130

GHL Systems Berhad

(293040-D)

NOTES TO THE FINANCIAL STATEMENTS

31 December 2014 (continued)

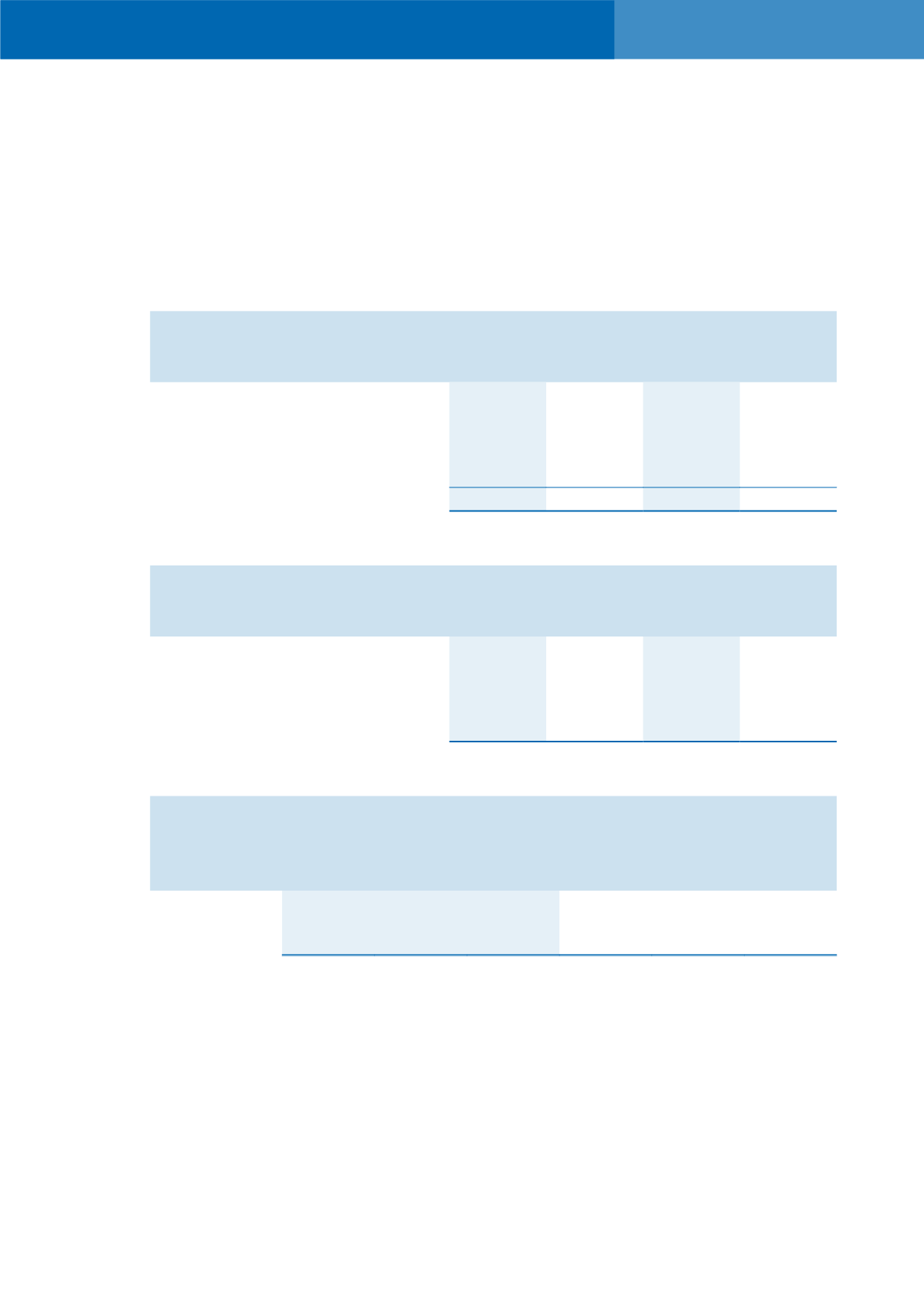

29. TAXATION (continued)

(c) The numerical reconciliation between the taxation and the product of accounting profit multiplied by

the applicable tax rates of the Group and of the Company are as follows (continued):

Group

Company

2014

2013

2014

2013

RM

RM

RM

RM

Under/(Over)provision of income tax

expense in prior years

168,048

(153,034)

-

(121,757)

(Over)/Under provision of deferred

tax in prior years

(2,169)

445,644

-

251,372

Taxation for the financial year

4,750,422 (1,885,127)

