NOTES TO THE FINANCIAL STATEMENTS

For The Financial Period From 1 January 2014 To 31 March 2015 (Cont’d)

119

Datasonic Group Berhad

(Company No. 809759-X)

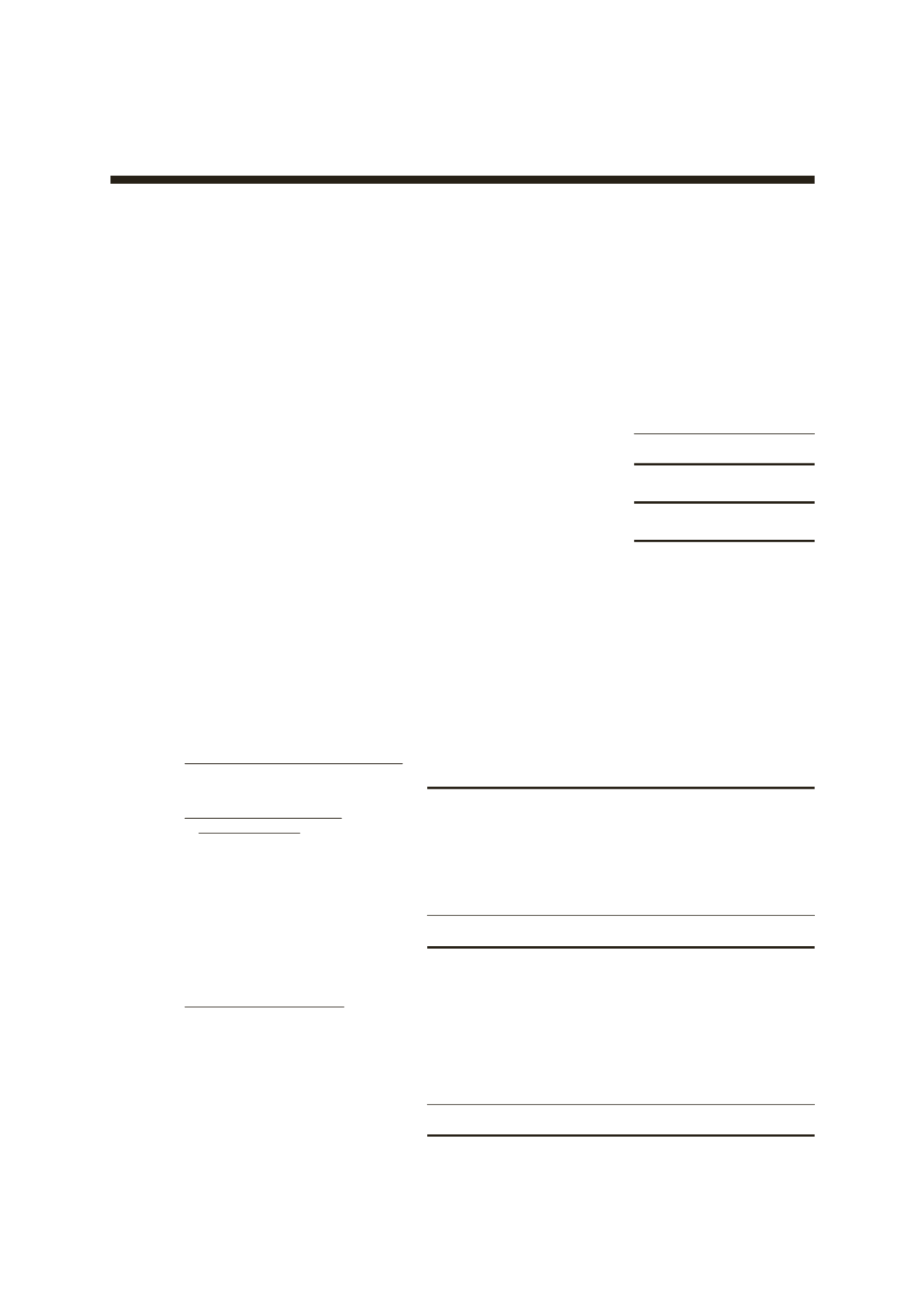

45. FINANCIAL INSTRUMENTS (CONT’D)

45.2 CAPITAL RISK MANAGEMENT (CONT’D)

The debt-to-equity ratio of the Group as at the end of the financial period/year was as follows:-

Group

31.3.2015

31.12.2013

RM’000

RM’000

Trade financing

28,813

16,536

Hire purchase payable

108

130

Term financing

15,814

–

Term loans

89,624

134,929

Total borrowings

134,359

151,595

Total equity

222,859

177,937

Debt-to-equity ratio

0.60

0.85

Under the requirement of Bursa Malaysia Practice Note No. 17/2005, the Company is required

to maintain a consolidated shareholders’ equity (total equity attributable to owners of the

Company) equal to or not less than the 25% of the issued and paid-up share capital (excluding

treasury shares) and such shareholders’ equity is not less than RM40 million. The Company has

complied with this requirement.

