NOTES TO THE FINANCIAL STATEMENTS

For The Financial Period From 1 January 2014 To 31 March 2015 (Cont’d)

120

Annual Report 2015

45. FINANCIAL INSTRUMENTS (CONT’D)

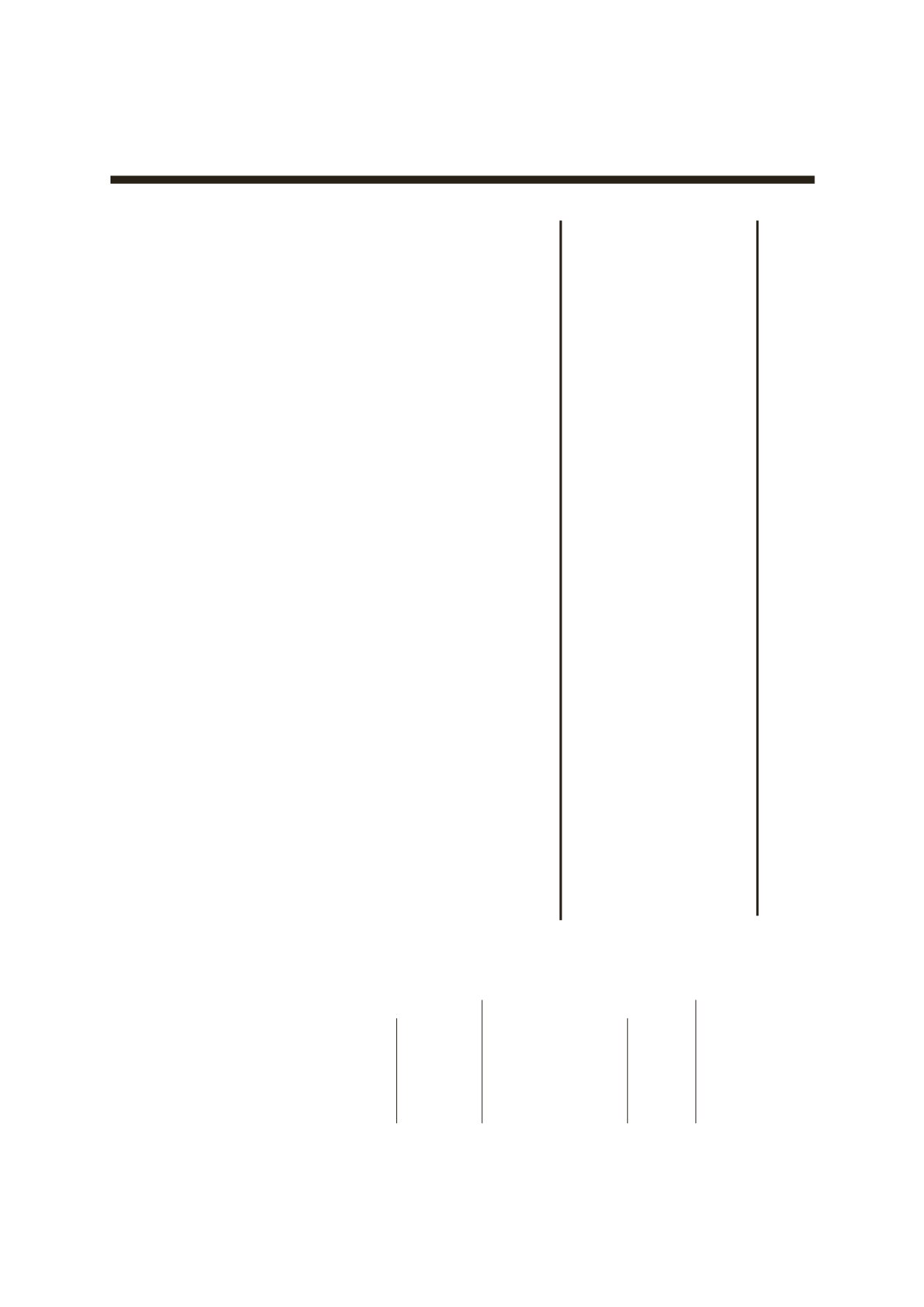

45.4 FAIR VALUE INFORMATION

Other than those disclosed below, the fair values of the financial assets and financial liabilities maturing within the next 12 months

approximated their carrying amounts due to the relatively short-termmaturity of the financial instruments. These fair values are determined

by discounting the relevant cash flows at rates equal to the current market interest rate plus appropriate credit rating, where necessary.

The fair values are included in level 2 of the fair value hierarchy.

