FRONTKEN CORPORATION BERHAD

(651020-T)

ANNUAL REPORT 2014

14

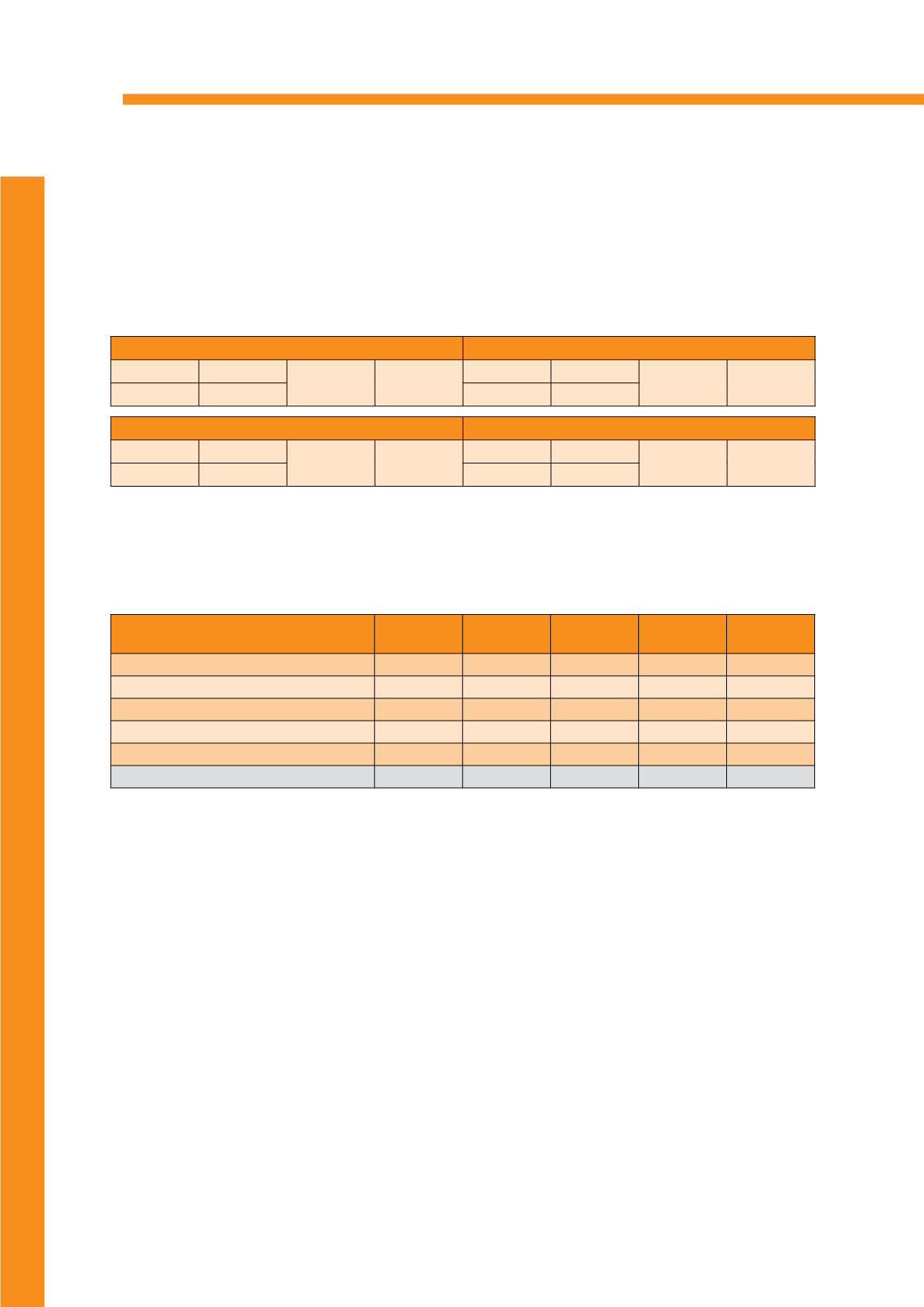

RESULTS OF OPERATIONS

in RM’000

REVENUE

EBITDA

2013

190,611

é

63%

2013

26,106

é

83%

2014

309,845

2014

47,790

NET PROFIT

EBITDA MARGIN

as a % of revenue

2013

(2,321)

é

909%

2013

13.7

é

12%

2014

18,775

2014

15.4

REVENUE

Reported revenue for the Group for the financial year ended 31 December 2014 amounted to RM309.8 million,

as against RM190.6 million in the previous year. The Group revenue for 2014 of RM309.8 million increased in

comparison with the previous year.

