114

GHL Systems Berhad

(293040-D)

NOTES TO THE FINANCIAL STATEMENTS

31 December 2014 (continued)

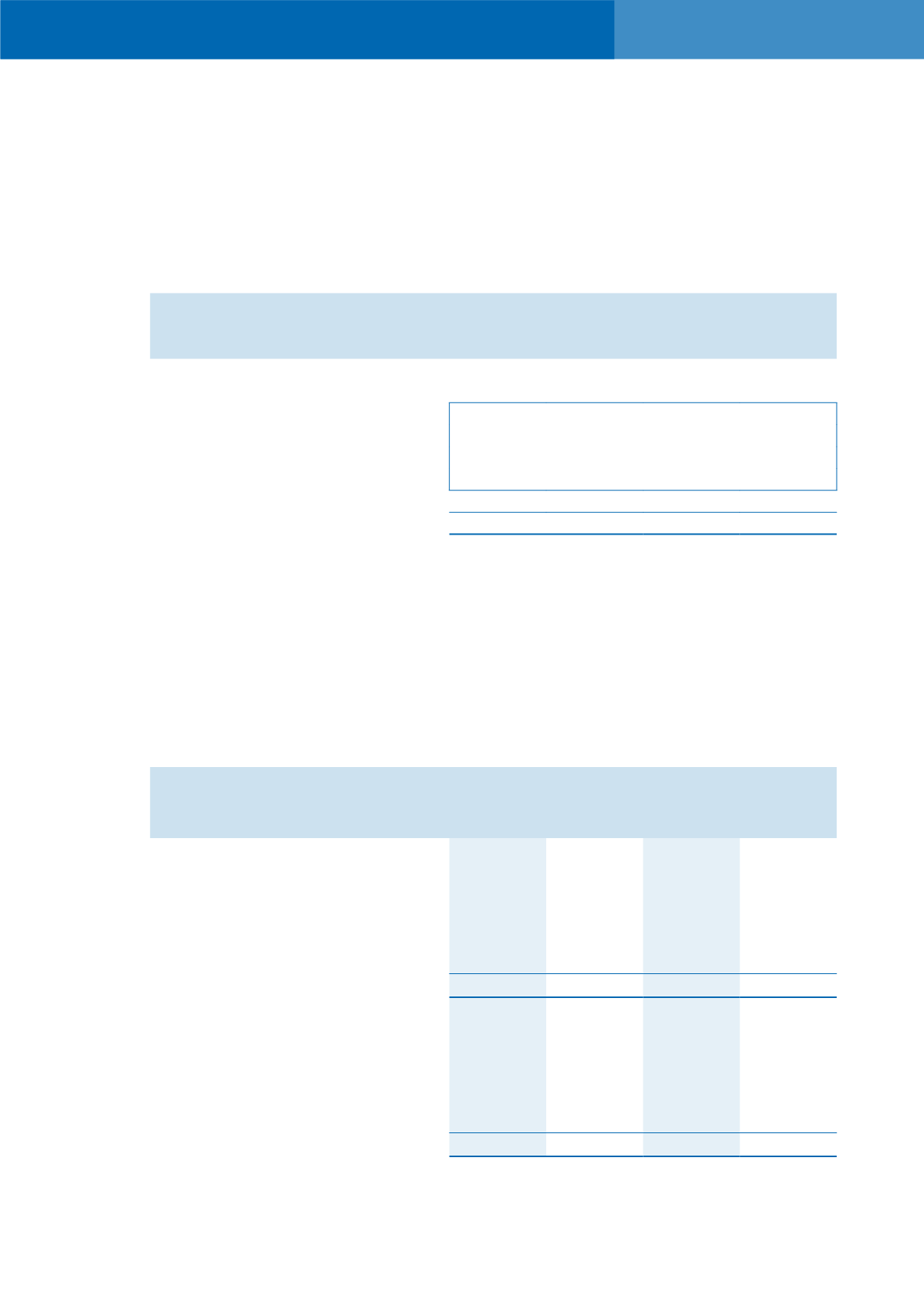

13. TRADE AND OTHER RECEIVABLES (continued)

(g) The reconciliation of movement in the impairment losses are as follows (continued):

Group

Company

2014

2013

2014

2013

RM

RM

RM

RM

Other receivables

At 1 January

487,272

488,351 26,656,542 21,962,527

Charge for the financial year

-

-

-

5,041,165

Reversal of impairment losses

-

-

(745,723)

(347,150)

Exchange differences

22,172

(1,079)

-

-

At 31 December

509,444

487,272 25,910,819 26,656,542

7,385,835 5,251,084 32,545,381 47,717,682

Tradeandother receivables that arecollectivelydetermined tobe impairedat theendof each reporting

period relate to those debtors that are not individually assessed for impairment and share similar credit

risk characteristics. These receivables are not secured by any collateral or credit enhancements.