Fair Value Of Financial Instruments Fair Value Of Financial Instruments

Total

Carried At Fair Value

Not Carried At Fair Value

Fair

Carrying

Level 1 Level 2 Level 3

Level 1 Level 2 Level 3

Value Amount

The Group

RM’000 RM’000 RM’000

RM’000 RM’000 RM’000

RM’000

RM’000

31.3.2015

Financial Assets

Trade receivables (non-current)

–

–

–

–

6,582

–

6,582

6,582

Other investment:

- club membership

–

110

–

–

–

–

110

110

Financial Liabilities

Trade financing

–

–

–

–

28,813

–

28,813

28,813

Hire purchase payable

–

–

–

–

108

–

108

108

Term financing

–

–

–

–

15,814

–

15,814

15,814

Term loans

–

–

–

–

89,624

–

89,624

89,624

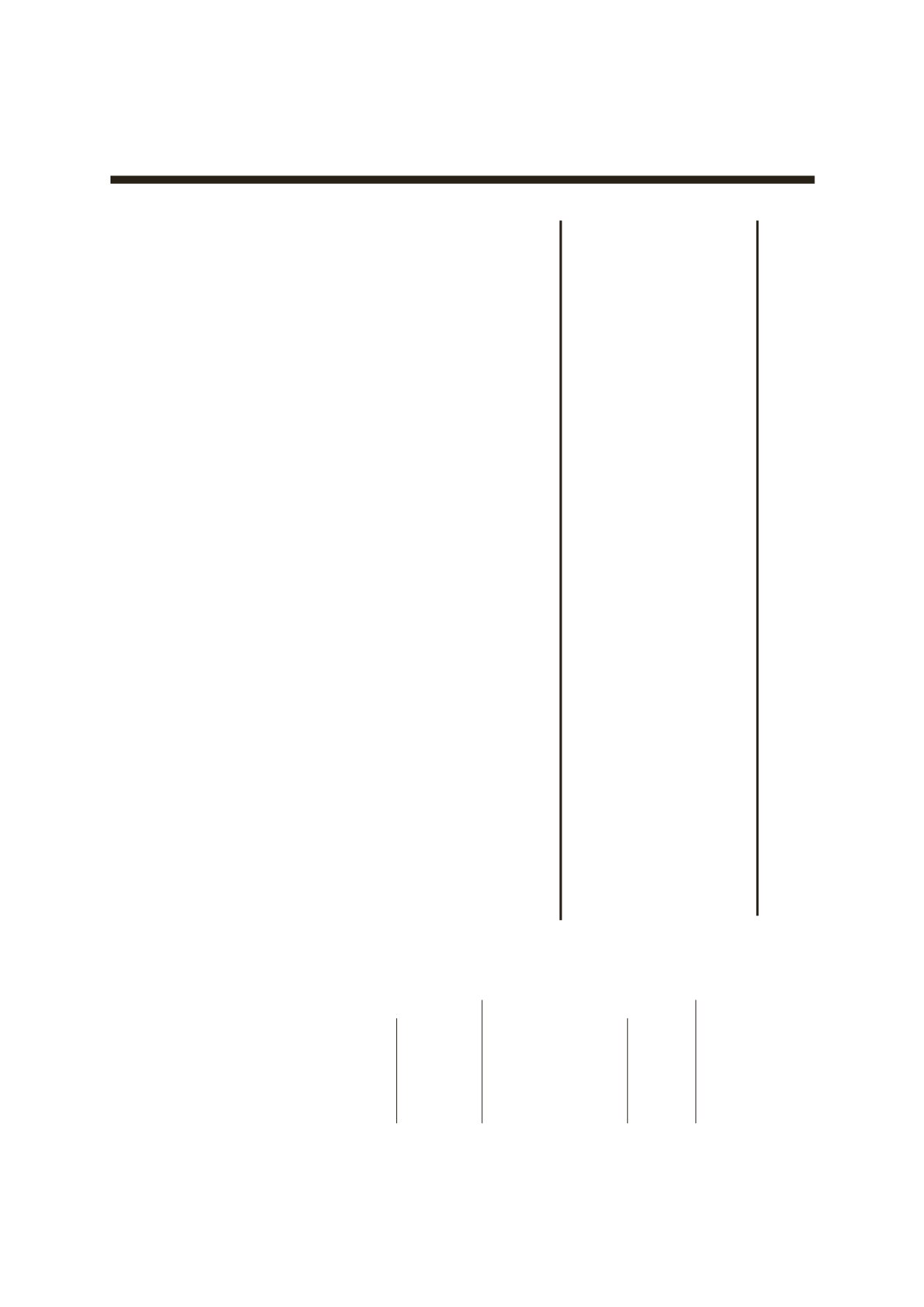

31.12.2013

Financial Assets

Other investment:

- club membership

–

110

–

–

–

–

110

110

Financial Liabilities

Trade financing

–

–

–

–

16,536

–

16,536

16,536

Hire purchase payable

–

–

–

–

130

–

130

130

Term loans

–

–

–

–

134,929

–

134,929 134,929