114

FRONTKEN CORPORATION BERHAD

(651020-T)

ANNUAL REPORT

2015

26.

FINANCIAL INSTRUMENTS (CONT’D)

(a) Financial Risk Management Policies (Cont’d)

(iv) Credit risk (Cont’d)

Ageing analysis (Cont’d)

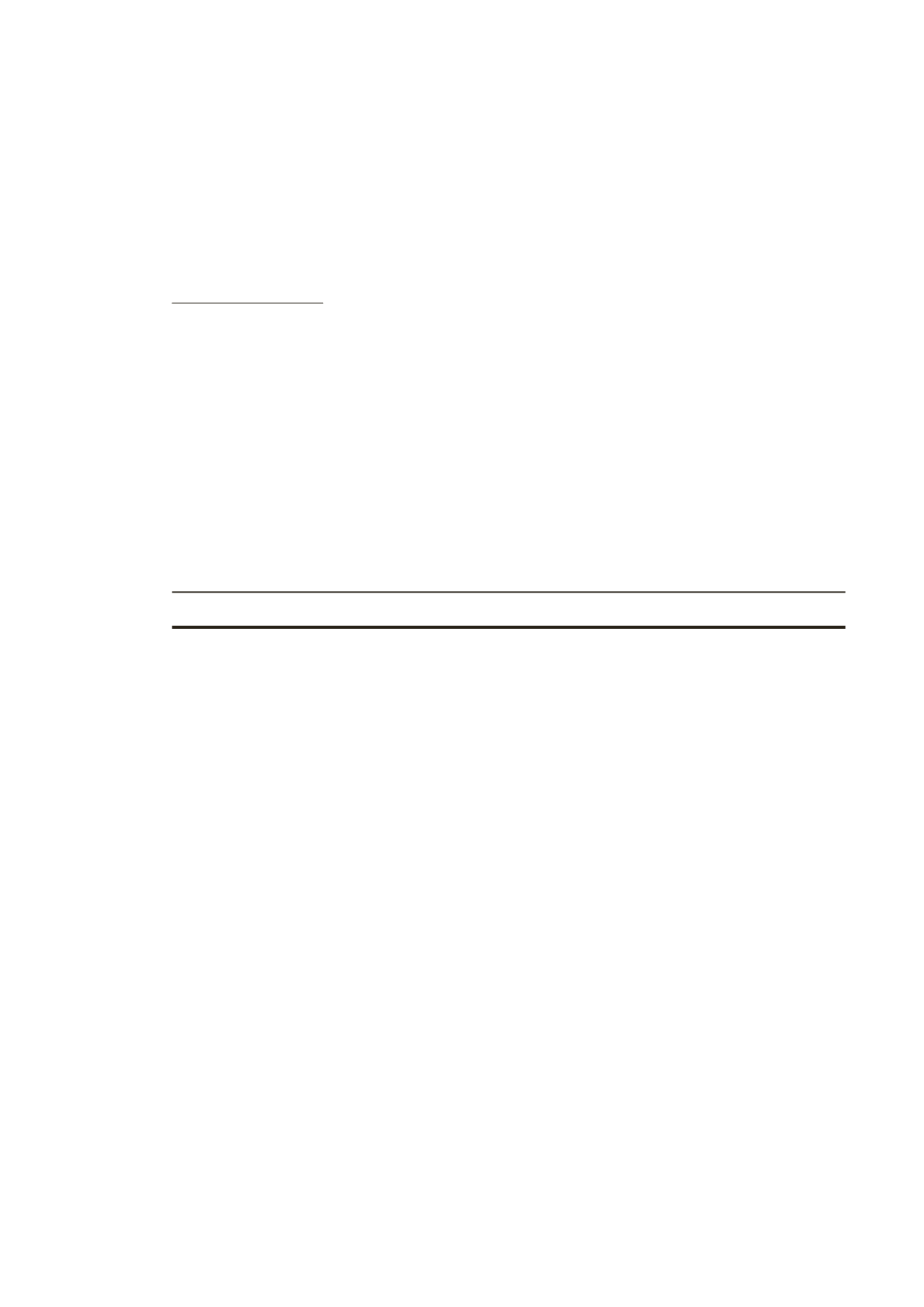

The ageing of the Group’s trade receivables as at end of the reporting period was:- (Cont’d)

Gross

Individual

Collective

Carrying

Amount

Impairment

Impairment

Value

The Group

RM

RM

RM

RM

2014

Not past due

90,046,306

-

-

90,046,306

Past due:-

- Less than 1 month

5,990,105

(163,605)

-

5,826,500

- 1 to 9 months

6,431,343

(253,767)

(418,373)

5,759,203

- over 9 months

2,030,230

(1,778,082)

(42,426)

209,722

104,497,984

(2,195,454)

(460,799)

101,841,731

At the end of the reporting period, trade receivables that are individually impaired are those which have

defaulted on payments. These receivables are not secured by any collateral or credit enhancement.

The Group believes that no additional impairment allowance is necessary in respect of trade receivables that

are past due but not impaired because they are companies with good collection track record and no recent

history of default.

(v) Liquidity risk

Liquidity risk arises mainly from general funding and business activities. The Group practises prudent risk

management by maintaining sufficient cash balances and the availability of funding through certain committed

credit facilities.

NOTES TO THE FINANCIAL STATEMENTS

(cont’d)