117

FRONTKEN CORPORATION BERHAD

(651020-T)

ANNUAL REPORT 2014

NOTES TO THE

FINANCIAL STATEMENTS

(cont’d)

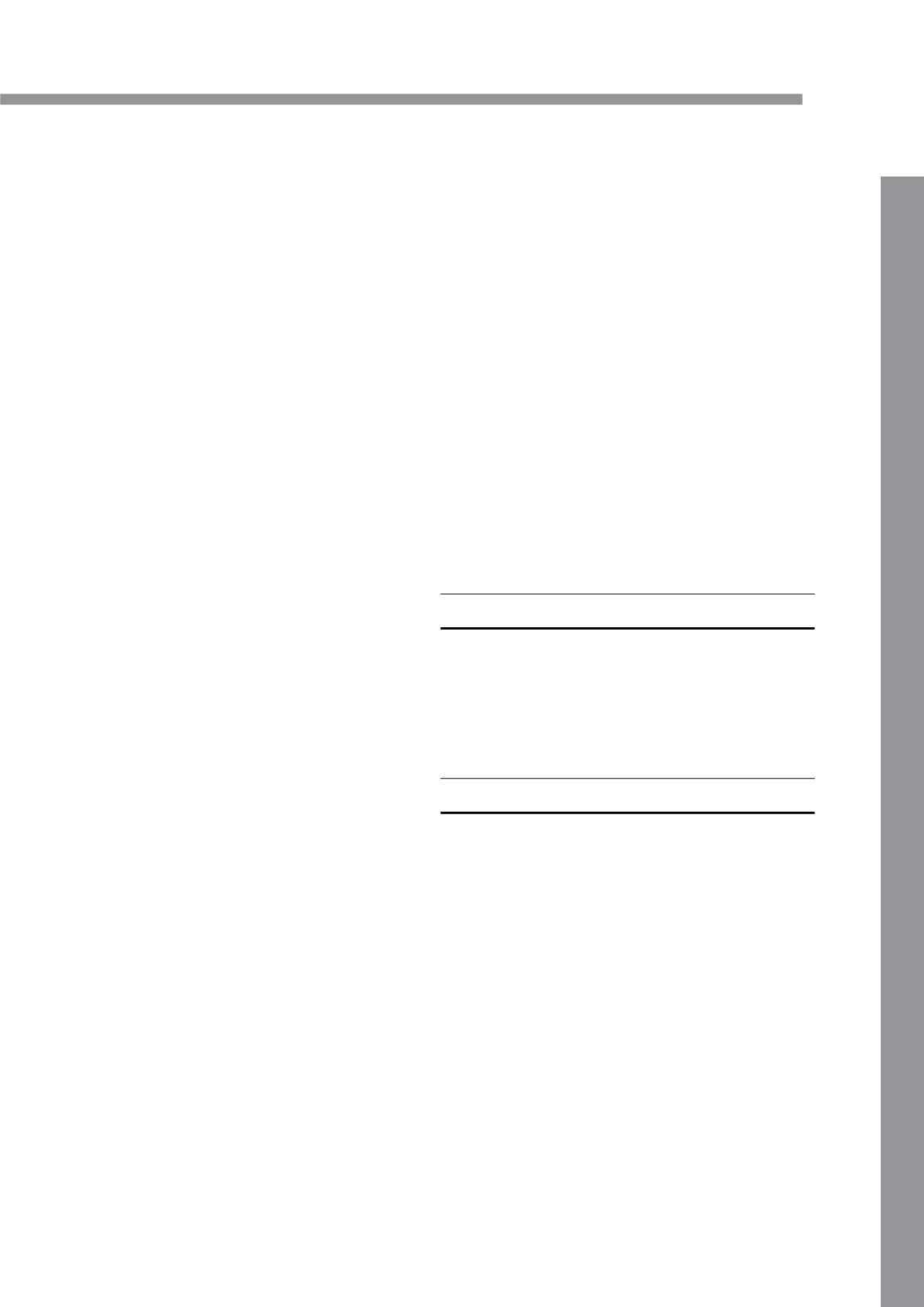

27. FINANCIAL INSTRUMENTS (CONT’D)

(a)

Financial Risk Management Policies (Cont’d)

(v)

Liquidity risk (Cont’d)