(177,176)

(638,701)

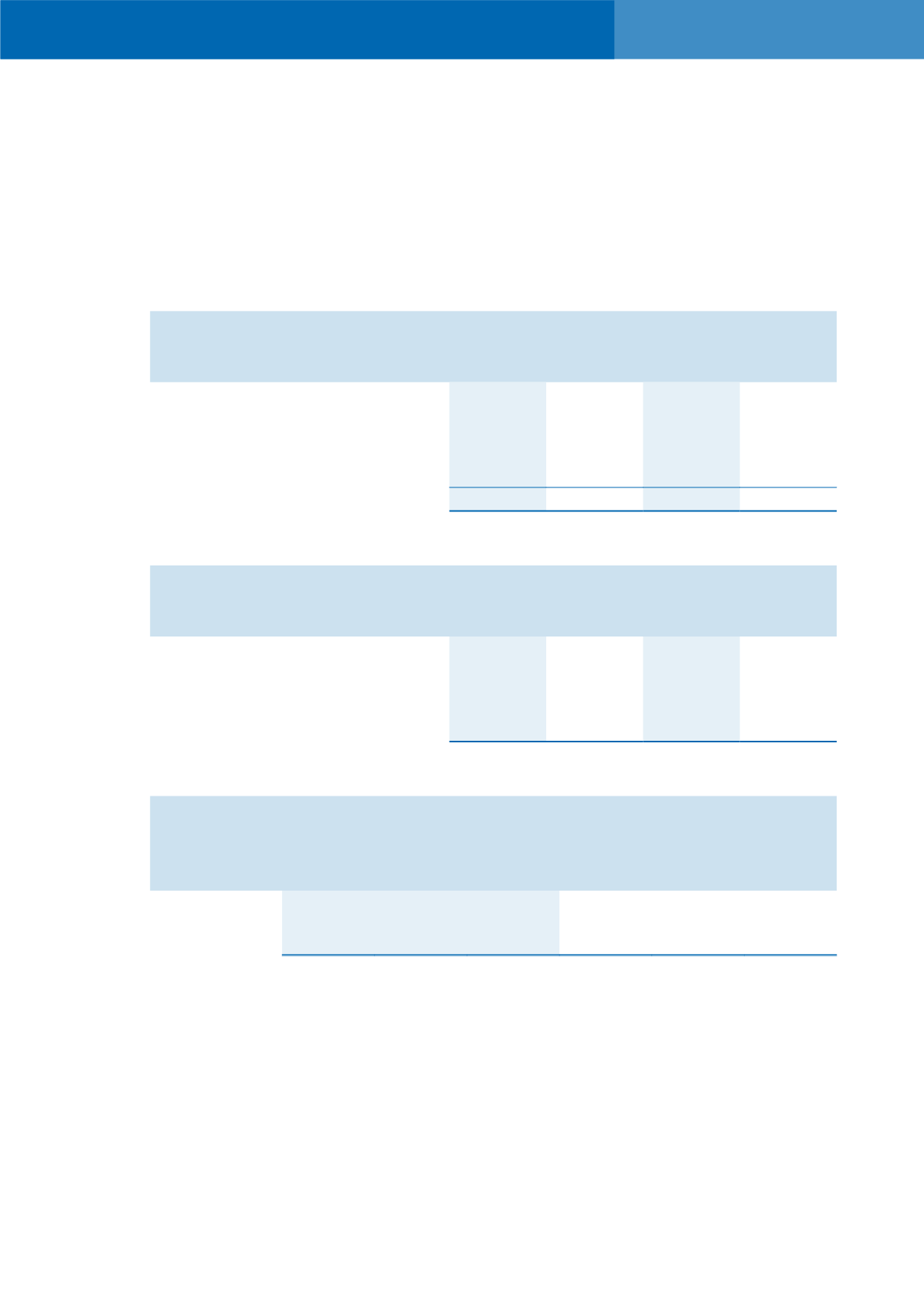

(d) Tax savings of the Group and the Company are as follows:

Group

Company

2014

2013

2014

2013

RM

RM

RM

RM

Arising from utilisation of current year

tax losses

-

5,311

-

5,311

Arising from utilisation of previously

unrecognised tax losses

-

48,421

-

-

(e) Tax on each component of other comprehensive income is as follows:

Group

2014

2013

Before tax Tax effect

After tax Before tax Tax effect

After tax

RM

RM

RM

RM

RM

RM

Foreign currency

translations

975,309

-

975,309 (699,250)

-

(699,250)