Annual report 2014

15

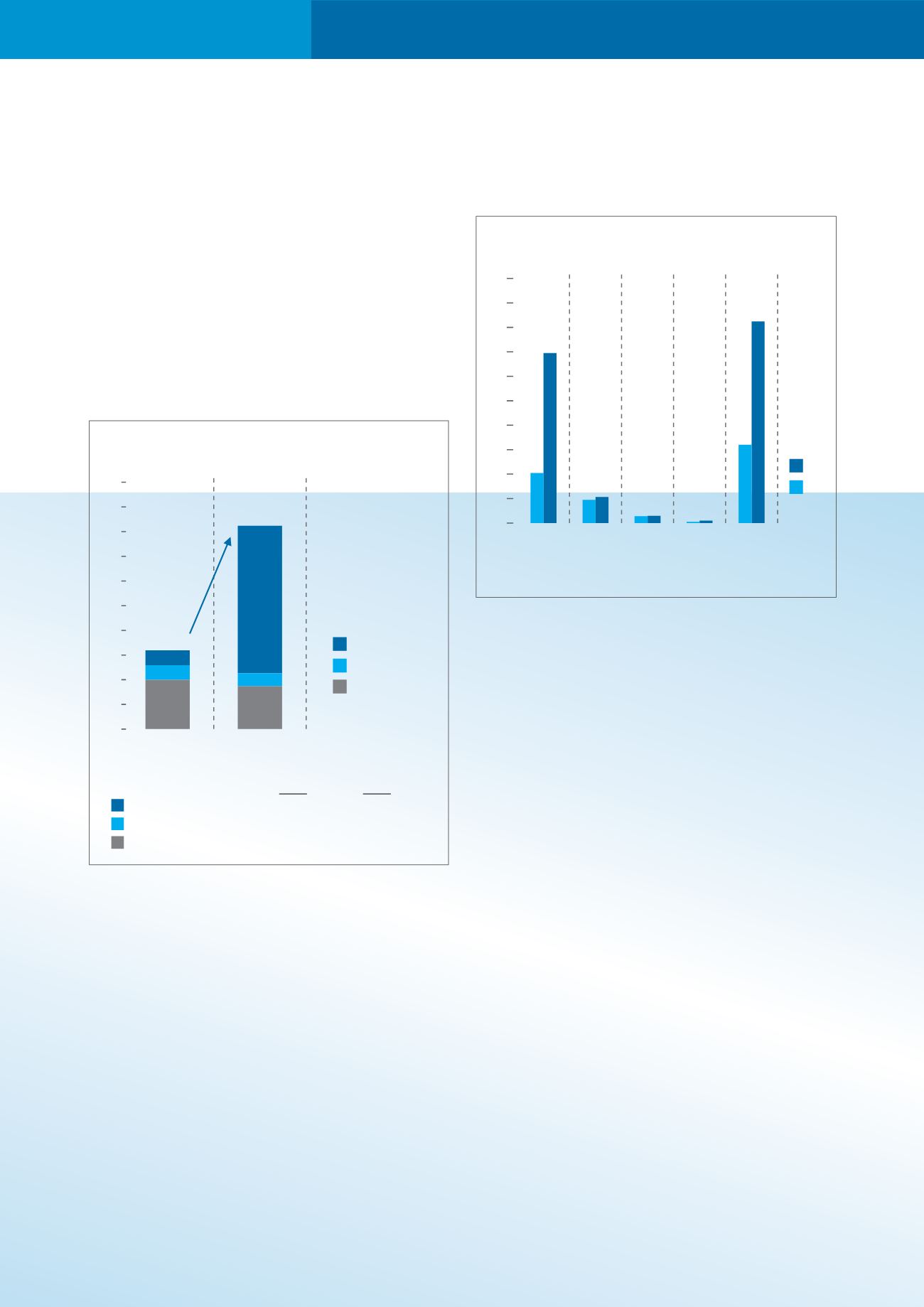

Figure 4 - Revenue by Country

0

20

40

60

80

100

120

140

160

180

200

2014

2013

Malaysia

Philippines

Thailand

Australia

Total

(RM’Mil)

FINANCIAL AND OPERATIONAL HIGHLIGHTS

In 2014, the TPA division replaced Shared Services as

the largest contributor to group turnover as e-pay’s

contribution was included for the last 10 months of the

financial period under review. Shared Services and

Solution Services were both marginally lower year-on-

year as maintenance fees, hardware and card sales

in 2014 were lower compared to the same period last

year.

Transaction Payment Acquisition (“TPA”)

The primary focus of the Group in 2015 will be to

implement the TPA business across the group. The

TPA initiative marks the latest phase of our evolution

and is strategic to the group. This TPA business has 2

distinct components, each in a different stage of

development. These are; i) e-pay’s direct contractual

relationships with merchants to provide Telco prepaid

and other top-up facilities and, bill collection services

for consumers (“reloadand collection services”) and ii)

GHL’s direct contractual relationships with merchants

to provide international and domestic card payment

services (“card payment services”). Each of these is

described in more detail as follows:-

e-pay (reload and collection services)

e-pay is the largest provider of reload and collection

services in Malaysia. It has about 23,000 acceptance

points nationwide, encompassing all petrol chains,

the largest convenience store chains and over 8,000

general stores. The e-pay brand is well known to

consumers who use the service. With over 15 years

experience, e-pay is clearly the market leader in

Malaysia within this industry segment.