Weighted

Contractual

average

Carrying undiscounted

effective rate

amount

cash flows Within 1 year

1 – 5 years

The Company

%

RM

RM

RM

RM

2014

Term loan

6.79

7,876,178

8,995,090

2,289,498

6,705,592

Other payables

–

1,832,062

1,832,062

1,832,062

–

Amount owing to

subsidiaries

- interest bearing

3.00

2,715,810

2,715,810

2,715,810

–

- interest free

–

12,422,503 12,422,503 12,422,503

–

24,846,553 25,965,465 19,259,873

6,705,592

2013

Other payables

–

168,411

168,411

168,411

–

Amount owing to

subsidiaries

- interest bearing

3.00

2,663,854

2,663,854

2,663,854

–

- interest free

–

3,030,758

3,030,758

3,030,758

–

5,863,023

5,863,023

5,863,023

–

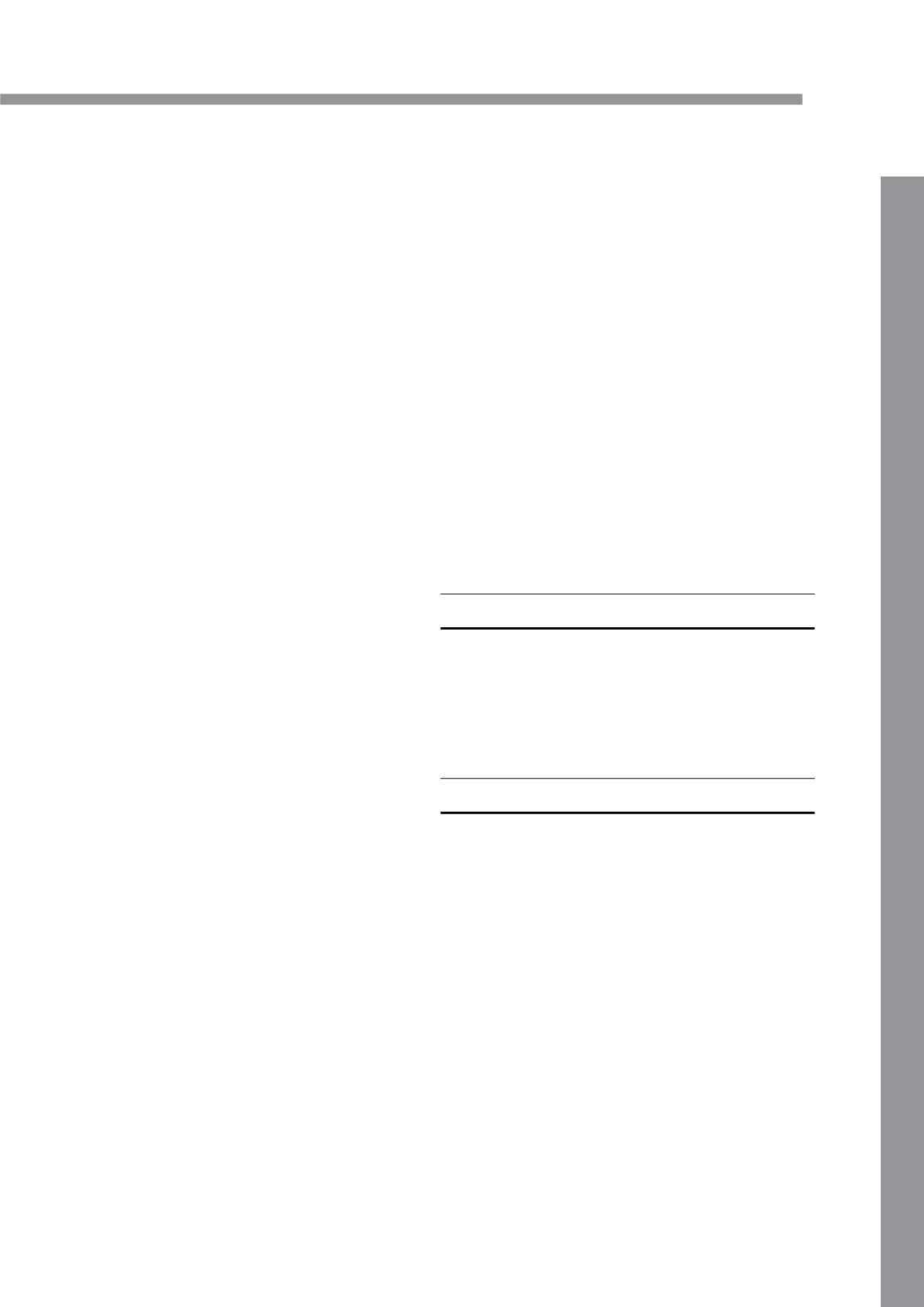

(b) Capital Risk Management

The Group manages its capital to ensure that entities within the Group will be able to maintain an optimal

capital structure so as to support their businesses and maximise shareholders’ value. To achieve this

objective, the Group may make adjustments to the capital structure in view of changes in economic

conditions, such as adjusting the amount of dividend payment, return of capital to shareholders or issue

new shares.

The Group manages its capital based on debt-to-equity ratio. The Group’s strategies were unchanged

from the previous financial year. The debt-to-equity ratio is calculated as net debt divided by total

equity. Net debt is calculated as external borrowings less cash and bank balances and fixed deposits

with licensed banks.

There was no change in the Group’s approach to capital management during the financial year.

The debt-to-equity ratio of the Company is not disclose in the financial statements as the cash and

bank balances and fixed deposits with licensed banks are in surplus position after net off with external

borrowings.

Under the requirement of Bursa Malaysia Practice Note No. 17/2005, the Company is required to maintain

a consolidated shareholders’ equity (total equity attributable to owners of the Company) equal to or

not less than the 25% of the issued and paid-up share capital (excluding treasury shares) and such

shareholders’ equity is not less than RM40 million. The Company has complied with this requirement.