NOTES TO THE FINANCIAL STATEMENTS

For The Financial Period From 1 January 2014 To 31 March 2015 (Cont’d)

118

Annual Report 2015

45. FINANCIAL INSTRUMENTS (CONT’D)

45.1 FINANCIAL RISK MANAGEMENT POLICIES (CONT’D)

(c) Liquidity Risk (Cont’d)

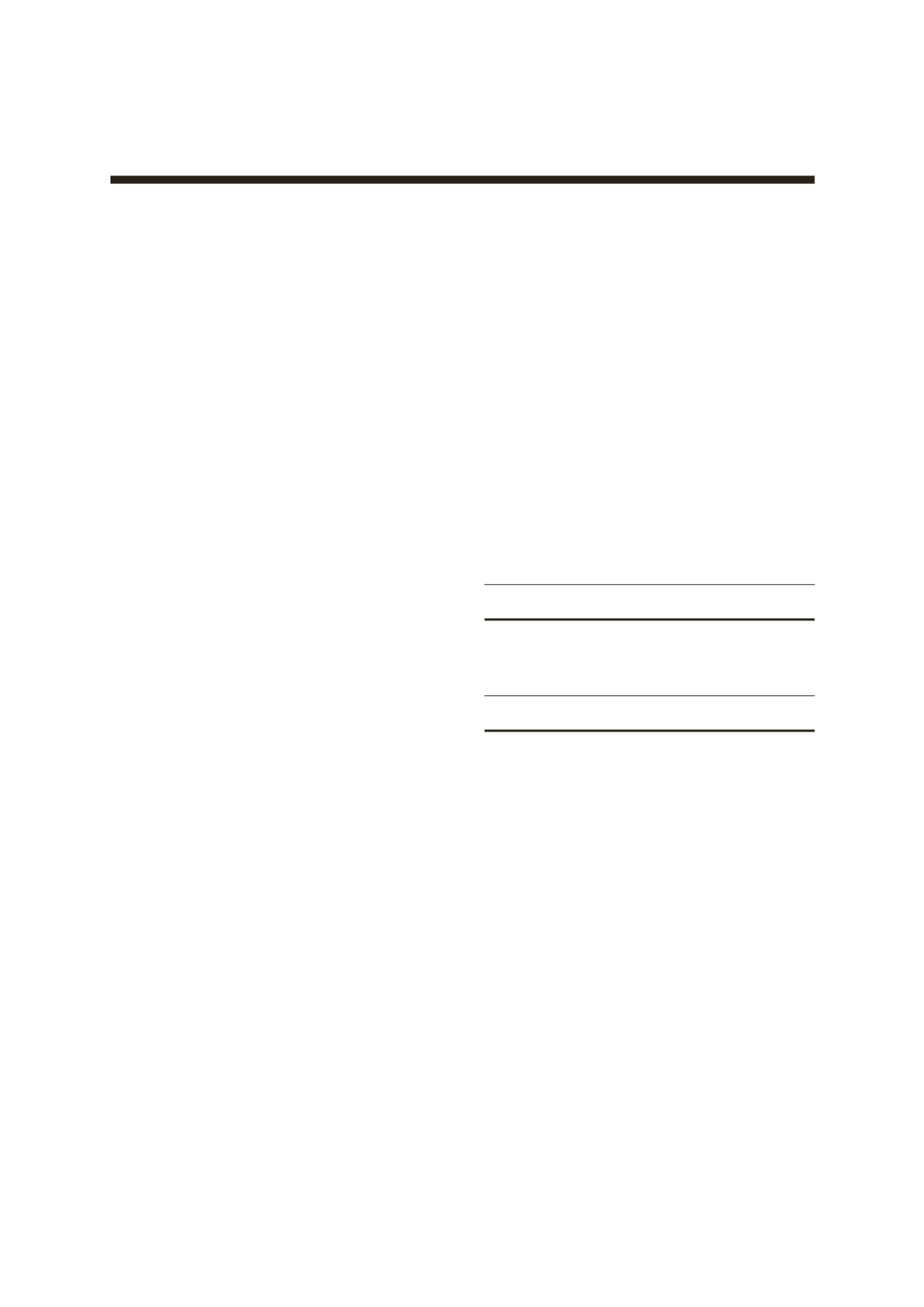

The following table sets out the maturity profile of the financial liabilities at the end of the

financial period/year based on contractual undiscounted cash flows (including interest

payments computed using contractual rates or, if floating, based on the rates at the end

