88

FRONTKEN CORPORATION BERHAD

(651020-T)

ANNUAL REPORT

2015

11.

INVESTMENTS IN SUBSIDIARIES (CONT’D)

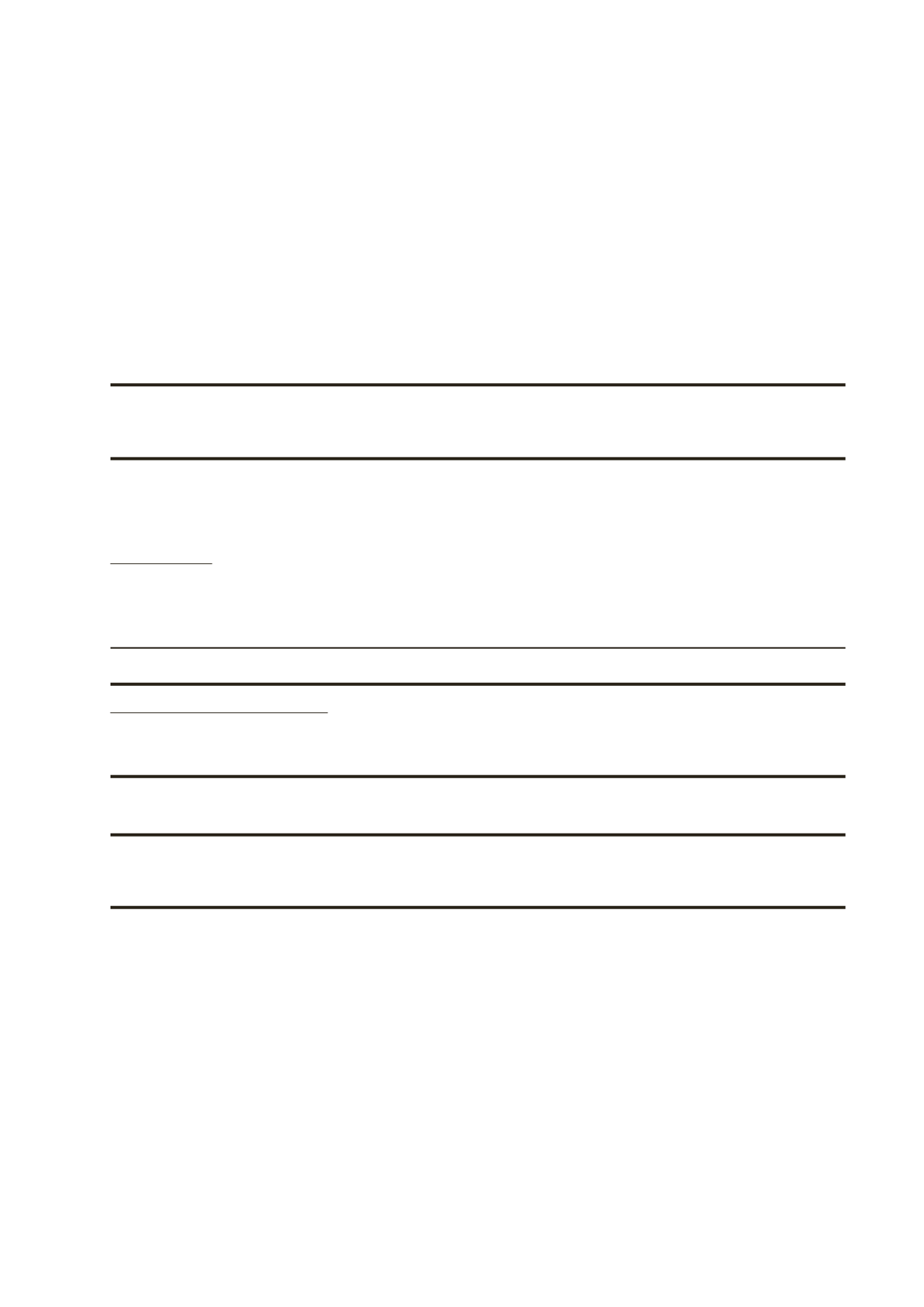

TTES

1 January to

1 June to

31 December

31 December

2015

2014

RM

RM

Total comprehensive income attributable

to non-controlling interests

2,287,578

1,339,608

Dividends paid to non-controlling interests

(1,925,000)

(1,320,000)

Net cash from operating activities

4,475,854

209,311

Net cash for investing activities

(293,768)

(245,274)

Net cash for financing activities

(3,577,525)

(1,422,942)

FPPL

2015

2014

RM

RM

At 31 December

Non-current assets

183,259

363,954

Current assets

13,179,249

13,762,737

Non-current liability

(57,859)

(115,401)

Current liabilities

(9,625,141)

(9,859,645)

Net assets

3,679,508

4,151,645

Financial year ended 31 December

Revenue

4,209,253

13,023,012

Loss for the financial year

(1,010,110)

(259,893)

Total comprehensive expenses

(472,138)

(182,161)

Total comprehensive expenses attributable

to non-controlling interests

(154,987)

(89,259)

Net cash for operating activities

(2,503,735)

(993,054)

Net cash from/(for) investing activities

373

(6,604)

Net cash from financing activities

2,486,678

83,410

During the financial year:-

(i)

the Company acquired 2,135,610 ordinary shares of NT$10 each representing 6.46% of the issued and paid-up

share capital of AGTC for a total cash consideration of NT$42,192,117 (including incidental costs) (equivalent to

RM5,103,100). Following the acquisition, the Group’s interest in AGTC increased from 57.92% to 64.38%. The

carrying amount of AGTC’s net assets in the Group’s financial statements on the date of the acquisition was

RM55,380,737. The Group recognised a decrease in non-controlling interests of RM5,909,957 and an increase in

retained earnings of RM806,858.

(ii) the Company’s wholly-owned subsidiary, FSPL, had on 25 August 2015 entered into a Sale and Purchase Agreement

with Giga Group Pte. Ltd., to acquire the remaining 49% of the entire issued and paid-up share capital in FPPL for

a cash consideration of S$585,060 (equivalent to RM1,758,924). Following the completion of the acquisition on 28

August 2015, FPPL became a wholly-owned subsidiary of FSPL. The carrying amount of FPPL’s net assets in the

Group’s financial statements on the date of the acquisition was RM1,956,027. The Group recognised a decrease

in non-controlling interests of RM1,879,320 and an increase in retained earnings of RM120,395.

NOTES TO THE FINANCIAL STATEMENTS

(cont’d)