14

GHL Systems Berhad

(293040-D)

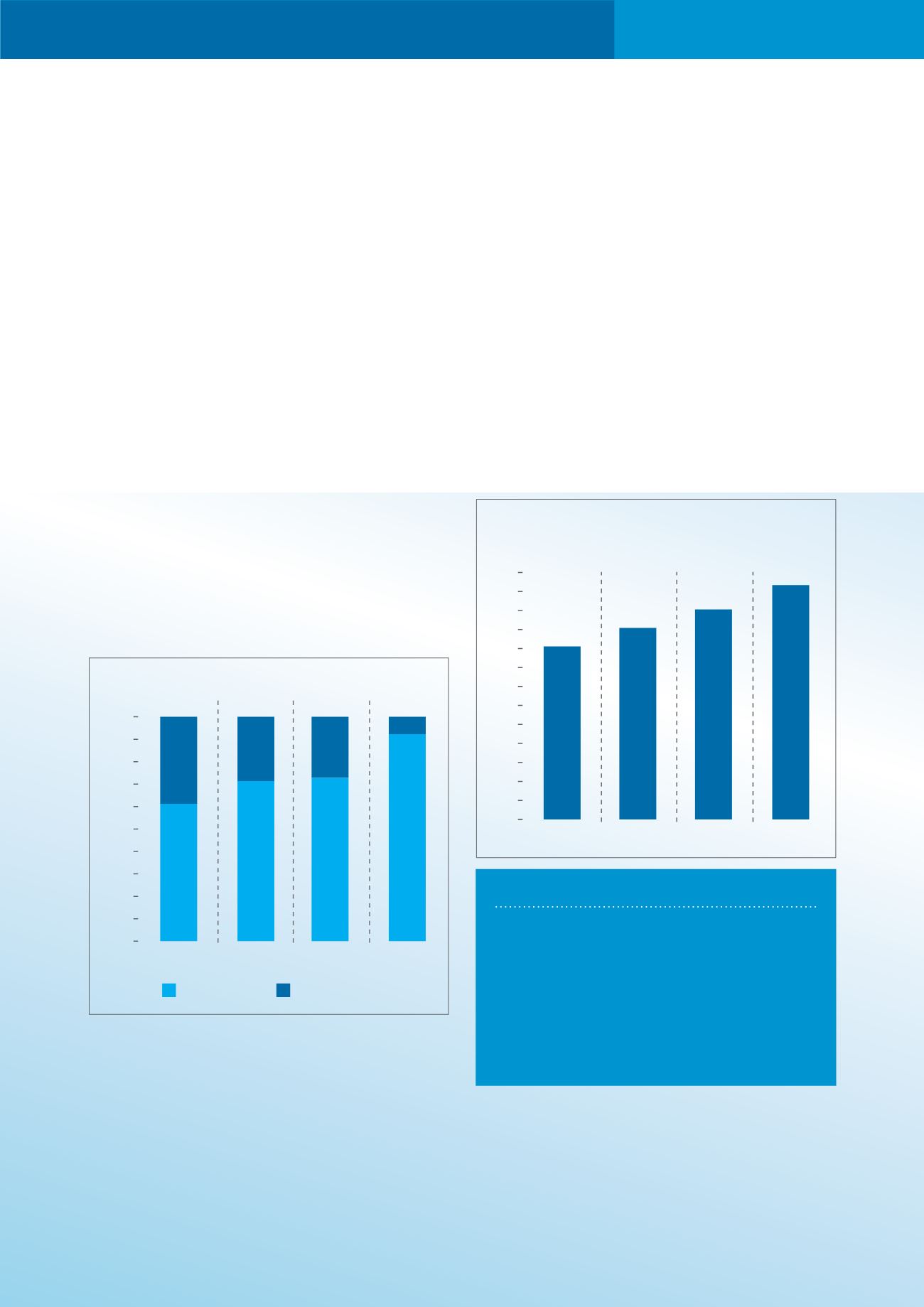

The transformation of the company from ad-hoc

hardware and software sales to the present of

providing services on a rental and revenue share

model has positively impacted the nature of our

revenues. As can be seen in Figure 1, the percentage

of our recurrent revenue has increased significantly

from 61.2% in 2011 to 92.3% in 2014. This in turn, has

improved the predictability and quality of our earnings

and hence, the value of your company.

In 2014, our annuity income increased significantly

over the previous year primarily because of the

inclusion of e-pay Asia Limited (“e-pay”), a company

that was acquired by GHL in the year. e-pay ‘s revenue

is derived from merchants under agreements directly

entered into between e-pay and the merchants.

The e-pay acquisition effectively jumped-started our

Transaction Payment Acquisition (“TPA”) business

and this is congruent with our ambition to become

ASEAN’s largest merchant acquirer. A more detailed

description of e-pay and its contribution to our TPA

business can be seen in the TPA section that follows

later.

2014, there were approximately 230,000 terminals

in Malaysia (Source: Bank Negara) and 150,000 in

the Philippines (Source: Our own estimate). Also, we

estimate that there are at least 500,000 companies in

the smallest merchant segment each in Malaysia and

Philippines that are not POS enabled. Further, Bank

Negara in its recent payment reform regulations, has

mandated Banks in Malaysia to increase the number

of POS acceptance points from 230,000 in 2014 to

>800,000 in 2020. GHL’s TPA initiative (described

more fully in a later section) assists Banks to achieve

this target. For these reasons, there is a significant

opportunity for growth in merchant acquisition within

the total addressable market.