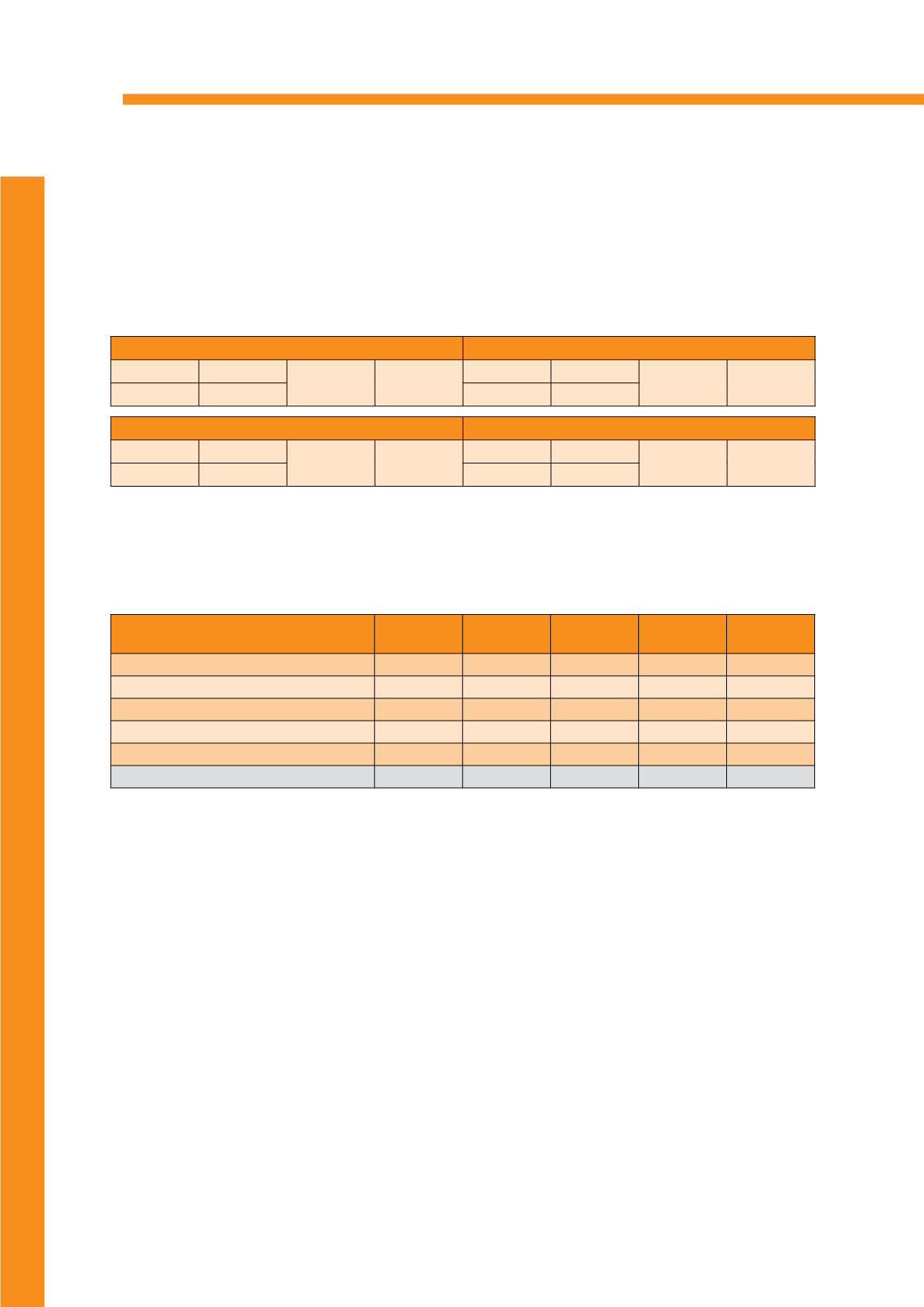

REVENUE

(by customer location)

2014

RM’000

%

2013

RM’000

%

% change

in revenue

Taiwan

90,405

29

63,992

34

41

Singapore

42,740

14

59,481

31

-28

Malaysia

157,893

51

43,600

23

262

Philippines

10,276

3

13,601

7

-24

Others

8,531

3

9,937

5

-14

Total

309,845 100

190,611 100

63

An analysis of revenue by customer location shows growth in Malaysia and Taiwan while the growth in Singapore,

Philippines and others had declined by 28%, 24% and 14% respectively. The revenue in Singapore decreased

from RM59.5 million to RM42.7 million. However, in Malaysia, the revenue increased by RM43.6 million to RM157.9

million. On an overall basis, the Group experienced a growth in revenue rate of 63% or an increase of RM119.2

million for year 2014.

The growth in Taiwan was due to the positive growth of the semi-conductor business while Philippines experienced

stiff competition in its services. The drop in Singapore was due to the deferment of outages by its power generation

customers. The increase in the activities in Malaysia was due to the progressive revenue from the project in Tanjung

Bin. Malaysia is our leading country in terms of revenue.

EARNINGS

Earnings before interest, tax, depreciation and amortization (“EBITDA”) of the Group for 2014 increased to RM47.8

million from RM26.1 million the year before. As a percentage of revenue, EBIDTA increased by 83% and was due

to higher revenue which increased by RM119.2 million or 63% compared to the year before.

The lower finance costs, lesser depreciation of property, plant and equipment, the net realized gain on foreign

exchange and sale of an associate company had a positive impact on net profit for 2014. The depreciation and

amortization of RM18.4 million in 2014 was lower than last year of RM18.7 million. Profit after tax increased from

RM0.5 million to RM23.2 million resulting from factors discussed above and provision of deferred taxation in last year.

As a result of the factors discussed above, the consolidated net profit attributable to shareholders of the Company

for the financial year ended 31 December 2014 was RM18.8 million, while last year was a consolidated net loss of

RM2.3 million. This translated to basic earnings per share in 2014 of 1.86 sen compared to basic loss per share

of 0.23 sen in 2013.

FINANCIAL

REVIEW