NOTES TO THE FINANCIAL STATEMENTS

For The Financial Period From 1 January 2014 To 31 March 2015 (Cont’d)

116

Annual Report 2015

45. FINANCIAL INSTRUMENTS (CONT’D)

45.1 FINANCIAL RISK MANAGEMENT POLICIES (CONT’D)

(b) Credit Risk (Cont’d)

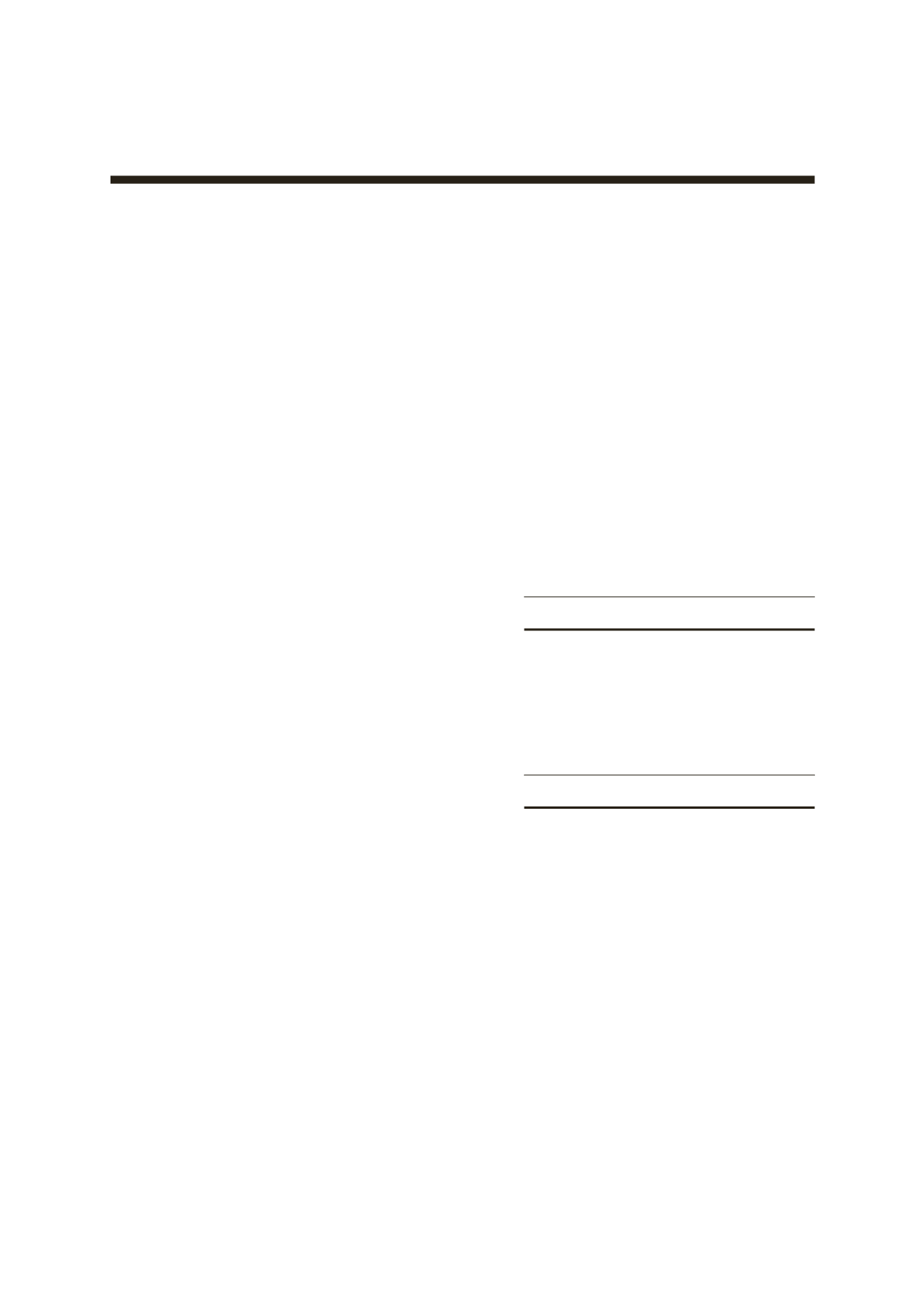

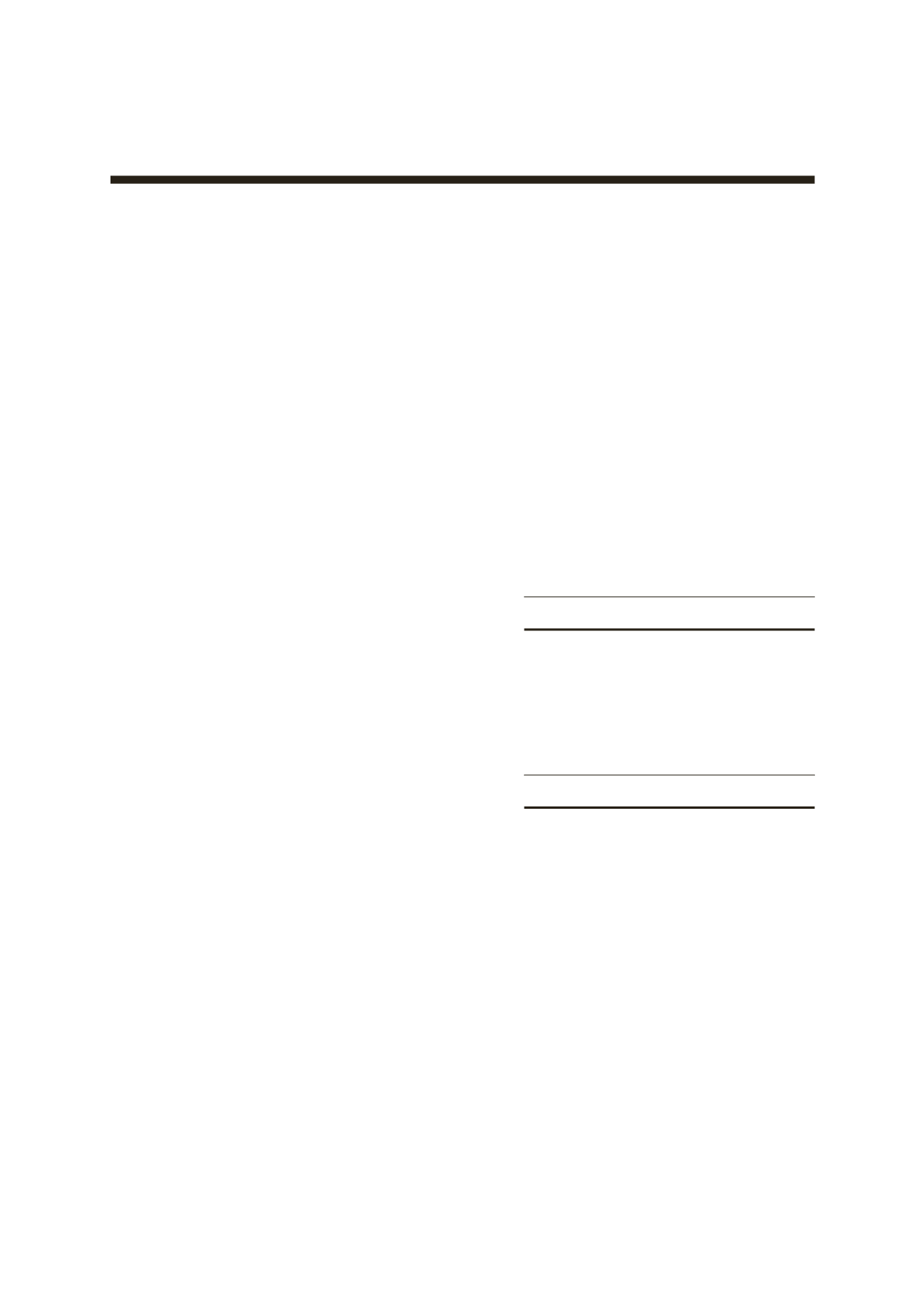

(iii) Ageing analysis

The ageing analysis of the Group’s trade receivables (excluding accrued income)

at the end of the financial period/year is as follows:-

Gross

Individual

Carrying

Amount

Impairment

Value

Group

RM’000

RM’000

RM’000

31.3.2015

Not past due

41,040

–

41,040

Past due:

- 31 to 60 days

6,787

–

6,787

- 61 to 90 days

43

–

43

- over 90 days

30,637

(598)

30,039

78,507

(598)

77,909

31.12.2013

Not past due

50,435

–

50,435

Past due:

- 31 to 60 days

20,299

–

20,299

- 61 to 90 days

34,426

–

34,426

- over 90 days

32,447

(75)

32,372

137,607

(75)

137,532

At the end of the financial year, trade receivables that are individually impaired

were those in significant financial difficulties and have defaulted on payments. These

receivables are not secured by any collateral or credit enhancement.

Trade receivables that are past due but not impaired

The Group believes that no impairment allowance is necessary in respect of these

trade receivables. They are substantially companies with good collection track

record and no recent history of default.

Trade receivables that are neither past due nor impaired

A significant portion of trade receivables that are neither past due nor impaired

are regular customers that have been transacting with the Group. The Groups uses

ageing analysis tomonitor the credit quality of the trade receivables. Any receivables

having significant balances past due or more than 180 days, which are deemed to

have higher credit risk, are monitored individually.