Figure 1 - Annuity Vs Non-Annuity Revenue

0

10

20

30

40

50

60

70

80

90

100

110

38.8

28.6

27.2

7.7

61.2

71.4

72.8

92.3

2011

2012

2013

2014

Annuity (%)

Non-annuity (%)

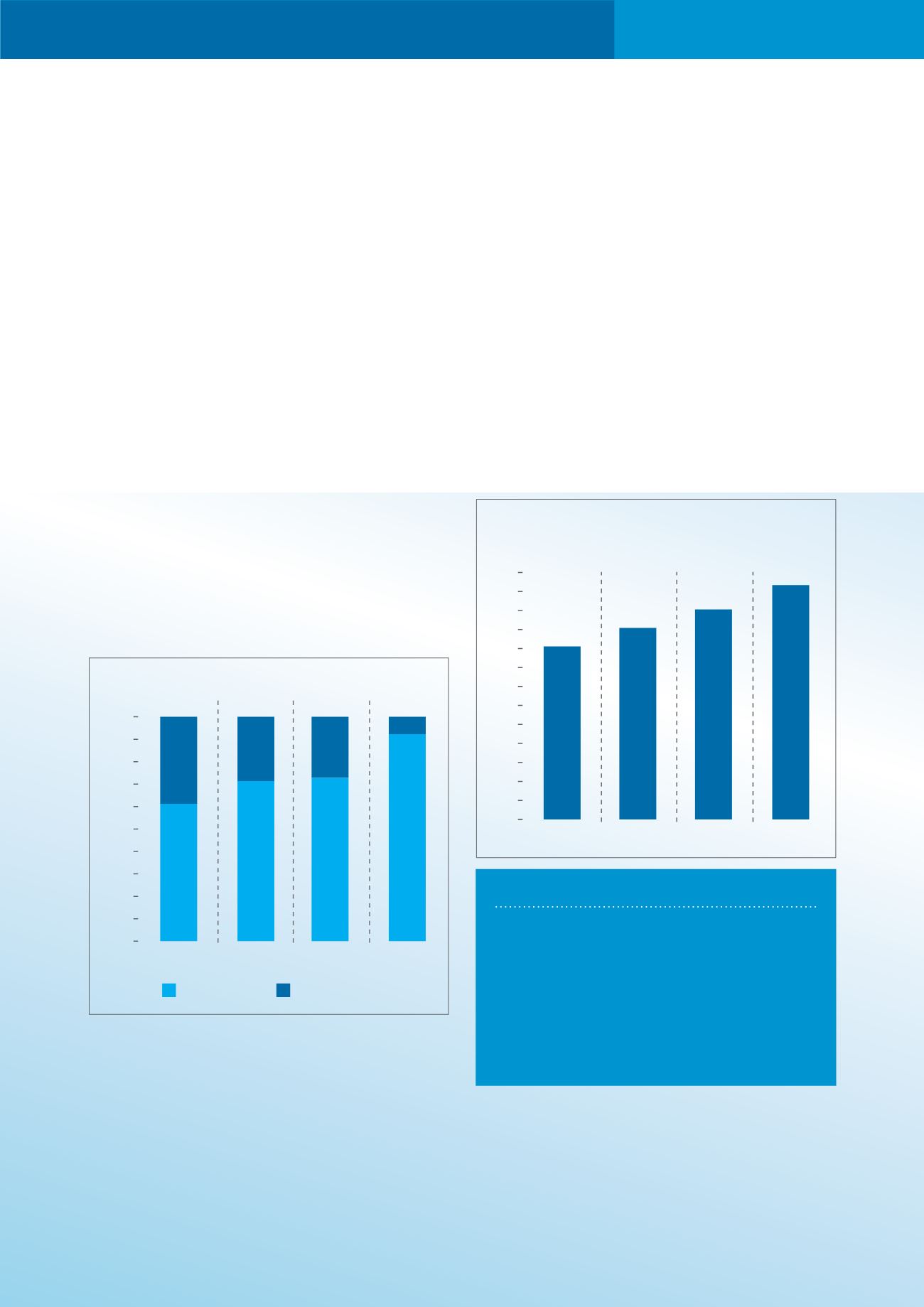

Figure 2 - Number of Acceptance Points

(Thousands)

0

10

20

30

40

50

60

70

80

90

100

110

120

130

2011

2012

2013

2014

2014 snapshot

DISTRIBUTION BY COUNTRY: 2014

Malaysia*– 63.7K

Philippines – 52.9K

Thailand – 6.8K

* inclusive of e-pay’s acceptance points for the

period 2011-2014

ceo

report

The creation of nationwide sales organisations in

2012, to actively source for merchants to accept card

payments has also enabled us to increase our POS

acceptance points and market share in the countries

that we operate in. This initiative has made us the

largest payment service provider both in Malaysia

and the Philippines. The growth in the number of

our acceptance points can be seen in Figure 2. In