Annual report 2014

129

NOTES TO THE FINANCIAL STATEMENTS

31 December 2014 (continued)

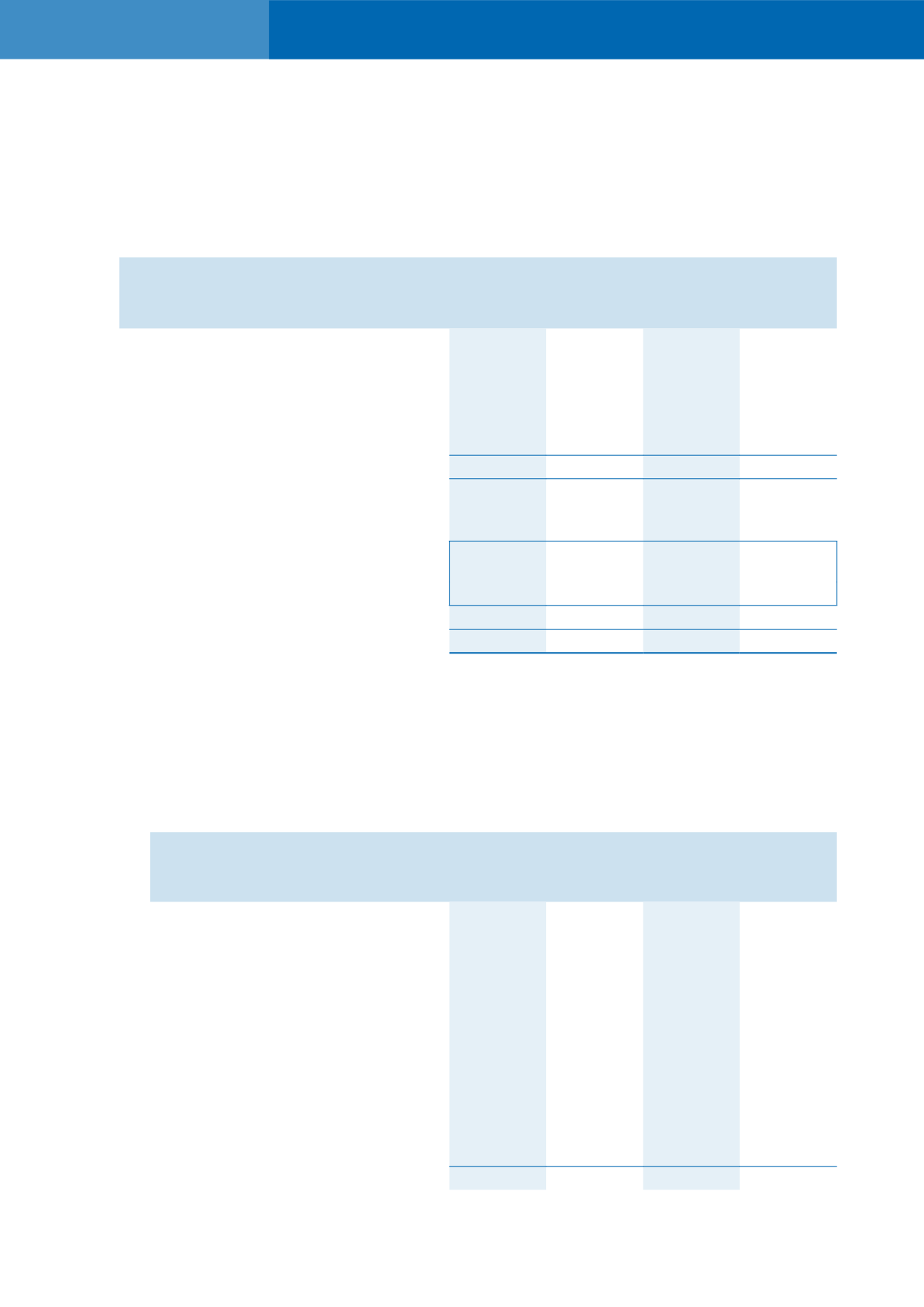

29. TAXATION

Group

Company

2014

2013

2014

2013

Note RM

RM

RM

RM

Current tax expense based on profit

for the financial year:

Malaysia income tax

1,968,654

-

-

-

Foreign income tax

1,672,853

-

87,886

-

Under/(Over)provision in prior years

168,048

(153,034)

-

(121,757)

3,809,555

(153,034)

87,886

(121,757)

Withholding tax

33,676

23,779

13,231

12,236

Deferred tax:

14

Relating to origination and reversal of

temporary differences

909,360 (2,201,516)

(278,293)

(780,552)

(Over)/Underprovision in prior years

(2,169)

445,644

-

251,372

907,191 (1,755,872)

(278,293)

(529,180)

Taxation for the financial year

4,750,422 (1,885,127)

(177,176)

(638,701)

(a) The Malaysian income tax is calculated at the statutory tax rate of twenty-five percent (25%) (2013:

25%) of the estimated taxable profits for the fiscal year.