(h) Information on financial risks of trade and other receivables is disclosed in Note 36 to the financial

statements.

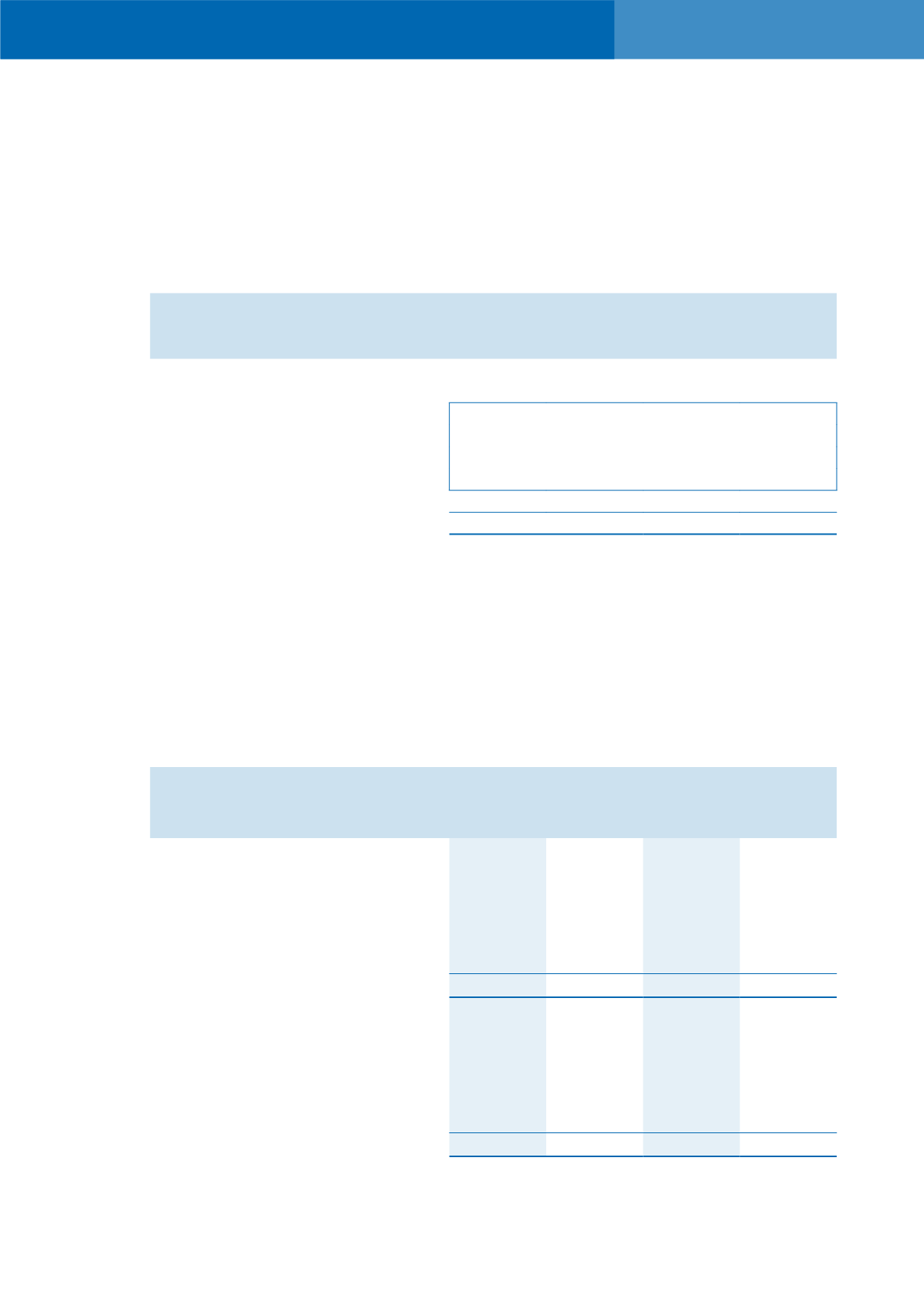

14. DEFERRED TAX

(a) The deferred tax assets and liabilities are made up of the following:

Group

Company

2014

2013

2014

2013

Note RM

RM

RM

RM

Balance as at 1 January

(2,148,399)

(392,527)

278,293

807,473

Acquisition of subsidiaries

10

360,000

-

-

-

Recognised in profit or loss

29

907,191 (1,755,872)

(278,293)

(529,180)

Recognised in other comprehensive

income

(12,030)

-

-

-

Balance as at 31 December

(893,238) (2,148,399)

-

278,293

Presented after appropriate

offsetting:

Deferred tax assets, net

(1,262,866) (2,443,243)

-

-

Deferred tax liabilities, net

369,628

294,844

-

278,293

(893,238) (2,148,399)

-

278,293