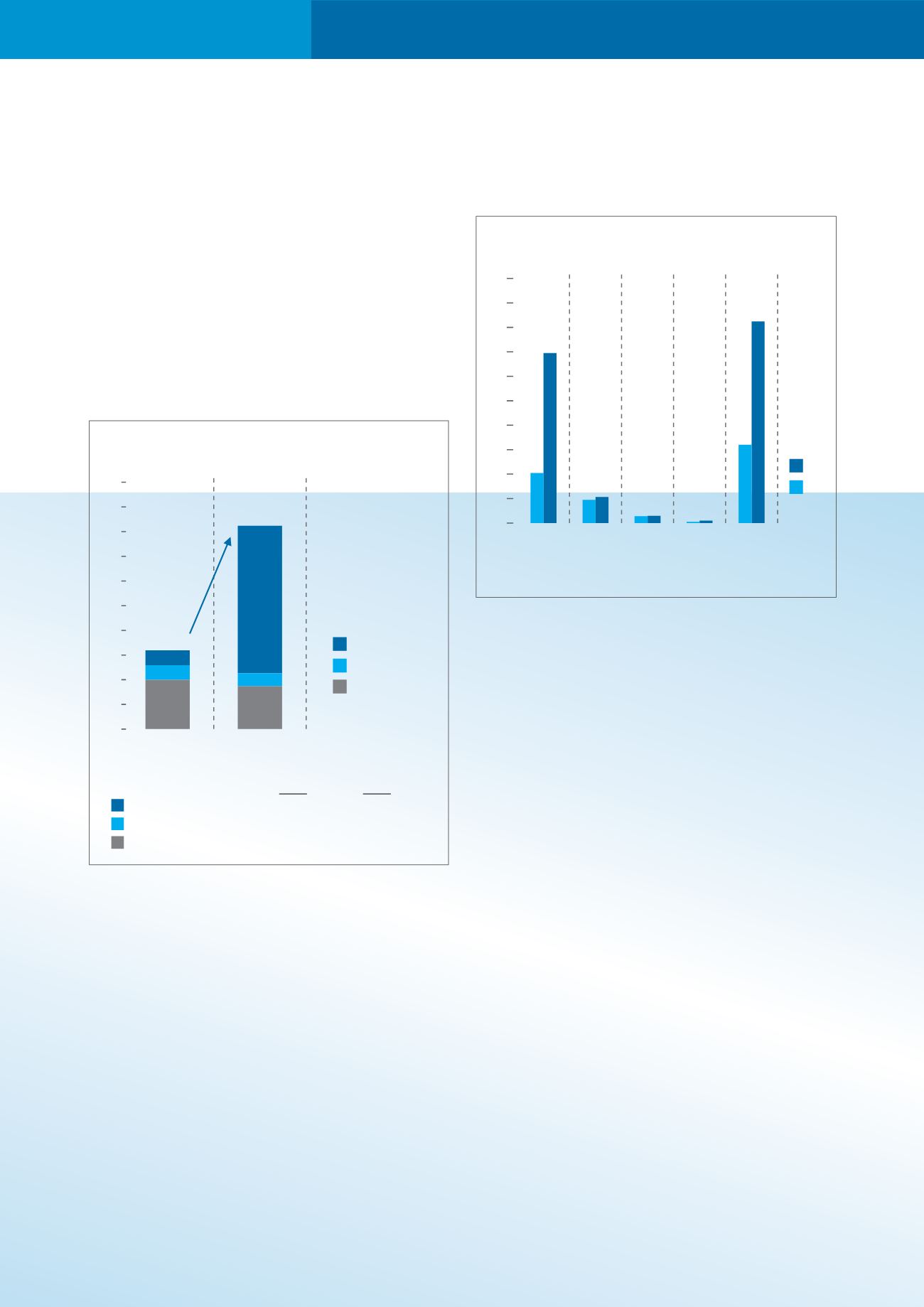

Figure 3 - Revenue By Business Segment

0

20

40

60

80

100

120

140

160

180

200

TPA

Solution Services

Shared Services

2013

(RM mil)

64.0

158%

164.9

2014

(RM mil)

Malaysian operations contributed the most to group

revenue primarily due to the inclusion of e-pay’s

revenues. At the EBIT margins level, Malaysian

operations (excluding inter-segment sales) improved

25.0% in 2014 versus 4.2% in 2013.

Philippines turnover grew 12.4% year-on-year to

RM19.0m (2013-16.8m) and EBIT margins maintained

at 16.9% in 2014 (2013-16.8%).

Thailand recorded modest revenue growth of 2.9% to

RM5.8 million (2013 RM5.7m) despite the challenging

market conditions caused by its uncertain political

climate. EBIT was negative with losses of RM1.9 million

compared to RM1.0 million loss in 2013 principally due

to provision and restructuring reserves taken.

ceo

report

2013

2014

Shared Services

39.9

34.8

Solutions Services

11.8

10.5

TPA

12.3

119.6