of the financial period/year) (Cont’d):-

Contractual

Effective Carrying Undiscounted Within 1 - 5 Over

Rate Amount

Cash Flows 1 Year

Years 5 Years

% RM’000 RM’000 RM’000 RM’000 RM’000

Company

31.3.2015

Other payables and accruals

–

472

472

472 –

–

Hire purchase payable

4.53

108

121

23

94

4

Term financing

4.45 to 5.85 15,814

18,723

3,450 8,665 6,608

16,394

19,316

3,945 8,759 6,612

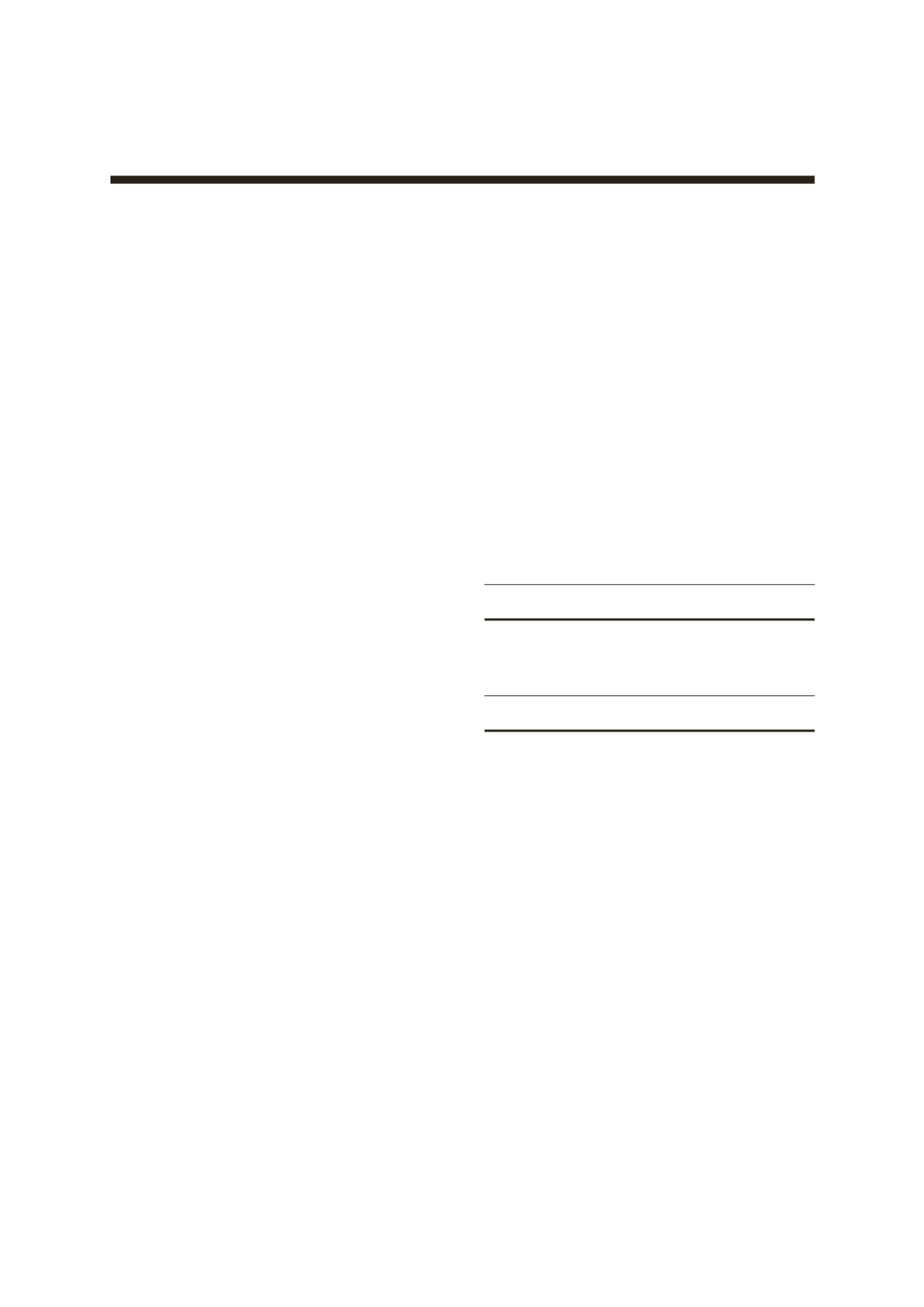

31.12.2013

Other payables and accruals

–

673

673

673 –

–

Hire purchase payable

4.53

130

150

23

94

33

803

823

696

94

33

45.2 CAPITAL RISK MANAGEMENT

The Group manages its capital to ensure that entities within the Group will be able to maintain

an optimal capital structure so as to support their businesses and maximise shareholders value.

To achieve this objective, the Group may make adjustments to the capital structure in view of

changes in economic conditions, such as adjusting the amount of dividend payment, returning

of capital to shareholders or issuing new shares.

TheGroupmanages its capital based on debt-to-equity ratio that complies with debt covenants

and regulatory, if any. The debt-to-equity ratio is calculated as total borrowings from financial

institutions divided by total equity.

There were no changes in the Group’s approach to capital management during the financial

period.