NOTES TO THE FINANCIAL STATEMENTS

For The Financial Period From 1 January 2014 To 31 March 2015 (Cont’d)

102

Annual Report 2015

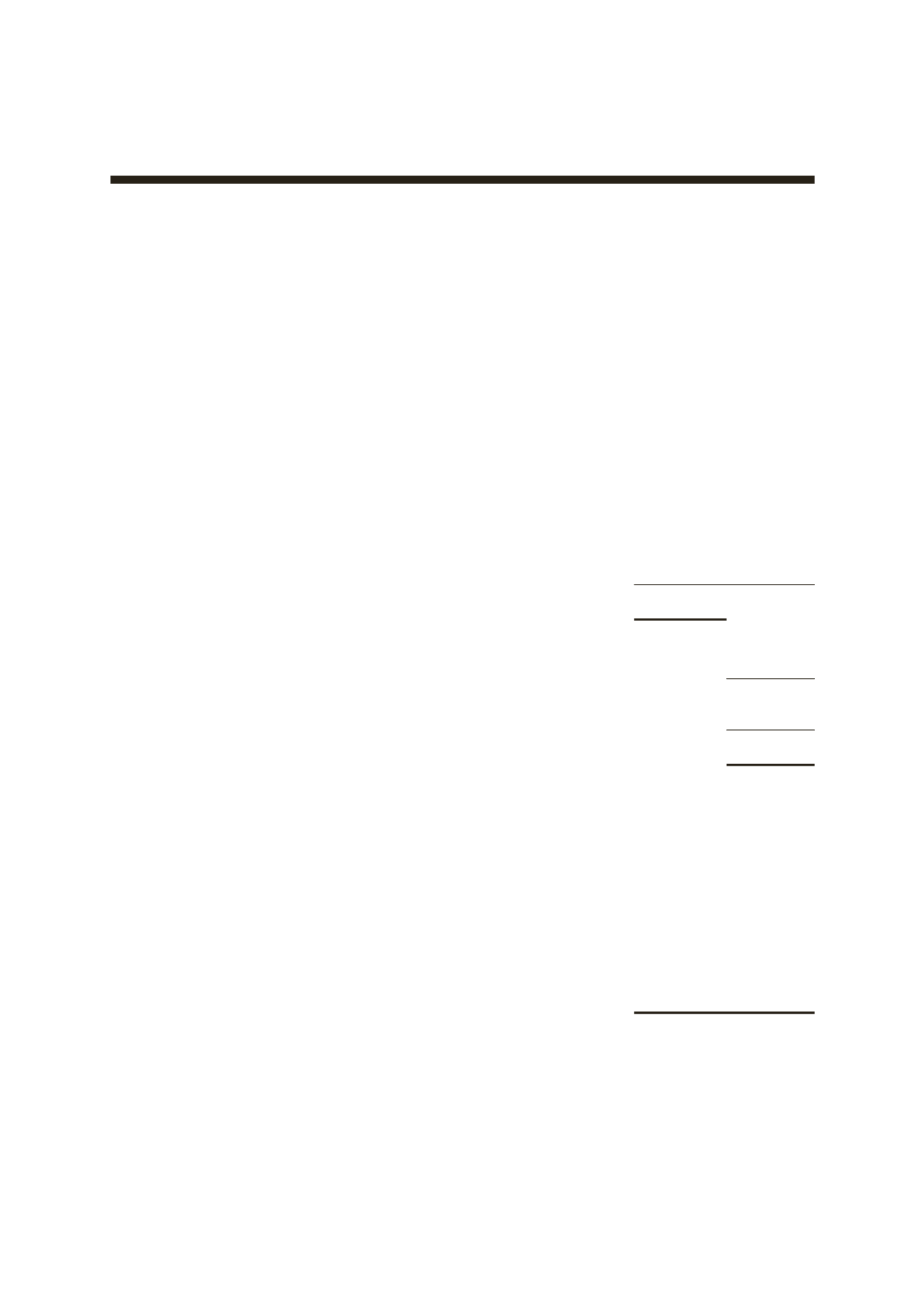

38. ACQUISITION OF SUBSIDIARIES

During the financial period, the Group acquired an 99.45% equity interest in DMSB together with its

wholly-owned subsidiary, CASB.

The fair values of the identifiable assets and liabilities of the subsidiaries at the date of acquisition

were:-

At Date Of Acquisition

Carrying

Fair Value

Amount

Recognised

RM’000

RM’000

Equipment

1,830

1,830

Inventories

2,056

2,056

Trade receivables

33

33

Other receivables and deposits

9,698

9,698

Cash and cash equivalents

4,975

4,975

Trade payables

(315)

(315)

Other payables and accruals

(453)

(453)

Amount owing to a director

(1)

(1)

Net identifiable assets and liabilities

17,823

17,823

Less: Non-controlling interests

(98)

Add: Goodwill on acquisition

4,153

Total purchase consideration

21,878

Less: Cash and cash equivalents of subsidiaries acquired

(4,975)

Net cash outflow for acquisition of subsidiaries

16,903

The non-controlling interests are measured at the non-controlling interests’ proportionate share of

the fair value of acquiree’s identifiable net assets at the date of acquisition.

