96

FRONTKEN CORPORATION BERHAD

(651020-T)

ANNUAL REPORT 2014

NOTES TO THE

FINANCIAL STATEMENTS

(cont’d)

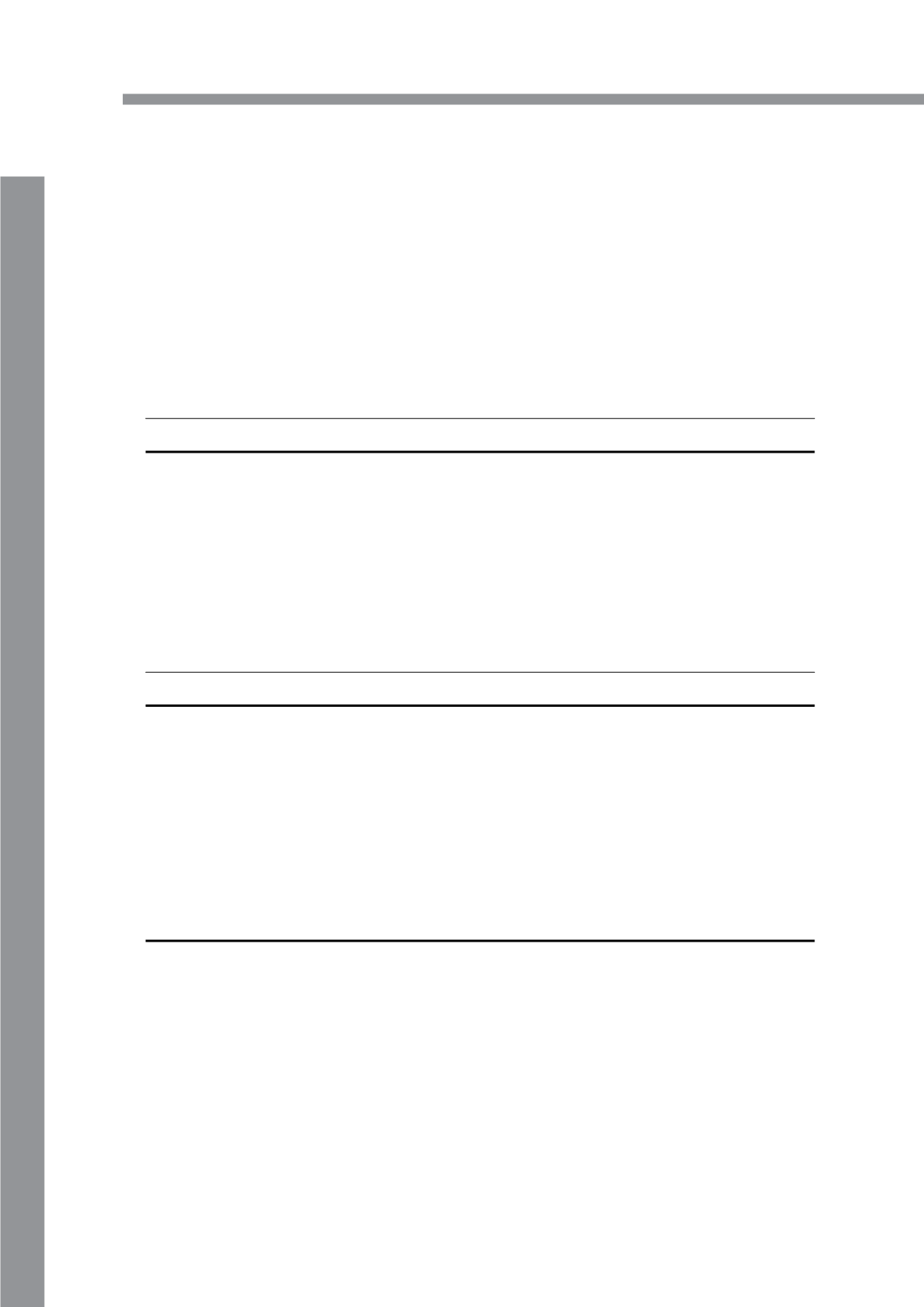

14. GOODWILL ON CONSOLIDATION

The Group

2014

2013

RM

RM

At beginning of year

25,394,265

25,394,265

Arising from acquisition of a subsidiary (Note 12)

