FRONTKEN CORPORATION BERHAD

(651020-T)

ANNUAL REPORT 2014

07

FINANCIAL

HIGHLIGHTS

(cont’d)

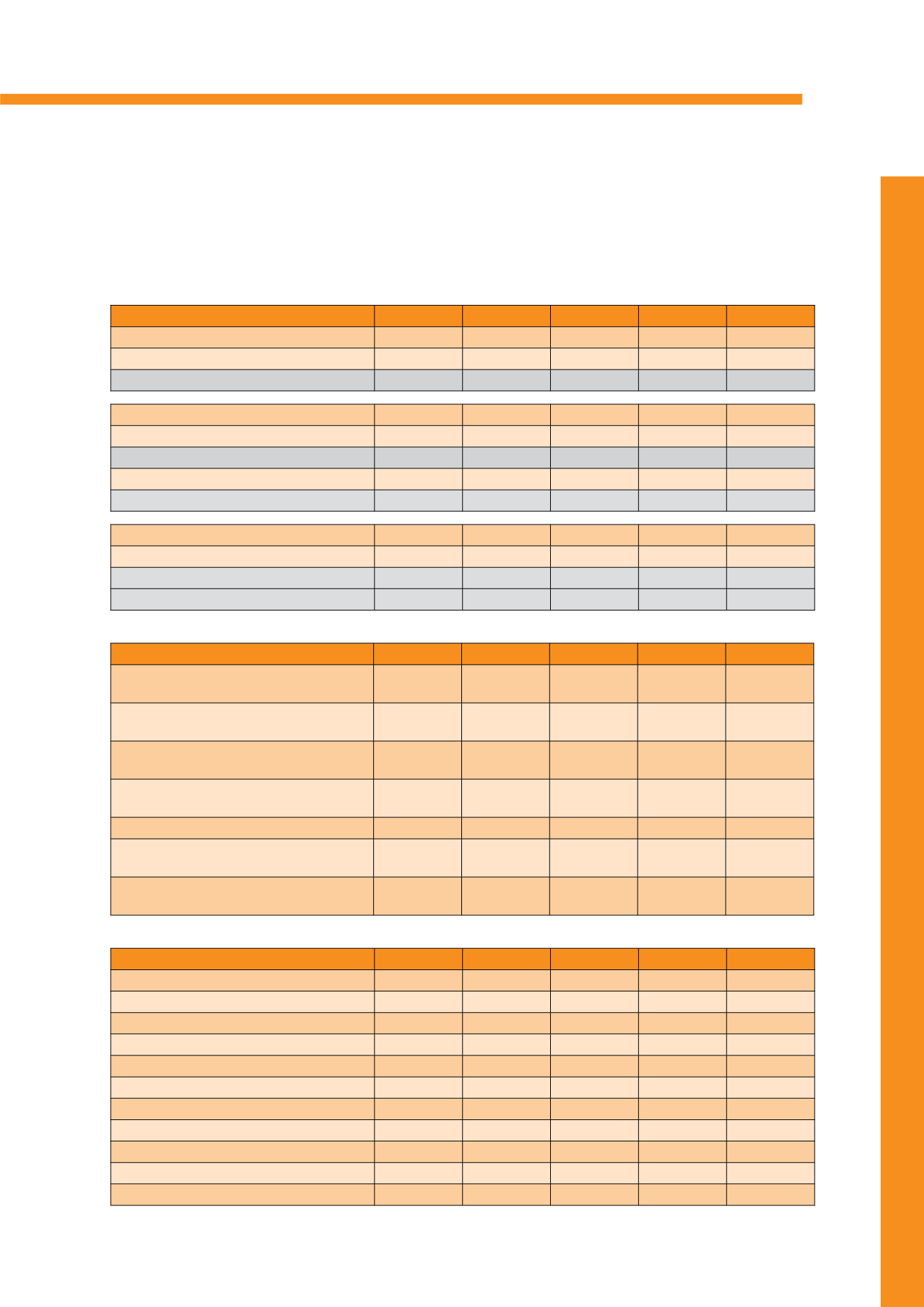

SUMMARISED GROUP BALANCE SHEETS

AS AT 31 DEC (RM’000)

2010

2011

2012

2013

2014

Non-Current Assets

211,563 214,177 183,606 171,779 173,019

Current Assets

121,628 119,411 131,016 130,379 183,363

Total Assets

333,191 333,588 314,622 302,158 356,382

Share Capital

101,141 101,141 101,141 101,141 101,141

Reserves

75,102

78,131

83,752

85,162 105,663

Shareholders’ Equity

176,243 179,272 184,893 186,303 206,804

Non-Controlling Interests

25,902

27,890

28,116

27,924

32,913

Total Equity

202,145 207,162 213,009 214,227 239,717

Non-Current Liabilities

62,572

55,614

32,095

29,484

27,958

Current Liabilities

68,474

70,812

69,518

58,447

88,707

Total Liabilities

131,046 126,426 101,613

87,931 116,665

Total Equity and Liabilities

333,191 333,588 314,622 302,158 356,382

SUMMARISED GROUP CASH FLOWS

YEAR ENDED 31 DEC (RM’000)

2010

2011

2012

2013

2014

Net Cash Flows From Operating

Activities

20,919

24,587

16,043

36,681

40,672

Net Cash Flows (For)/From Investing

Activities

(35,390)

(6,403)

17,527

(8,010)

(21,164)

Net Cash Flows From/(For) Financing

Activities

25,217 (14,771)

