77

FRONTKEN CORPORATION BERHAD

(651020-T)

ANNUAL REPORT

2015

8.

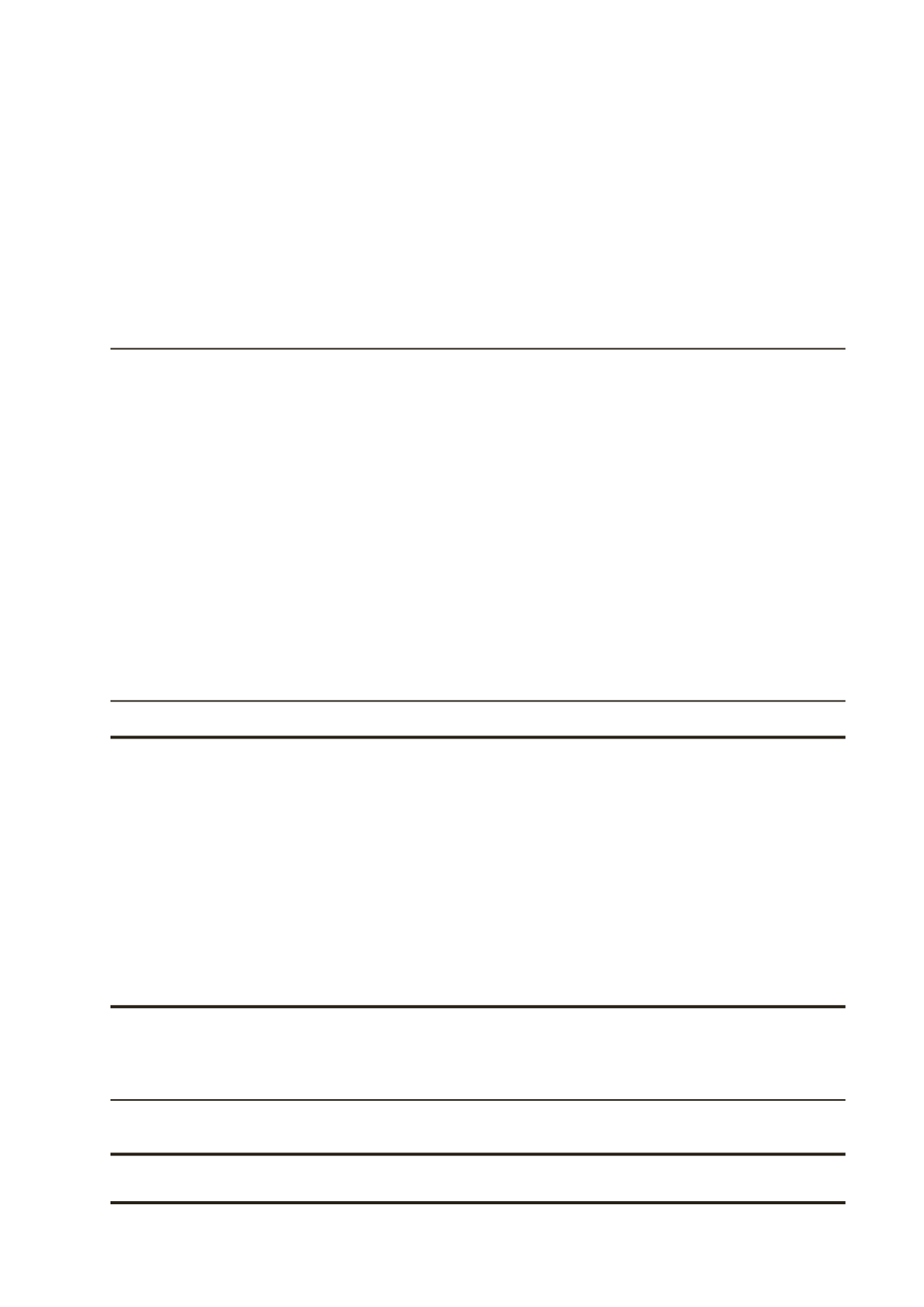

INCOME TAX EXPENSE (CONT’D)

A reconciliation of income tax expense at the applicable statutory income tax rate to income tax expense at the

effective income tax rate is as follows:

The Group

The Company

2015

2014

2015

2014

RM

RM

RM

RM

Profit before tax

15,998,086

28,139,842

178,853

1,609,481

Tax at the applicable tax

rate of 25% (2014 : 25%)

3,999,522

7,034,961

44,713

402,370

Effect of different tax rates

of other tax jurisdictions

(2,442,613)

(1,564,212)

-

-

Tax effects of:

Non-deductible expenses

2,764,384

1,281,652

1,226,397

521,320

Income not subject to tax

(46,020)

(483,479)

(1,271,110)

(923,690)

Utilisation of deferred tax

assets previously not

recognised

(480,971)

(692,523)

-

-

Utilisation of unabsorbed

reinvestment allowances

(407,000)

(806,000)

-

-

Tax incentives

(223,082)

(133,922)

-

-

Income tax exemption

(353,983)

(183,707)

-

-

Deferred tax assets not recognised

for the year

2,132,632

863,919

-

-

Under/(Over)provision in prior years

- Current tax

1,553,391

242,305

-

-

- Deferred tax

-

(600,939)

-

-

Effect of share of results in associates

(6,297)

(6,333)

-

-

Income tax expense

6,489,963

4,951,722

-

-

The statutory tax rate will be reduced to 24% from the current financial year’s rate of 25%, effective year of assessment

2016.

9.

EARNINGS PER SHARE

Basic earnings per share is calculated by dividing profit for the year attributable to owners of the Company by the

weighted average number of ordinary shares in issue during the financial year.

The Group

2015

2014

RM

RM

Profit for the year attributable to owners of the Company (RM)

4,007,044

18,775,293

Number of shares in issue as of January 1

1,011,408,160 1,011,408,160

Effects of:

Treasury shares acquired

(4,984,134)

(2,493,970)

Conversion of warrants

34,287,141

-

Weighted average number of ordinary shares for basic earnings

per share computation

1,040,711,167 1,008,914,190

Basic earnings per ordinary share attributable

to equity holders of the Company (sen)

0.39

1.86

No disclosure on diluted earnings per share as there were no dilutive potential ordinary shares outstanding at the end

of the reporting period.

NOTES TO THE FINANCIAL STATEMENTS

(cont’d)