93

FRONTKEN CORPORATION BERHAD

(651020-T)

ANNUAL REPORT

2015

13.

GOODWILL ON CONSOLIDATION (CONT’D)

The calculation of value-in-use for CGU are most sensitive to the following assumptions:

(i)

Budgeted gross

margin

Management determines budgeted gross margin based on past performance and its

expectations of market development.

(ii) Growth rates

The growth rates are based on industry growth forecasts. Changes in selling prices and

direct costs are based on past practices and expectations of future changes in the market.

These calculations use pre-tax cash flow projections based on financial budgets approved

by management and extrapolated cash flows for a three-year period based on growth rates

consistent with the long-term average growth rate for the industry.

(iii) Discount rate

Management estimates discount rate using pre-tax rate that reflect current market

assessments of the time value of money and the risk specific to the CGU. The rate used to

discount the forecasted cash flows reflects specific risks and expected returns relating to

the industry.

The management believes that there is no reasonable change in the above key assumptions would cause the carrying

amount of the goodwill to exceed its recoverable amounts.

14.

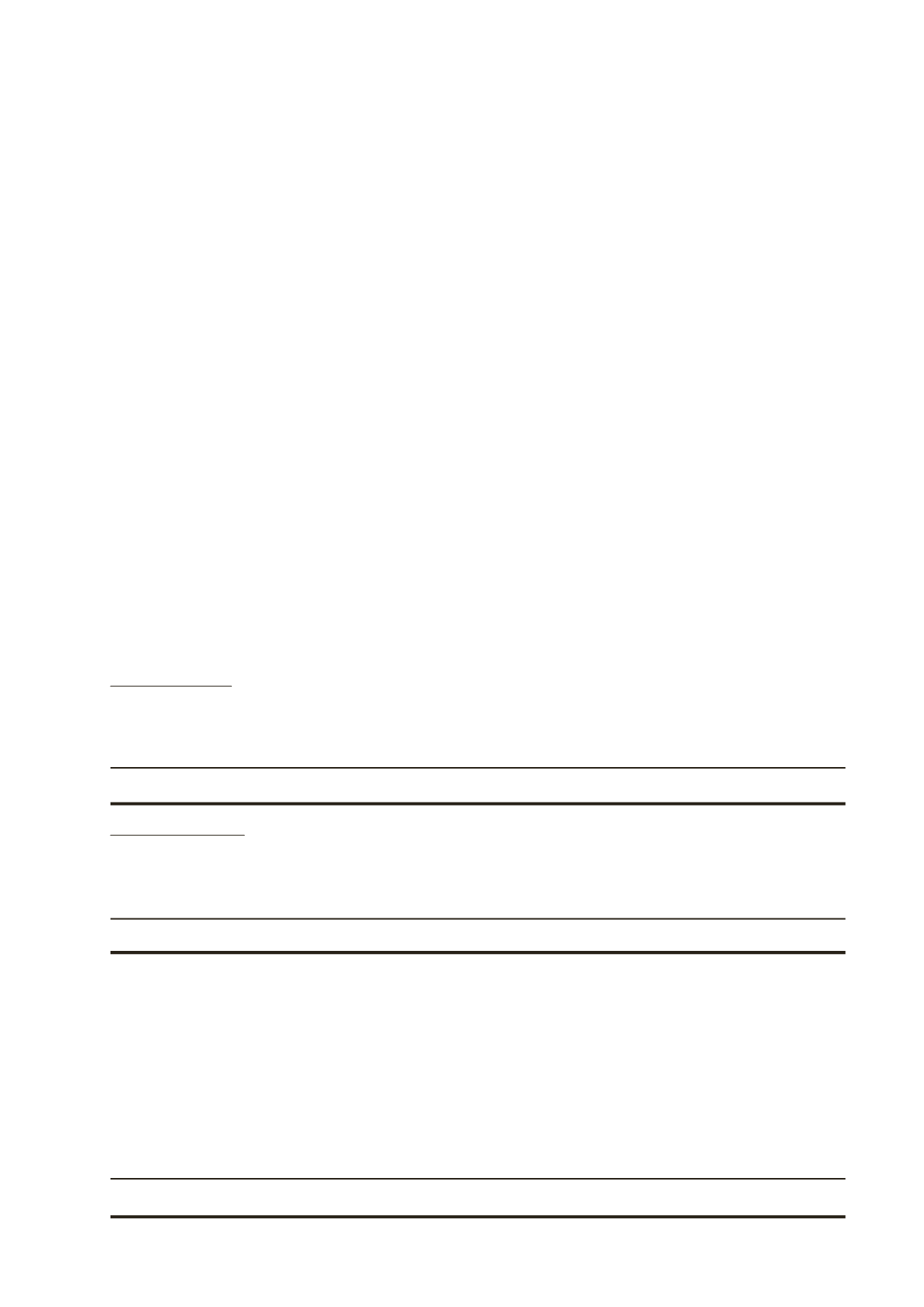

DEFERRED TAX ASSETS/LIABILITIES

The Group

2015

2014

RM

RM

Deferred tax assets

At beginning of year

1,062,816

665,109

Transfer from profit or loss (Note 8)

37,141

289,118

Transfer to other comprehensive expenses

105,318

95,117

Foreign currency translation differences

200,569

13,472

At end of year

1,405,844

1,062,816

Deferred tax liabilities

At beginning of year

2,571,891

3,653,351

Transfer from/(to) profit or loss (Note 8)

486,043

(1,164,261)

Arising from acquisition of a subsidiary

-

48,932

Foreign currency translation differences

388,230

33,869

At end of year

3,446,164

2,571,891

The net deferred tax liabilities and assets are in respect of the tax effects of the following:

The Group

Deferred Tax

(Assets)/Liabilities

2015

2014

RM

RM

Temporary differences arising from

property, plant and equipment

2,091,901

2,272,694

Others

(51,581)

(763,619)

2,040,320

1,509,075

NOTES TO THE FINANCIAL STATEMENTS

(cont’d)