136

GHL Systems Berhad

(293040-D)

Annual report 2015

Notes to the Financial Statements

31 December 2015 (continued)

32. EXECUTIVES’ SHARE SCHEME (“ESS”) (continued)

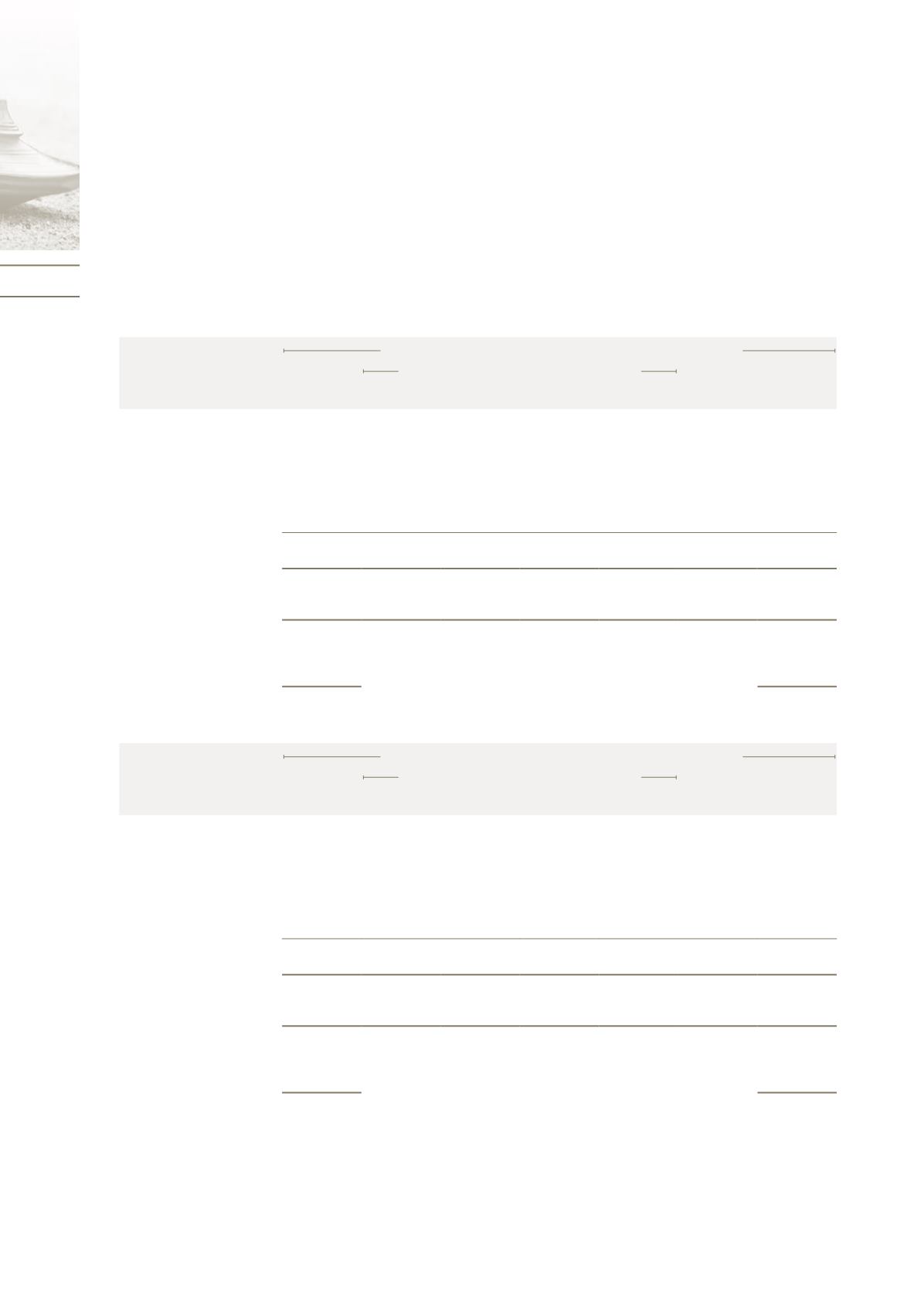

The details of the options over ordinary shares of the Company are as follows (continued):

Number of options over ordinary shares of RM0.20 each

Outstanding

as at

1.1.2014

Movements during the financial year

Outstanding

as at

31.12.2014

Exercisable

as at

31.12.2014

Granted Bonus issue Exercised Forfeited

2014

3 September 2013

- first tranche

4,128,366

-

532,910 (2,895,210) (200,000) 1,566,066 1,566,066

- second tranche

6,266,667

-

680,148 (4,895,056) (410,134) 1,641,625 1,641,625

- third tranche

#

6,266,667

- 2,633,342 (433,234) (1,016,766) 7,450,009 900,100

16,661,700

- 3,846,400 (8,223,500) (1,626,900) 10,657,700 4,107,791

Weighted average

exercise prices (RM)

0.34

-

0.23

0.33

0.31

0.23

0.23

Weighted average

remaining contractual

life (months)

32

20

#

The ESS granted becomes exercisable with the approval from ESS committee.

Number of options over ordinary shares of RM0.20 each

Outstanding

as at

1.1.2014

Movements during the financial year

Outstanding

as at

31.12.2014

Exercisable

as at

31.12.2014

Granted Bonus issue Exercised Forfeited

2014

20 June 2014

#

- first tranche

- 1,333,333 666,668

-

- 2,000,001 2,000,001

- second tranche

- 1,333,333 666,668

-

- 2,000,001

-

- third tranche

- 1,333,334 666,664

-

- 1,999,998

-

- 4,000,000 2,000,000

-

- 6,000,000 2,000,001

Weighted average

exercise prices (RM)

-

0.86

0.57

-

-

0.57

0.57

Weighted average

remaining contractual

life (months)

-

30

#

The grant was made to eligible employees from the newly acquired subsidiaries.

During the financial year, the Group recognised share options granted under shares options scheme of

RM473,967 (2014: RM962,066) in profit or loss, out of which an amount of RM274,446 (2014: RM741,586) was

in respect of employees of subsidiaries. At Company level, the amount of RM274,446 (2014: RM741,586) was

recorded as an increase in investments in subsidiaries (Note 10) with a corresponding credit to equity.