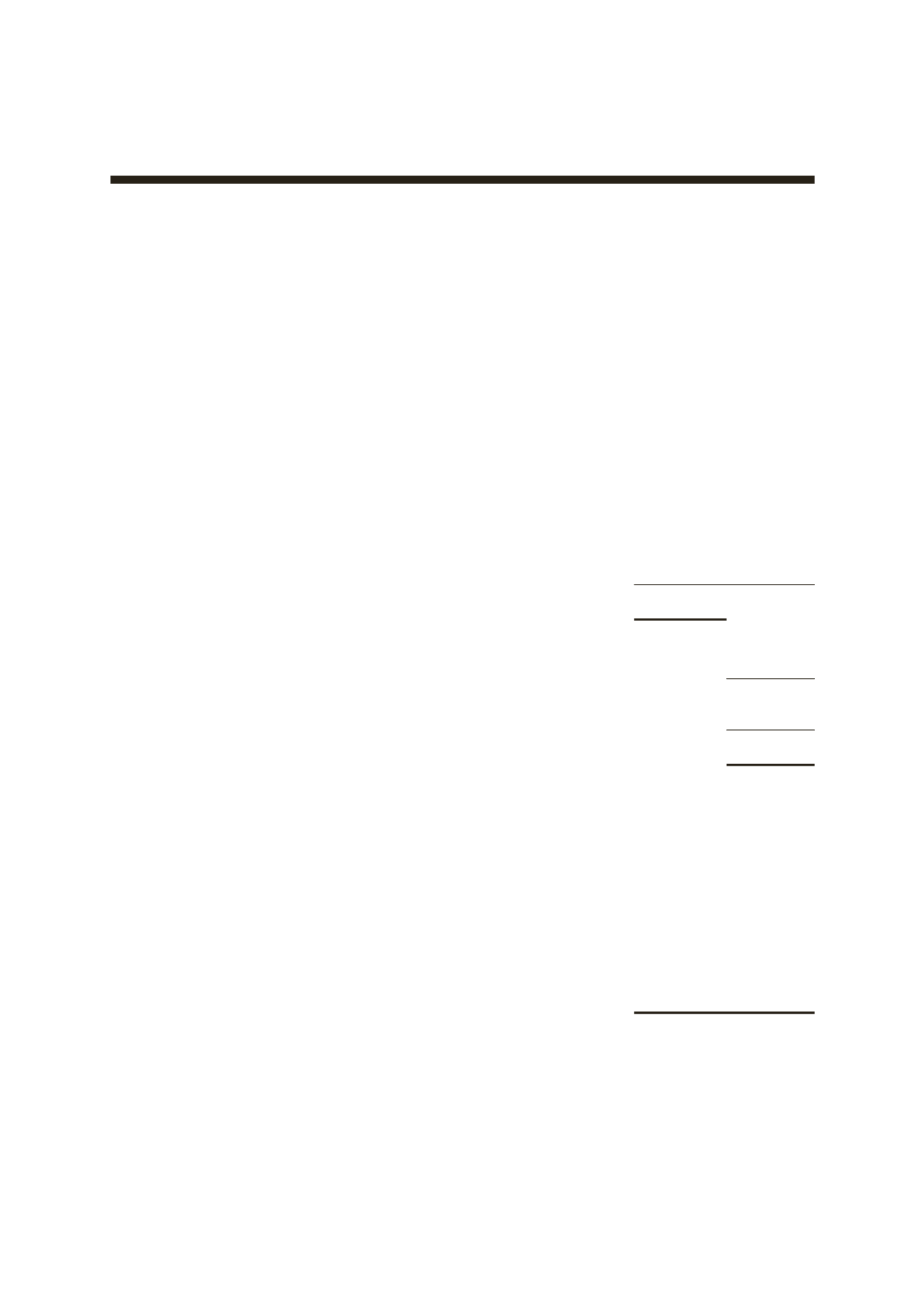

The acquired subsidiaries have contributed the following results to the Group:-

Group

16.7.2014

1.1.2013

to

to

31.3.2015

31.12.2013

RM’000

RM’000

Revenue

512

–

Loss after taxation

5,168

–

If the acquisition had taken place at the beginning of the financial year, the Group’s revenue and

profit after taxation from continuing operations would have been RM285,613,000 and RM71,652,000

respectively.