(b) Taxation for other taxation authorities are calculated at the rates prevailing in those respective

jurisdictions.

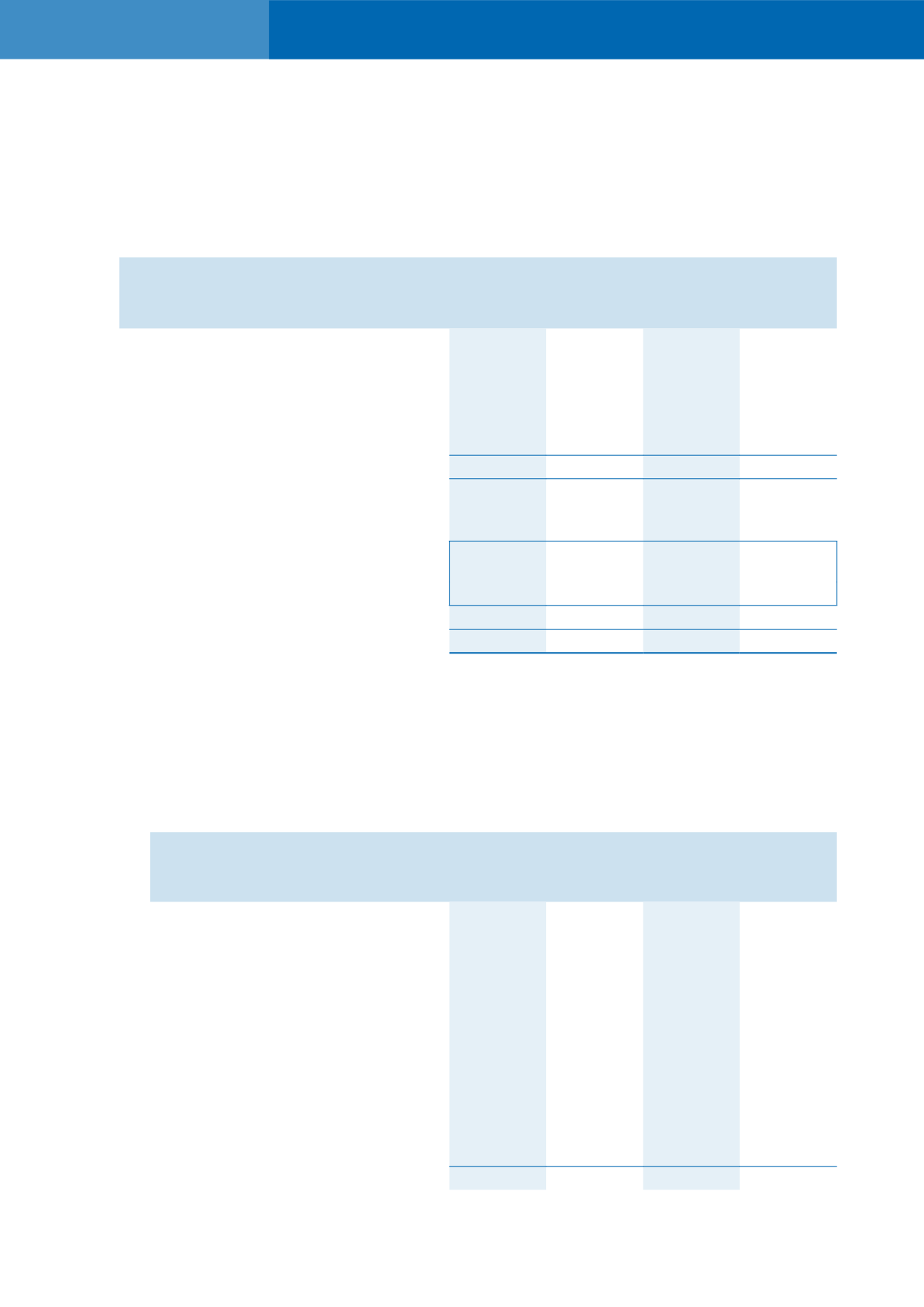

(c) The numerical reconciliation between the taxation and the product of accounting profit multiplied by

the applicable tax rates of the Group and of the Company are as follows:

Group

Company

2014

2013

2014

2013

RM

RM

RM

RM

Tax at Malaysian statutory tax rate of

25% (2013: 25%)

2,780,420

820,050 2,495,953

(261,356)

Tax effects in respect of:

Tax incentive

(1,148,647)

(704,987)

-

-

Non-allowable expenses

2,071,660

22,596

956,165 1,860,461

Non-taxable income

(571,984)

(343,592) (4,131,717) (2,367,421)

Deferred tax not recognised

1,206,992 1,301,618

502,423

-

Different tax rate in foreign jurisdiction

246,102

-

-

-

Utilisation of previously unrecognised

tax losses and allowances

-

(3,273,422)

-

-

4,584,543 (2,177,737)

(177,176)

(768,316)