Annual report 2014

117

NOTES TO THE FINANCIAL STATEMENTS

31 December 2014 (continued)

14. DEFERRED TAX (continued)

(b) The components and movements of deferred tax liabilities and assets during the financial year prior to

offsetting are as follows (continued):

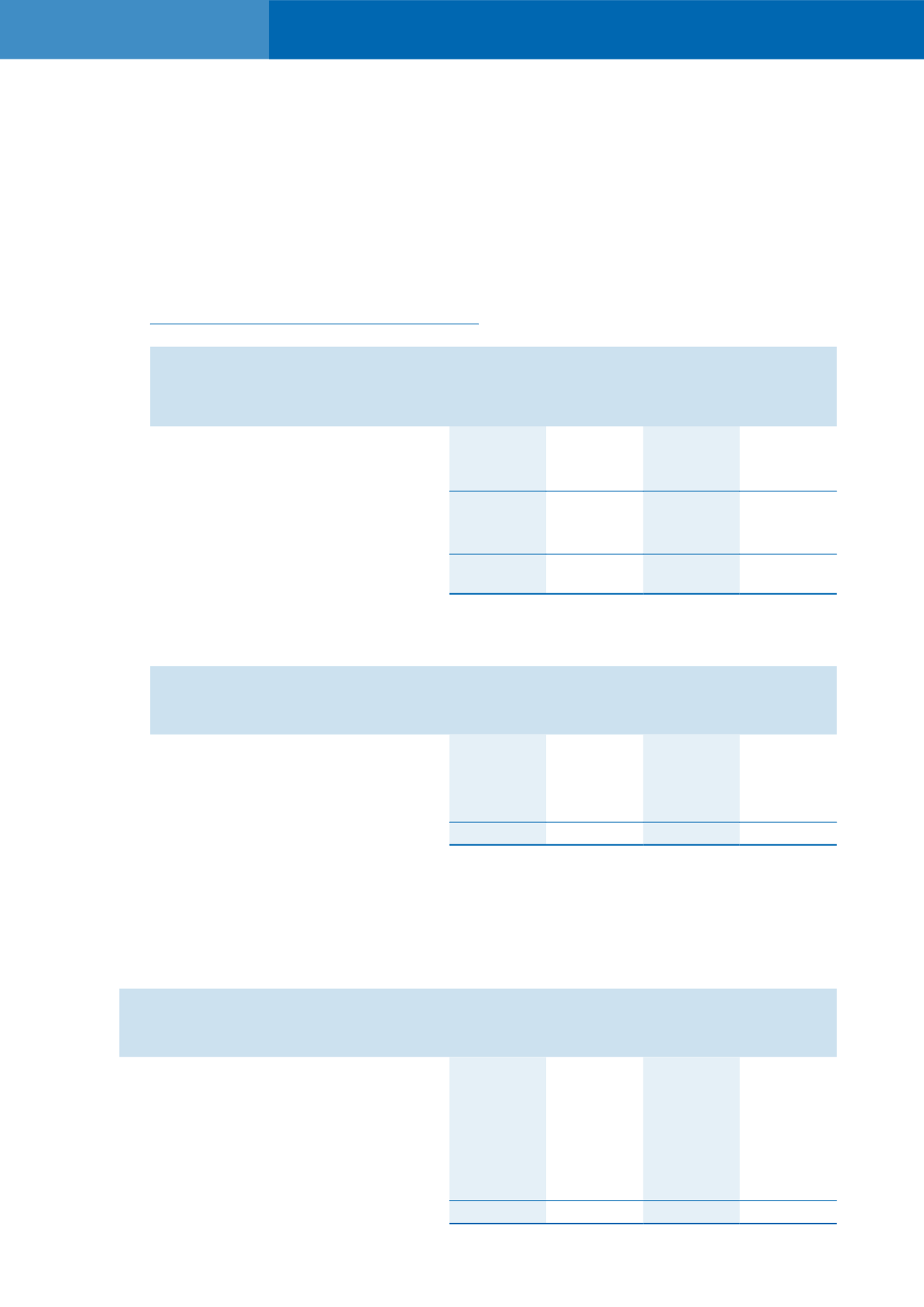

Deferred tax assets of the Company (continued)

Unabsorbed

capital

allowances

Unused tax

losses

Others

Total

RM

RM

RM

RM

Balance as at 1 January 2013

-

-

-

-

Recognised in profit or loss

(110,010)

(179,732)

(191,827)

(481,569)

Balance as at 31 December 2013

(before offsetting)

(110,010)

(179,732)

(191,827)

(481,569)

Offsetting

110,010

179,732

191,827

481,569

Balance as at 31 December 2013

(after offsetting)

