12

FRONTKEN CORPORATION BERHAD

(651020-T)

ANNUAL REPORT

2015

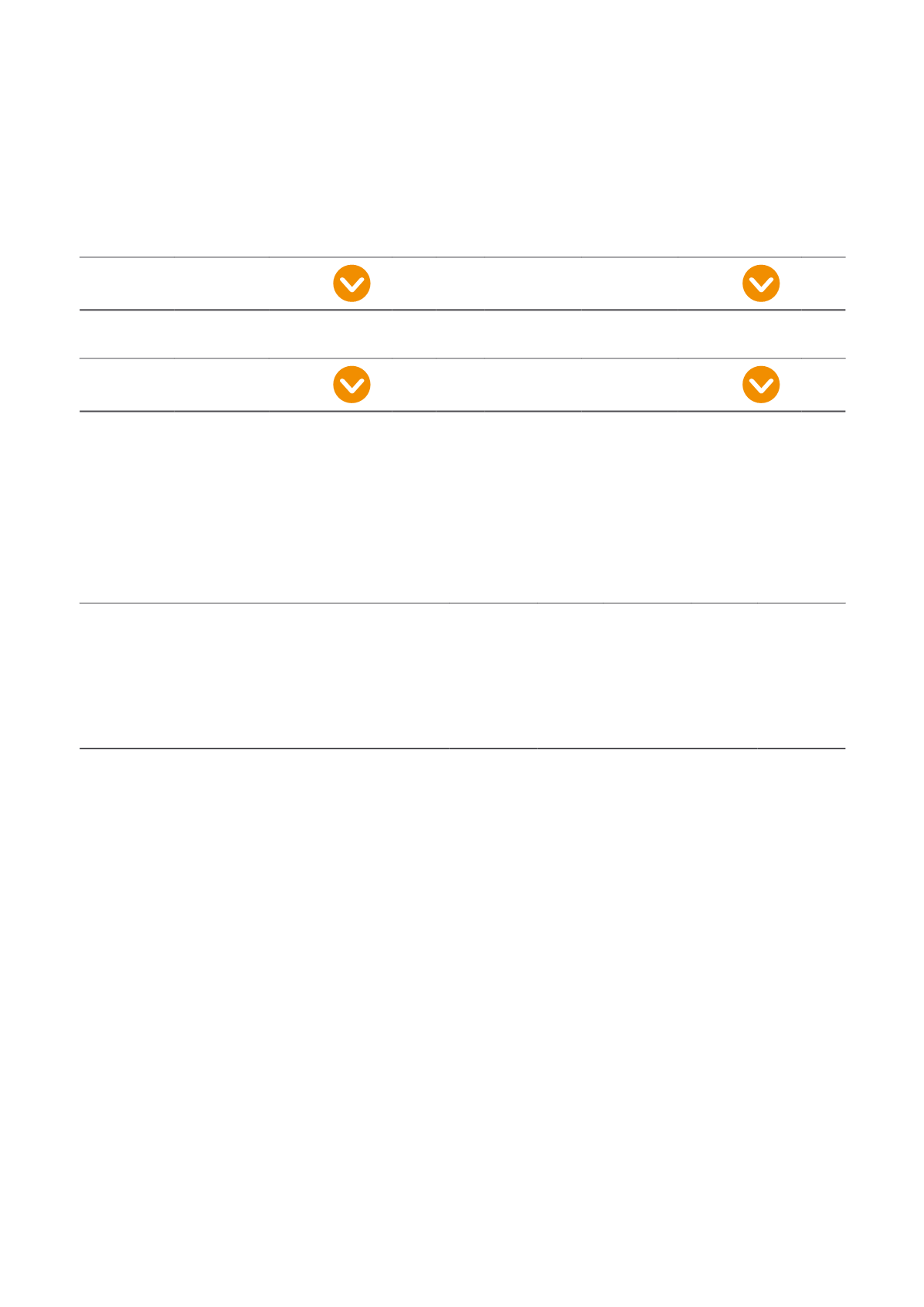

RESULTS OF OPERATIONS

in RM’000

REVENUE

EBITDA

2014

309,845

9%

2014

47,790

25%

2015

280,573

2015

35,625

NET PROFIT

EBITDA MARGIN as a % of revenue

2014

18,775

79%

2014

15.4

3%

2015

4,007

2015

12.7

REVENUE

The revenue for the Group for the financial year ended 31 December 2015 was RM280.6 million against RM309.8 million in

the previous year. Overall, the Group revenue decreased by RM29.3 million or 9.4% compared to the preceding financial year

mainly due to the completion of the project at Tanjung Bin.

REVENUE

(by customer location)

2015

RM’000

%

2014

RM’000

%

% change

in revenue

Taiwan

107,337

38

90,405

29

19

Singapore

35,263

13

42,740

14

-17

Malaysia

113,398

40

157,893

51

-28

Philippines

15,213

6

10,276

3

48

Others

9,362

3

8,531

3

10

Total

280,573

100

309,845

100

-9

An analysis of revenue by customer location showed growth in our business across the Group particularly in Taiwan and

the Philippines except for Singapore and Malaysia which declined by 17% and 28% respectively. The revenue in Singapore

decreased from RM42.7 million to RM35.3 million mainly due to decline in our customers’ business following the weakening

in market condition in the region. The reduction in turnover for our Malaysia business was mainly due to the lower revenue

recognition from the project in Tanjung Bin as the same was completed in the beginning of the third quarter of year 2015.

Other than the lower project revenue recognition, the Group’s other Malaysia business units showed a positive growth for

year 2015.

The revenue in Taiwan increased from RM90.4 million to RM107.3 million in year 2015 or a 19% increase compared to the

preceding financial year. The revenue growth in Taiwan was due to the positive growth of the semiconductor business. The

better performance for our subsidiary in Philippines was attributable to improved clientele coverage.

EARNINGS

Earnings before interest, tax, depreciation and amortization (“EBITDA”) of the Group for year 2015 decreased to RM35.6

million from RM47.8 million the year before. As a percentage of revenue, EBIDTA decreased by 3% which was mainly due

to lower revenue, higher expenses from the project in Tanjung Bin and loss on disposal of investment in a subsidiary. If we

were to exclude the cost overrun suffered in the Tanjung Bin project, the EBITDA for year 2015 would have been better than

that achieved in year 2014.

Lower depreciation of property, plant and equipment and net gain on foreign exchange had a positive contribution to the

Group’s net profit for year 2015. The depreciation and amortization of RM18.1 million in year 2015 was lower than that

recorded for last year’s RM18.4 million. The lower profit after tax of RM9.5 million compared to the RM23.2 million achieved

in year 2014 was mainly attributable to the higher project expenses recognised as discussed above.

FINANCIAL

REVIEW