(16,946)

(34,105)

(4,426)

Net Increase/(Decrease) in Cash and

Cash Equivalents

10,746

(3,413)

16,624

(5,434)

15,082

Effect of exchange differences

134

257

208

1,061

1,079

Cash and Cash Equivalents at

Beginning of Year

9,405

20,285

23,955

40,787

36,414

Cash and Cash Equivalents at End of

Year

20,285

23,955

40,787

36,414

52,575

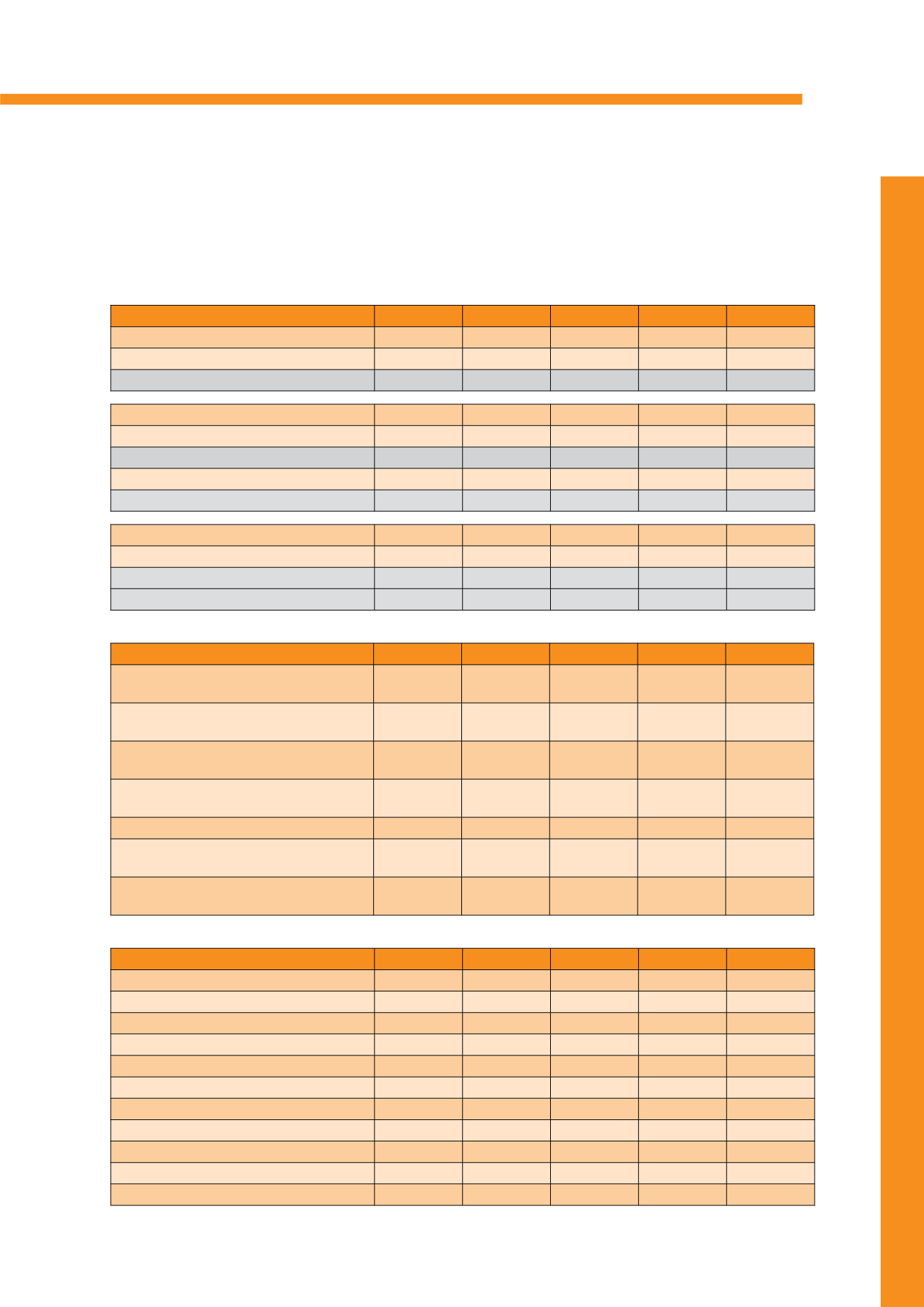

FINANCIAL ANALYSIS

(RM’000)

2010

2011

2012

2013

2014

Turnover growth

6.8% 35.0% -8.6% 5.3% 62.6%

Profit Before Tax Growth

61.7% -77.1% 8.0% 82.5% 376.1%

Net Profit Growth

42.6% -79.3% 53.8% -160.8% 909.0%

Pre-tax Profit Margin

8.9% 1.5% 1.8% 3.1% 9.1%

Net Profit Margin

8.2% 1.3% 2.1% -1.2% 6.1%

Gearing Ratio (Net of cash) (times)

0.3

0.3

0.1

0.0

0.0

Return on Average Shareholders’ Equity

7.7% 1.4% 2.1% -1.3% 9.6%

Return on Average Total Assets

4.2% 0.7% 1.2% -0.8% 5.7%

Loss/Earnings Per Share (Sen)

- Basic

^1.3

0.3

0.4

-0.2

1.9

- Diluted

1.0

n/a

n/a

n/a

n/a

^ Computed based on weighted average number of shares which had been adjusted to incorporate the effect of the rights issue

implemented in 2010