-

-

-

-

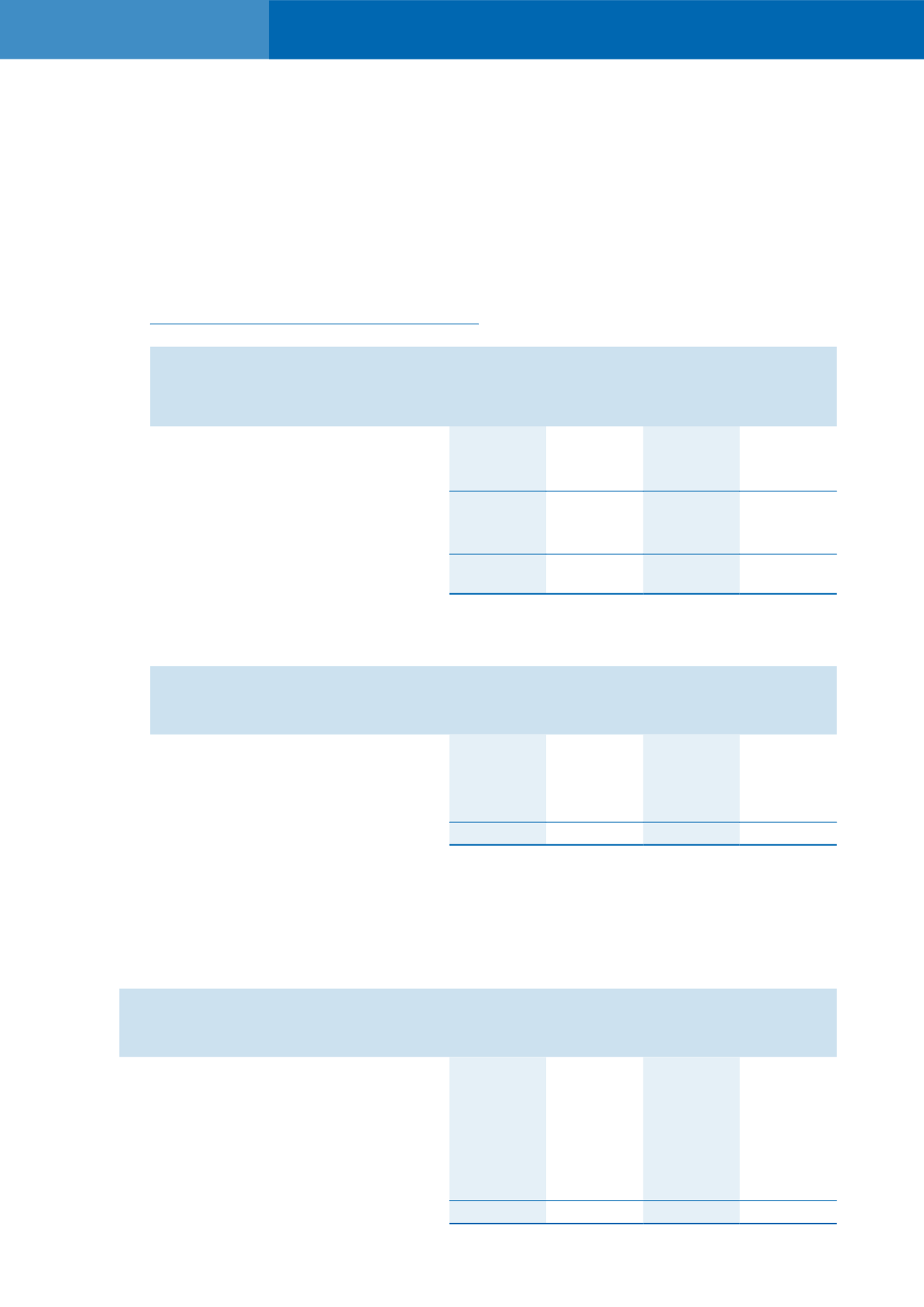

(c) The amounts of temporary differences for which no deferred tax assets have been recognised in the

statement of financial position are as follows:

Group

Company

2014

2013

2014

2013

RM

RM

RM

RM

Unused tax losses

14,925,383 10,051,912 2,009,692

-

Unabsorbed capital allowances

400,585

404,794

-

-

Other deductible temporary differences

2,841,485 2,882,778

-

-

18,167,453 13,339,484 2,009,692

-

Deferred tax assets of certain subsidiaries have not been recognised in respect of these items as it is

not probable that taxable profits of the subsidiaries would be available against which the deductible

temporary differences could be utilised.

15. INVENTORIES

Group

Company

2014

2013

2014

2013

RM

RM

RM

RM

At cost

EDC equipment

12,908,827 3,425,210

-

-

Microchips

-

1,044,837

-

1,044,837

Prepaid airtime PINS

36,111,340

-

-

-

Others

2,746,395 2,126,035 1,177,039 1,456,243

51,766,562 6,596,082 1,177,039 2,501,080