8,366,591

–

At end of year

33,760,856

25,394,265

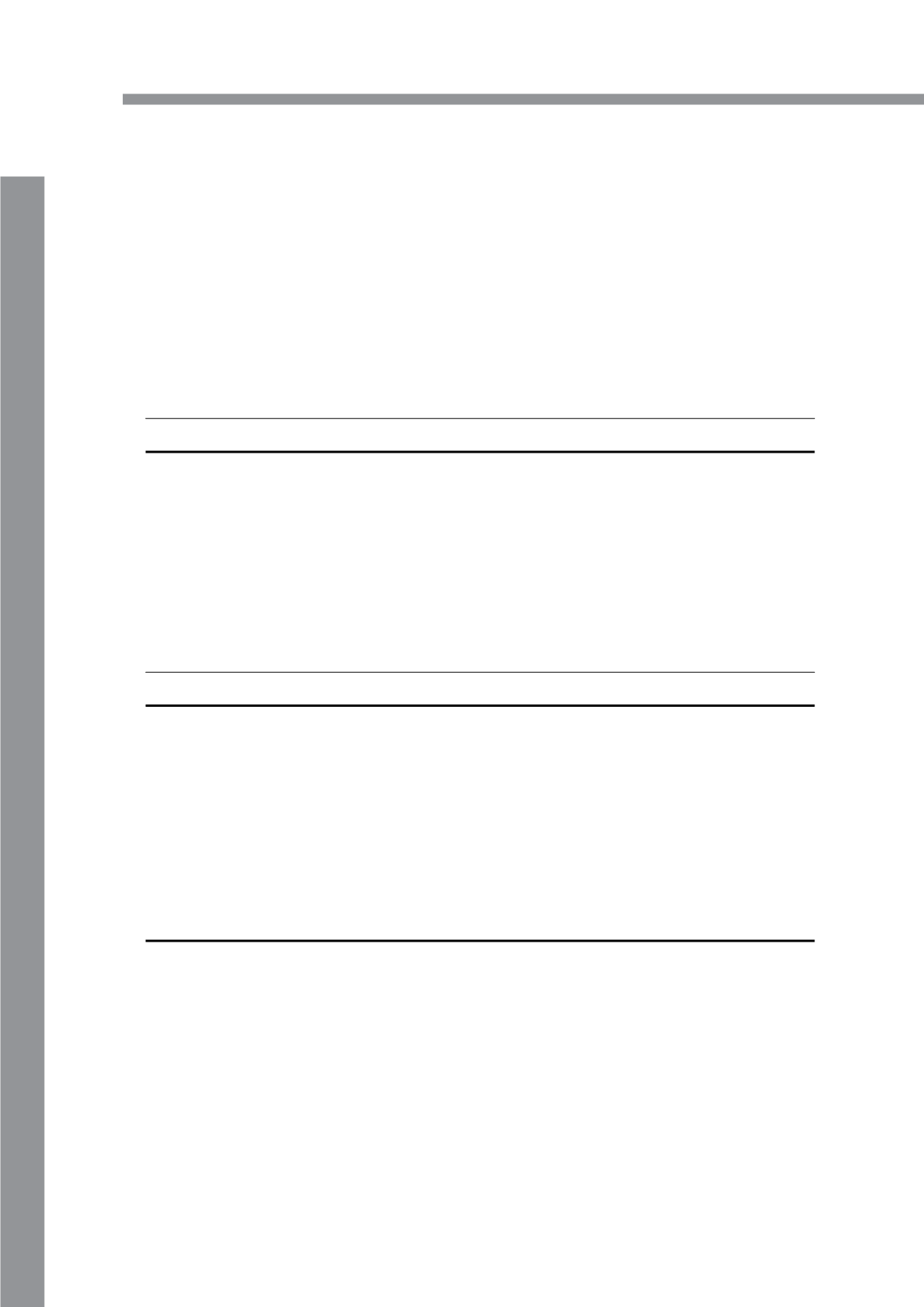

Goodwill acquired in a business combination is allocated, at acquisition, to the cash-generating unit (“CGU”)

that is expected to benefit from that business combination. The carrying amount of the goodwill had been

allocated as follows:

The Group

2014

2013

RM

RM

Frontken (East Malaysia) Sdn. Bhd.

805,812

805,812

Ares Green Technology Corporation

24,588,453

24,588,453

TTES Frontken Integrated Services Sdn. Bhd.

(formerly known as TTES Team & Specialist Sdn. Bhd.)

8,366,591

–

33,760,856

25,394,265

The Group tests goodwill annually for impairment, or more frequently if there are indications that goodwill

might be impaired.

The recoverable amount of the CGU is determined from value-in-use calculation. The key assumptions for

the value-in-use calculation are those regarding the expected changes to pricing and direct costs, growth

rates and discount rates during the period.

2014

2013

%

%

Budgeted gross margin

26 to 37

26 to 37

Growth rates

0.0 to 5.0

0.0 to 5.0

Pre-tax discount rate

10.20

10.27

The calculation of value-in-use for CGU are most sensitive to the following assumptions:

(i)

Budgeted gross

margin

Management determines budgeted gross margin based on past performance and

its expectations of market development.

(ii)

Growth rates

The growth rates are based on industry growth forecasts. Changes in selling prices

and direct costs are based on past practices and expectations of future changes

in the market. These calculations use pre-tax cash flow projections based on

financial budgets approved by management and extrapolated cash flows for a

three-year period based on growth rates consistent with the long-term average

growth rate for the industry.

(iii)

Discount rate

Management estimates discount rate using pre-tax rate that reflect current market

assessments of the time value of money and the risk specific to the CGU. The rate

used to discount the forecasted cash flows reflects specific risks and expected

returns relating to the industry.

The management believes that no reasonable change in the above key assumptions would cause the carrying

amount of the goodwill to exceed its recoverable amounts.