process of development.

The development expenditures of the Group include staff costs amounting to RM1,659,000 (31.12.2013

- RM1,483,000).