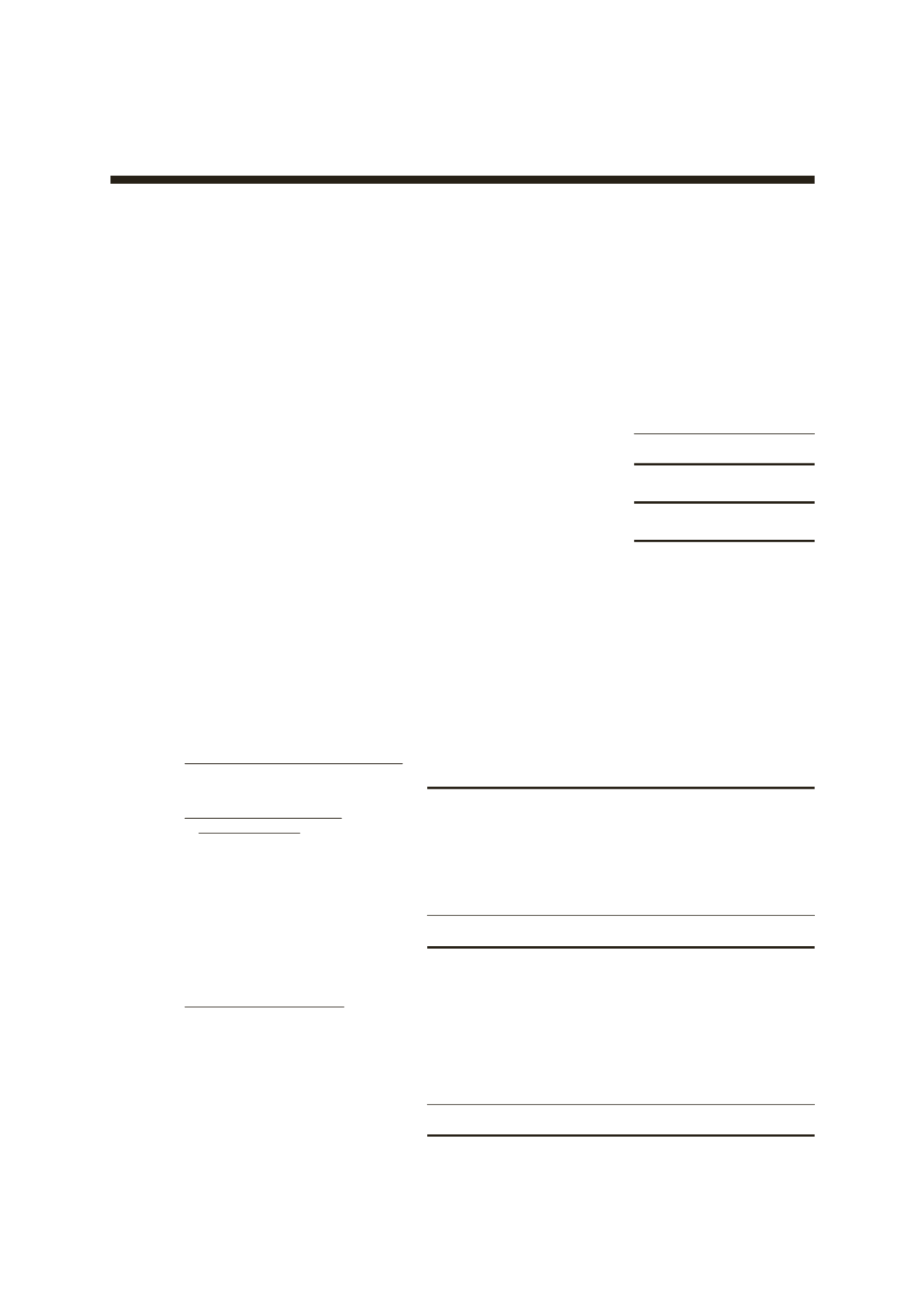

45.3 CLASSIFICATION OF FINANCIAL INSTRUMENTS

Group

Company

31.3.2015

31.12.2013 31.3.2015

31.12.2013

RM’000

RM’000

RM’000

RM’000

Financial Assets

Available-for-sale financial asset

Other investment

110

110

–

–

Loans and receivables

financial assets

Trade receivables

(1)

77,909

137,532

–

–

Other receivables and deposits

1,018

1,810

123

39

Amount owing by subsidiaries

–

–

94,565

26,021

Deposits with licensed banks

3,965

8,282

74

2,203

Cash and bank balances

45,018

27,142

1,182

2,779

127,910

174,766

95,944

31,042

Financial Liabilities

Other financial liabilities

Trade payables

1,537

17,113

–

–

Other payables and accruals

(2)

3,960

9,707

472

673

Trade financing

28,813

16,536

–

–

Hire purchase payable

108

130

108

130

Term financing

15,814

–

15,814

–

Term loans

89,624

134,929

–

–

139,856

178,415

16,394

803

Notes:

(1)

- The trade receivables exclude accrued income.

(2)

- The other payables and accruals exclude deferred income.